19 Dec 2025

The gap between buying and renting isn't just growing—it’s exploding.

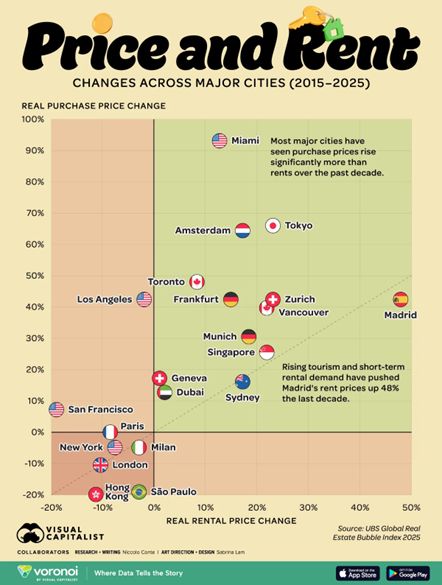

The latest data from the UBS Global Real Estate Bubble Index (2015–2025) reveals a massive divergence. If you’re an investor, homeowner, or renter, you need to see these numbers:

🚀 The Rocket Ship: Miami

Miami is in a league of its own. Real home prices have skyrocketed by 93.1%. Compare that to a modest 12.7% rent increase. The "Magic City" is officially the world's capital for capital appreciation.

🇪🇸 The Rental Crisis: Madrid

While most of the world watches home prices, Madrid is seeing a rental surge like no other.

Home Prices: +42.4%

Rent Prices: +48.0% This is the steepest rental hike of any major global city, fueled by a massive tourism rebound and a booming short-term rental market.

📉 The Cooling Giants: London & Milan

Not every "safe haven" stayed safe.

London: Prices and rents have both dropped 10.5% since 2015. Between Brexit's shadow and a significant millionaire exodus, the luster is fading.

Milan: A quiet decline, with property values down 4.9% and rents down 3%.

🥨 The Stability Zone: Zurich & Munich

German-speaking hubs remain engines of growth. Both saw double-digit increases across the board:

Zurich: +42.4% (Home) | +23.1% (Rent)

Source: Visual Capitalist, Voronoi, UBS