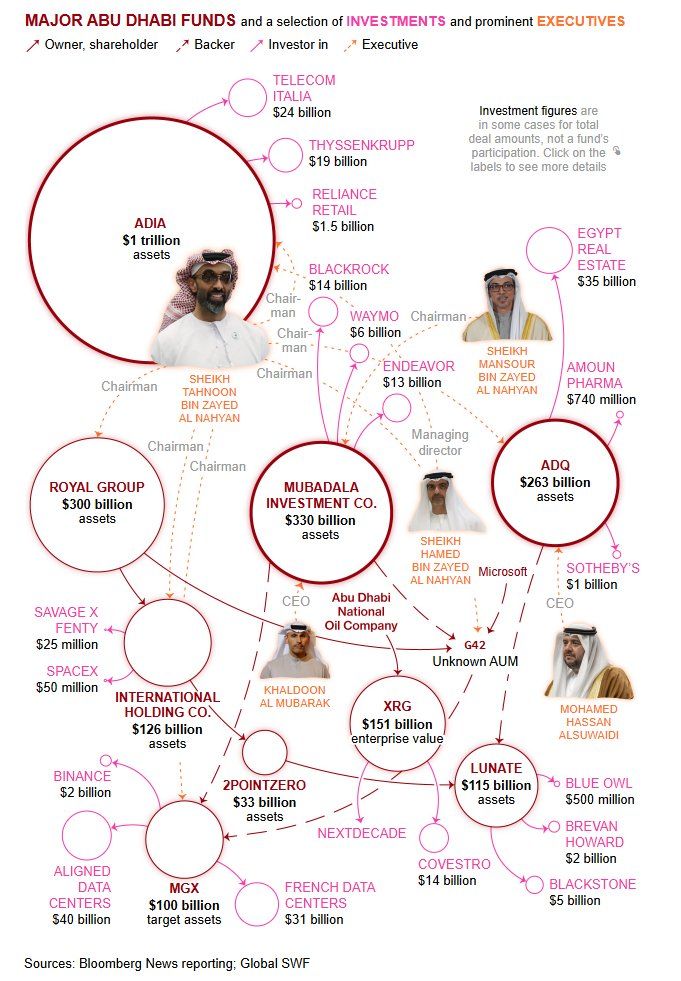

"It’s uncommon for a city to have even one sovereign wealth fund; the UAE’s capital has three"

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The decision allows non-residents to invest directly in the main market effective Feb. 1.

Here is the breakdown of what is going on: 1. The $100 Billion Life Raft 💰 OpenAI is reportedly looking to raise a staggering $100B (Source: WSJ). With a target valuation of $830B, this isn't just a fundraising round—it’s a geopolitical event. Sam Altman isn't just looking for "growth capital"; he’s securing a bridge to 2030 profitability. 2. From Debt to Equity 📉 Private credit markets (like Blue Owl) have been tightening the taps on AI infrastructure. OpenAI is pivoting from cheaper debt to massive equity dilution. Why? Because when you’re "incinerating" cash to build the future, you need a sovereign-sized safety net. 3. The Oracle "Survival" Surge 🚀 This isn't just about OpenAI. This cash flows directly into compute. Oracle and CoreWeave are the primary beneficiaries. This funding ensures OpenAI can pay its hyperscaler partners for years to come. The market is breathing a sigh of relief: Bankruptcy risks for AI infrastructure plays are evaporating. 4. The Credit Default Swap (CDS) Collapse 📉 Before tonight, Oracle’s CDS was at a 16-year high (~156bps). Investors were pricing in serious risk. Now? We expect a short-covering frenzy. The "AI winter" just got hit by a heatwave of Emirati capital. The Bottom Line: The world was waiting for the US to backstop the AI revolution. Instead, Abu Dhabi stepped up. This $100B injection doesn't just fund a chatbot; it stabilizes the entire AI ecosystem for the next 24 months. Is this the start of the 2025 bull run, or just a very expensive bridge to the unknown?

Saudi Arabia’s Public Investment Fund (PIF) just made a big statement. In Q3, the near-$1 trillion sovereign wealth fund fully exited nine US-listed companies — including names like Visa and Pinterest — cutting its exposure to US equities by 18%. Yet PIF still holds $19.4B across six US-listed giants, including Uber and Take-Two Interactive. For context? Its US equity holdings once peaked at $56B in late 2021. And then there’s the gaming play. 🎮 PIF has kept its stake in Electronic Arts — but that will soon shift off the US-listed books once the $55B take-private mega-deal closes. It’s the largest leveraged buyout in history. PIF is leading the consortium alongside Silver Lake Capital and Jared Kushner, with PIF writing the biggest equity check — positioning it as EA’s majority owner. This is just the latest move in a fast-growing gaming investment spree driven by Crown Prince Mohammed bin Salman’s personal interest in the sector. All of this lands right before the crown prince’s highly anticipated visit to the White House on Tuesday, where he is expected to meet President Trump and sign a series of major defence and trade agreements. 💬 Big question: Is this a strategic portfolio rebalance? A geopolitical signal? Or the beginning of a new investment era focused on entertainment, gaming, and national digital transformation? What’s your read on this move? Source: FT https://lnkd.in/e69yETNc