7 Jul 2025

Retail investors reap big gains from ‘buying the dip’ in US stocks:

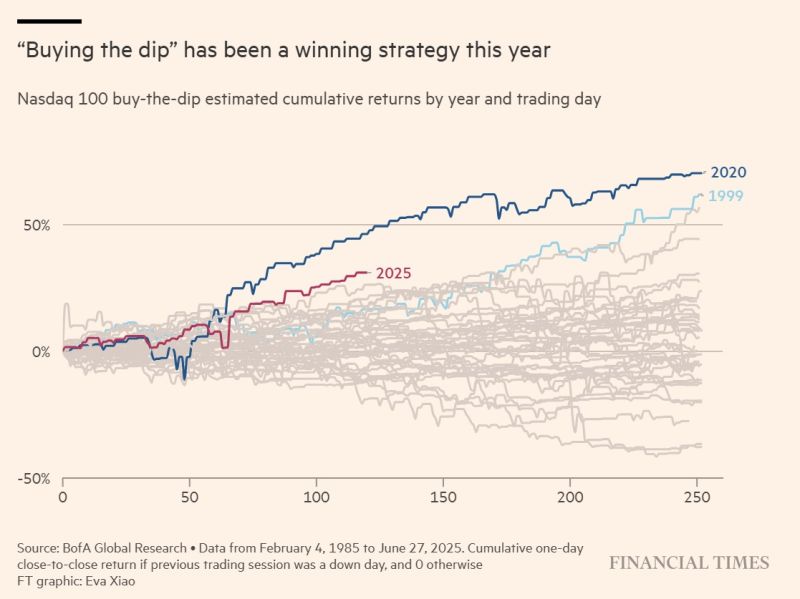

"Retail traders “buying the dip” in US stocks this year have racked up the biggest profits since the early stages of the Covid-19 crisis, helping to fuel a rally that has pushed Wall Street equities to record highs.

Individual investors have poured a record $155bn into US stocks and exchange traded funds during 2025, according to data provider VandaTrack, surpassing the meme-stock boom of 2021 (...)

The rebound in US stocks — which hit fresh all-time highs last week even as the dollar and US Treasuries remain under pressure — has been “powered by a buy-the-dip dynamic that by some metrics has been even stronger than that seen in the latter stages of the 90s tech bubble,” said BofA equity analyst Vittoria Volta.

Professional investors have eyed the rally with caution due to lingering concerns over the impact of Trump’s landmark tax and spending bill on America’s national debt and the potential hit to US economic growth from his tariffs.

Deutsche Bank strategists said this week that there had been “few signs of strong bullish sentiment and risk appetite” among institutional investors since their demand peaked in the first few months of this year.

But dip-buyers are playing a risky game by opting not to cash out when prices surge, according to Rob Arnott, chair of asset management group Research Affiliates.