21 May 2024

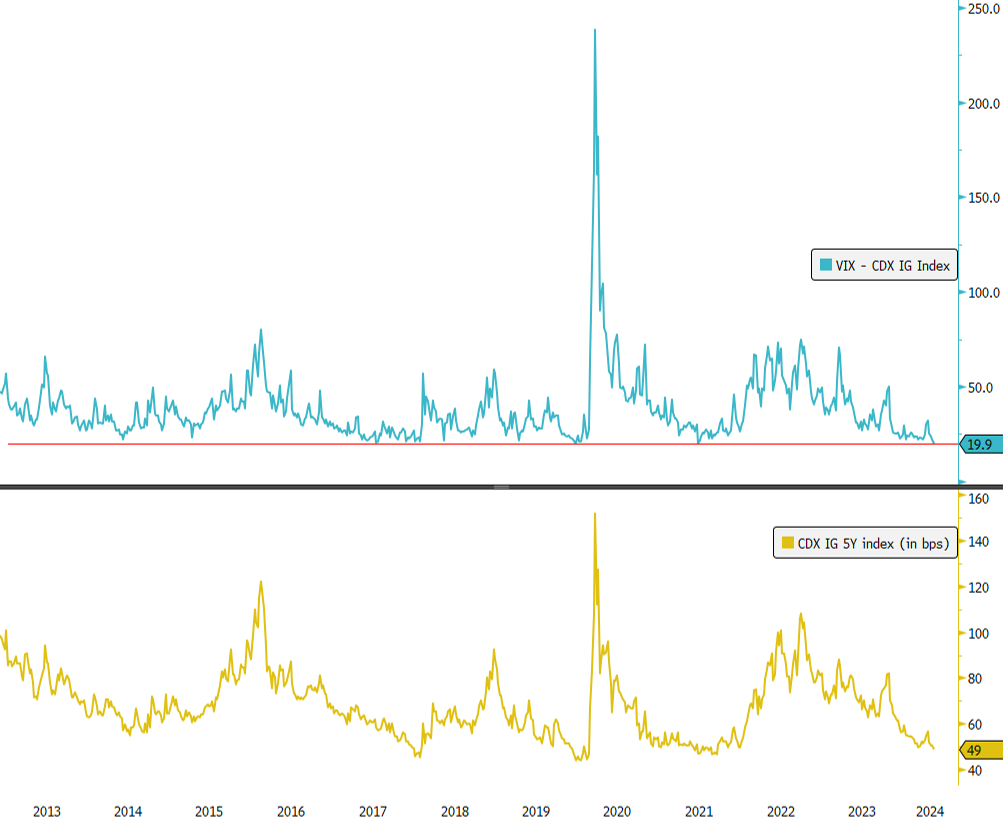

📉 Trend Alert: The 1-month volatility of the CDX North America Investment Grade index, a basket of 125 equally weighted credit default swaps on investment-grade issuers, has dropped to its lowest level since the index was launched in 2012.

📊 What’s Driving This Trend?

Resilient Economy: The US economy is demonstrating strong resilience, which supports narrower credit spreads.

Stable Equities: Low volatility in the US equity markets indicates investor confidence, further stabilizing the bond market.

Strong Corporate Health: Robust fundamentals of US companies are contributing to lower credit risk perceptions.

📈 Interest Rates & Credit Spreads:

Negative Correlation: There's a current negative correlation between US interest rates and credit spreads. This means that as interest rates rise, credit spreads tend to narrow, and vice versa.

Positive Impact: This trend has led to US corporate bonds significantly outperforming US Treasuries, marking the biggest relative outperformance since the pandemic crisis in March 2020.

❓ Future Considerations: How long can we expect this low volatility and narrow spreads to continue? Watch the credit market closely for any signs of weakness.

Source: Bloomberg