8 Jan 2026

Investors are scrambling to figure out the "Day After" playbook. If the Court overturns them, we aren’t just looking at a policy shift—we’re looking at a complete market regime change.

Here’s the bull vs. bear breakdown:

✅ The "Soft Landing" Bull Case

Overturning tariffs = Instant Disinflation.

Core goods inflation drops.

Consumer purchasing power gets a massive boost.

Short-term relief for the American wallet.

❌ The "Fiscal Nightmare" Bear Case

It’s not all sunshine and roses.

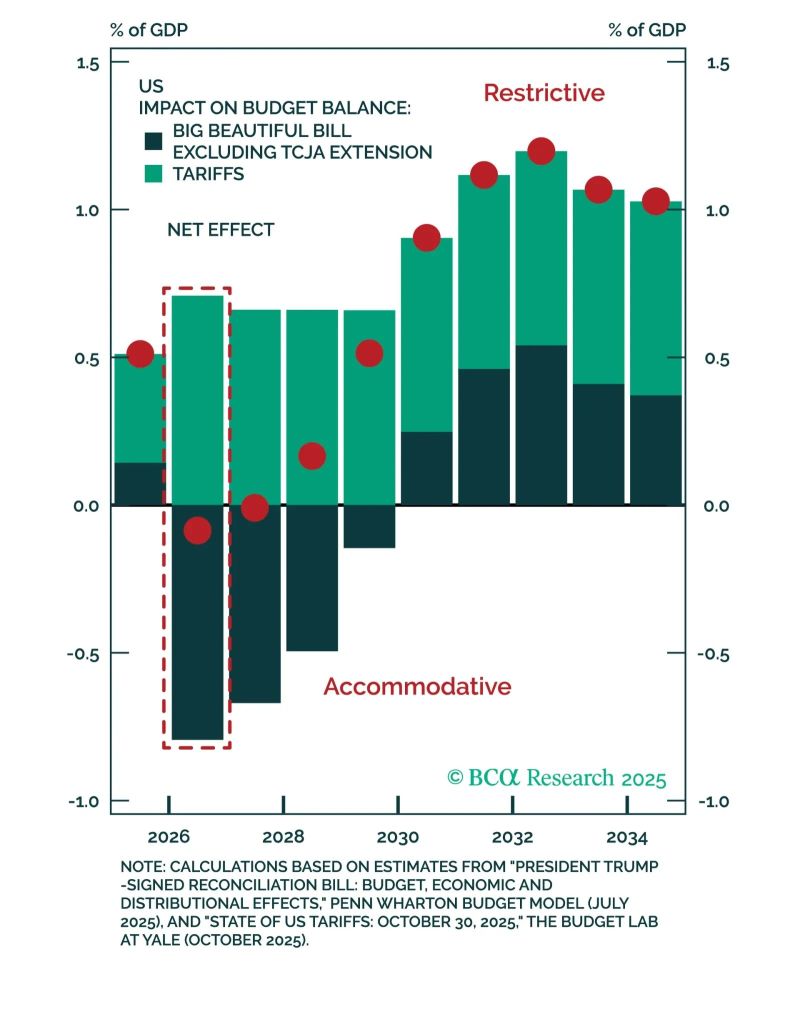

Fiscal Sustainability: Our deficit takes a direct hit (check the chart below 📉).

Labor Heat: A boost in spending could supercharge labor demand, sparking structural inflation down the road.

The "Wild Card" Factor 🃏

Don't expect the Administration to sit idly by. If the Court says "No," the White House will likely pivot to a raft of new legal avenues to keep protectionist measures alive.

The $10 Trillion Question: How does the Fed react?

If the Fed sees tariff removal as a green light for more rate cuts, we are looking at a "Risk On" environment.

The Play: Long duration might be the winner. 📈

The Risk: If the term premium spikes because of fiscal concerns, that "Long" call could turn "Short" faster than you can hit 'sell.'

Source: BCA, Jonathan LaBerge