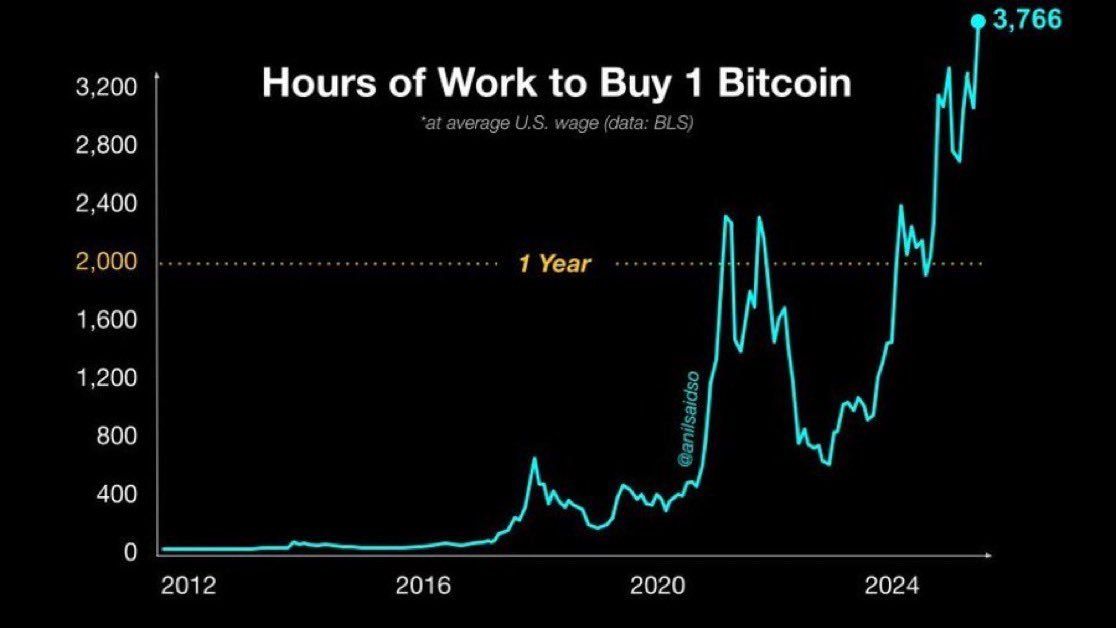

The average american now needs to work nearly two full years to buy a single Bitcoin

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Bespoke shows how you can outperform $IBIT with a simple strategy: buy the (NYSE) close, sell the (NYSE) opening... Since the iShares Bitcoin ETF $IBIT began trading, had you only owned it after hours (buy the close, sell the next open), it's up 222%. Had you only owned intraday (buy the open, sell the close), it's down 40.5%. (Past performance is no guarantee of future results.) Results have been so impressive that Nicholas just file for an ETF that replicates this strategy: NICHOLAS BITCOIN AND TREASURIES AFTER DARK ETF (NGHT) will only hold bitcoin at night, buying it when the US market closes and selling it when it opens. Source: Bespoke, Eric Balchunas, Bloomberg

Yesterday, Bitcoin erased 16 hours of gains in just 20 minutes after the US market opened. ‼️ Since early November, BTC has dumped most of the time after US market opens. The same thing happened in Q2 and Q3. 📌 @zerohedge has been calling this out repeatedly, and he thinks Jane Street is the most likely entity doing this. Bull Theory then highlighted that when you look at the chart, the pattern is too consistent to ignore: a clean wipe out within an hour of the market opening followed by slow recovery. That’s classic high-frequency execution. They add that it actually fit their profile: • Jane Street is one of the largest high-frequency trading firms in the world. • They have the speed and liquidity to move markets for a few minutes. They then assume (this is NOT verified) that what Jane Street does in a consistent manner is the following: 1. Dump BTC at the open. 2. Push the price into liquidity pockets. 3. Re-enter lower. 4. Repeat daily. And by doing this, they might have accumulated billions in $BTC. As of now, Jane Street holds $2.5B worth of BlackRock’s IBIT ETF, their 5th largest position. Does it mean that the dump in BTC isn't due to macro weakness but due to manipulation by one major entity??? What’s your take?

Did you know Nuclear energy generates 20% of all US electricity? That's our clean, reliable base load. But here’s the terrifying truth: 🇺🇸 The US once supplied nearly all its own Uranium fuel. TODAY: The US imports nearly 100% of the uranium we use. Let that sink in. One-fifth of US power generation is entirely dependent on foreign governments. In a world defined by geopolitical turbulence and supply chain risk, this isn't just an economic issue—it's a massive national security risk. The Mandate is Clear: The US must shift from relying on external sourcing to securing a resilient, domestic nuclear fuel cycle. Self-sufficiency is no longer optional; it’s paramount for energy independence and long-term stability. Source: Lukas Ekwueme @ekwufinance