8 Dec 2025

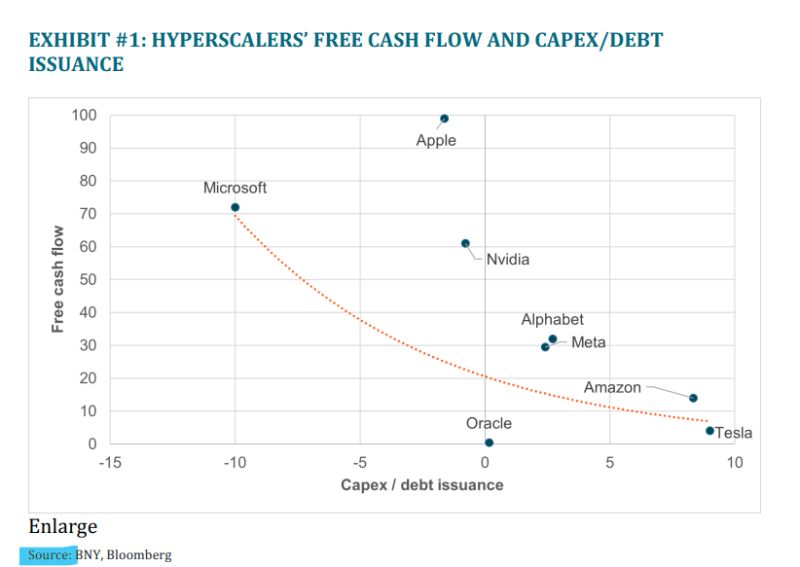

BNY just dropped a massive reality check. Everyone is celebrating the Magnificent 7's AI investments, but how are they paying for this revolution?

The playbook is simple: Free Cash Flow OR... massive debt. (Look at Oracle's recent debt noise—it's a leading indicator).

The Math That Makes Value Investors Sweat:

The Mag 7 (ex-Tesla) forward P/E is nearly 30x. That's nowhere near "value investor comfort."

The market is demanding a clear ROI by 2026.

The pace of this AI buildout is directly tied to two things: Future Earnings and the Cost of Capital.

The Domino Effect:

If Margins Drop or Borrowing Costs Rise, the AI investment boom must slow down.

That deceleration hits U.S. GDP hard.

Hello, Federal Reserve and Government intervention?

The feedback loop's timing will dictate how the entire equity market trades.

2026's Real Headwinds:

Everyone expects lower rates, but don't forget the silent killers:

Term Premiums

Government Deficits (Crowding out private investment)

Future Tax Risks

The core question isn't whether AI is real—it's whether the current investment pace is sustainable until the returns finally justify the spending. This is the true AI bubble concern.

Are we watching a self-sustaining cycle, or an investment spree built on borrowed time (and borrowed money)?

Source: Neil Sethi