16 Dec 2024

"So how can investors think about a bitcoin allocation? We take a risk budgeting approach: sizing the allocation based on how much it would contribute to total portfolio risk – measured by its long-run volatility and correlation to other assets (...). But from a portfolio construction perspective, it has some similarities with the “magnificent 7” group of mostly mega-cap tech stocks. Their market value – averaging $2.5 trillion in December 2024 – is similar to bitcoin’s (...)

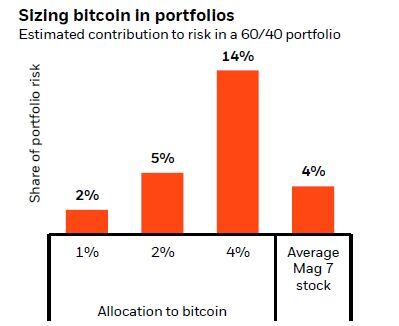

In a traditional portfolio with a mix of 60% stocks and 40% bonds, those seven stocks – if held at their current weights in the MSCI World – each account for 4% of the overall portfolio risk on average. That’s about the same share a 1-2% exposure to bitcoin would represent: Even though bitcoin’s correlation to other assets is relatively low, it’s more volatile, making its effect on total risk contribution similar overall.

A bitcoin allocation would have the advantage of providing a diverse source of risk, while an overweight to the magnificent 7 would add to existing risk and to portfolio concentration.

Why not more than 2%? A larger bitcoin allocation means its share of overall portfolio risk rises sharply. This effect is small when the allocation is small, but above 2% bitcoin’s share of total portfolio risk becomes outsized compared with the average magnificent 7 stock (...) .

In an extreme case, should there no longer be any prospect of broad bitcoin adoption, the loss could be the entire 1-2% allocation. We think this is much less likely to happen to a magnificent 7 stock given these companies generate major cash flow and have tangible underlying assets.

The upshot? By allocating no more than 2% to bitcoin, investors would: 1) introduce a very different source of return and risk; and 2) manage risk exposure to bitcoin".