14 Mar 2024

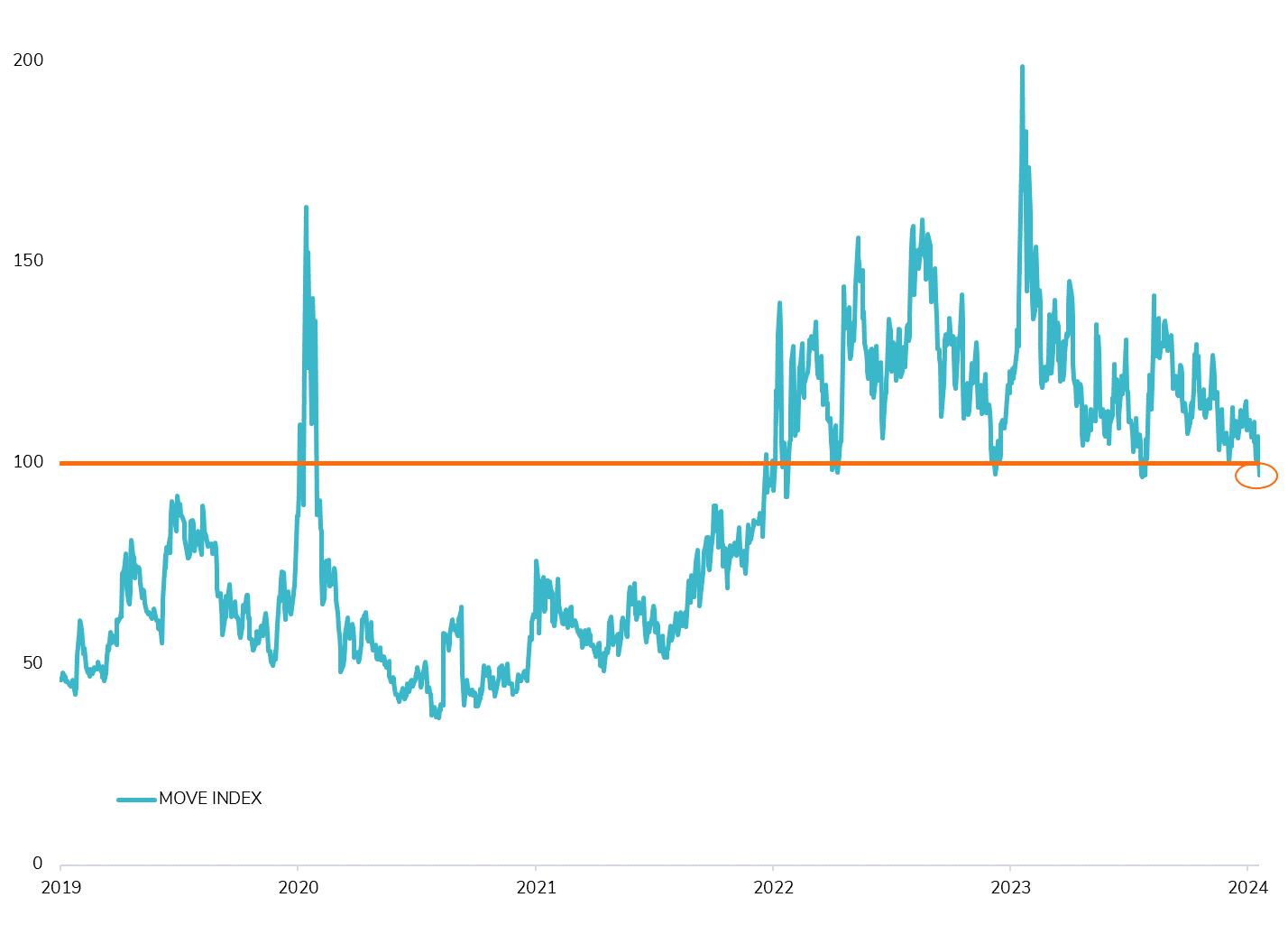

The #MOVE index, a key measure of US #interestrate #volatility, has dropped below 100 for the first time since September 2023. This marks a significant shift in market dynamics. While attempts to breach this threshold have been made three times since early 2022, they were short-lived, with volatility bouncing back above 100 each time.

For the past two years, the #government #bond market has been in a high volatility regime, making investing in long-term US #Treasuries challenging due to relatively low adjusted yield to volatility. The question now is whether this high volatility regime is coming to an end or if it's just another false alarm.

Several indicators suggest that this could be another false signal. Growing uncertainty surrounding #inflation in the US may prompt the #Fed to adjust its monetary policy, potentially implementing a reverse operation twist (and thus steepen the yield curve). Additionally, there's still a positive #carry from #shorting bonds.

However, signs of improvement are emerging as well. Recent #auctions have shown that the market is absorbing the supply effectively, and the #correlation between bonds and equities is turning negative again. Could this be a pivotal moment in the US Treasuries market? Let's keep a close eye on how things unfold.

Source: Bloomberg

#fixedincome #bond