16 Jan 2024

As we move further into the new year, there's a noteworthy trend unfolding in the world of finance - the steady rise of the 10-year US Treasury nominal yield. However, it's not as straightforward as it may seem.

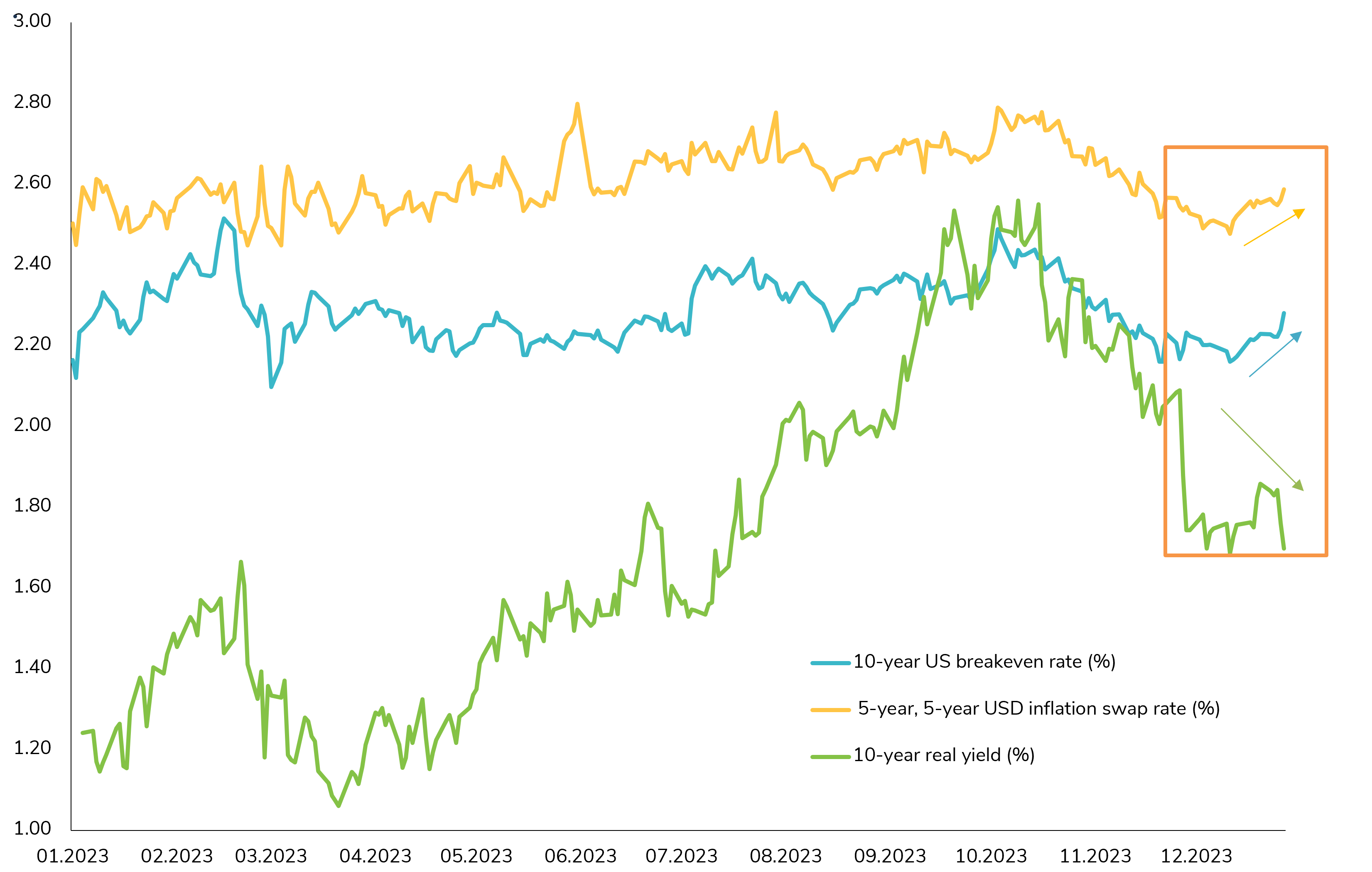

While many have been discussing the prospect of strong disinflation, what's actually exerting pressure on higher rates are the increasing long-term US inflation expectations. You can see this clearly in the chart below, which tracks the 10-year US breakeven (BE) rate and the 5-year, 5-year USD inflation swap rate. Both have climbed by more than 10 basis points, while the US real rate remains lower than at the beginning of the year.

So, what is the market pricing in? Is it a reflection of the Federal Reserve's successful navigation toward a soft landing for the US economy? Or is it a response to rate-cut expectations, hinting at the resilience of the US economy?

The dynamics at play here are fascinating and open up a world of possibilities. As we continue to monitor these developments, it's clear that 2024 holds some intriguing questions for investors. Source: Bloomberg