21 Jan 2026

The headlines are screaming "Trade War." JPMorgan’s desk is whispering "Opportunity." 📈

While the media focuses on the chaos, JPM’s International Market Intel team is looking at the scoreboard. Here is why they think the "Greenland Standoff" is actually a bullish signal for 2026:

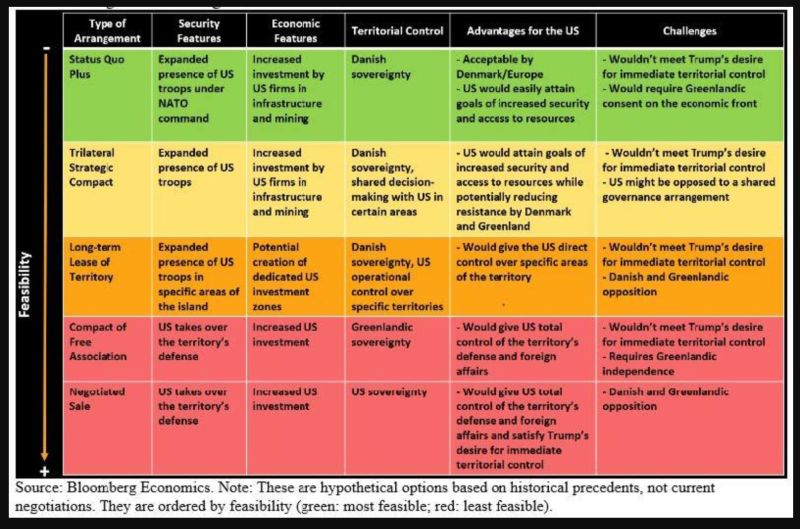

1. It’s a Negotiation, Not an Invasion. 🤝 Federico Manicardi (JPM) calls it straight: This is classic Art of the Deal. Trump throws out a maximalist stance (10% EU tariffs / buying Greenland) to create leverage and urgency. The goal? A "Negotiated Arrangement," not a sale.

2. The "Bullish" Outcome. 🐂 JPM expects a deal where: ✅ Denmark keeps sovereignty. ✅ The US gets Arctic security & missile defense upgrades. ✅ Access to critical natural resources is secured. Result? Uncertainty clears, and the 2026 growth reboot stays on track.

3. The "Tail Risks" are Overblown. 🧊 An actual invasion? "Melts NATO faster than Arctic ice" and polls horribly. A sale? Unlikely and unnecessary. JPM sees the downside limited to a mid-single-digit (MSD) drop at worst before the rebound.

4. Eyes on Davos. 🏔️ With Trump addressing the World Economic Forum tomorrow, expect the rhetoric to shift from "threats" to "affordability and growth."

The Bottom Line: Volatility is a gift if you understand the playbook. The market is anticipating a growth reboot, and JPM believes this "orange flag" is just noise on the path to a deal.

Source: ZeroHedge