30 Dec 2025

If you think the energy transition is just about solar panels and wind turbines, you’re missing the biggest structural shift in the market right now.

Uranium is no longer just a commodity. It is becoming a top-tier strategic asset. 🛡️

Here is why the "Nuclear Renaissance" is reaching a boiling point:

1️⃣ The AI Power Hunger 🤖

Large language models don't just need data; they need uninterrupted, carbon-free baseload power. * Tech giants (Amazon, Google, Microsoft) are pivotting to nuclear to power their massive AI data centers.

Unlike renewables, nuclear provides the 24/7 "always-on" energy that AI requires to function.

2️⃣ Extreme Supply Concentration 🇰🇿

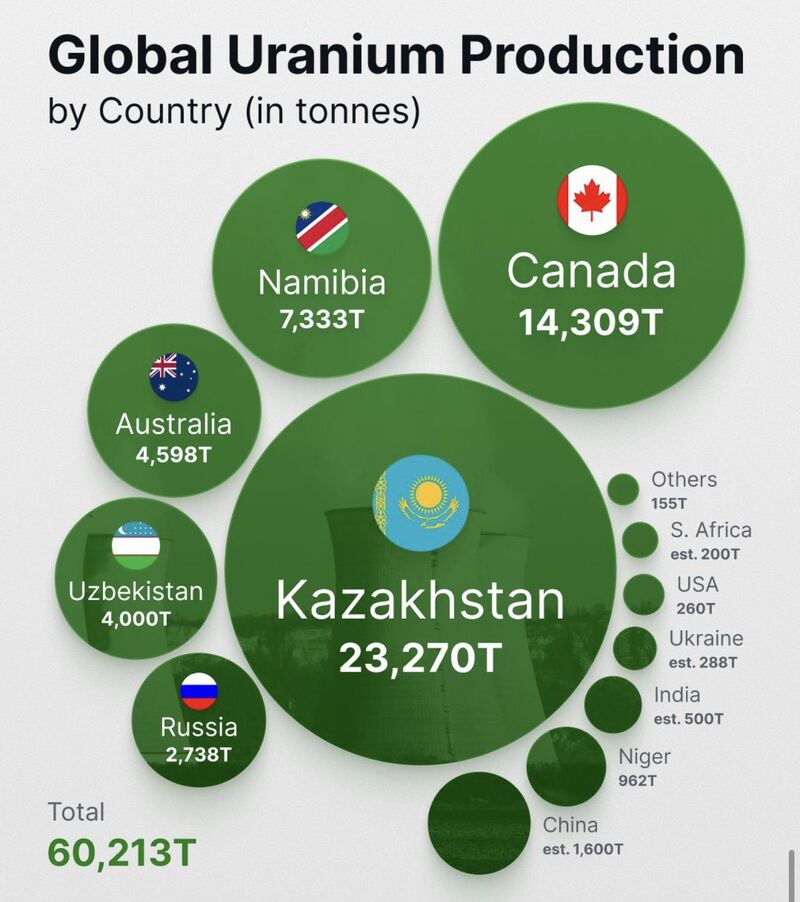

The global supply map is shockingly narrow.

Kazakhstan dominates the market, producing ~40% of the world’s uranium.

Canada and Namibia form the critical "second tier" for Western energy security.

In a world of geopolitical tension, depending on a single region for 40% of your fuel is a massive risk.

3️⃣ The Looming Deficit 📉

The math doesn't add up.

We are seeing record reactor restarts and new builds globally.

Primary mine production is lagging behind actual reactor requirements.

Secondary supplies (stockpiles) are thinning out fast.

The Bottom Line: As we move toward a high-tech, low-carbon future, the demand for "reliable green power" is skyrocketing—but the "fuel" for that power is controlled by just a handful of players.

In a tight, concentrated market, security of supply is the only thing that matters.

Source: Jack Prandelli on X