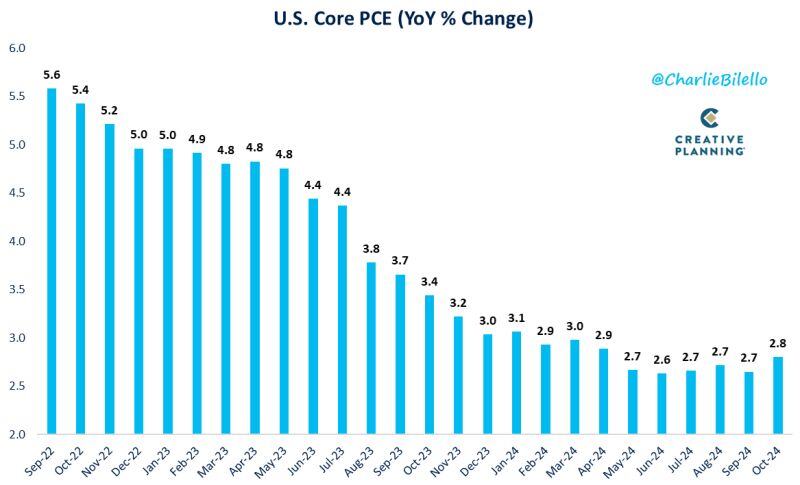

BREAKING: October PCE inflation, the Fed's preferred inflation measure, RISES to 2.3%, in-line with expectations of 2.3%.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Federal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace, according to minutes from the November meeting released Tuesday. The meeting summary contained multiple statements indicating that officials are comfortable with the pace of inflation, even though by most measures it remains above the Fed’s 2% goal. With that in mind, and with conviction that the jobs picture is still fairly solid, Federal Open Market Committee members indicated that further rate cuts likely will happen, though they did not specify when and to what degree.

In social media posts, Trump accused the countries of permitting illegal immigration and drug trafficking. Trump said the new China tariffs would come on top of existing levies. He had also threatened on the campaign trial to impose “whatever tariffs are required” to stop Chinese cars from crossing into the US from Mexico. FT >>> The tariffs on the US’s three largest trading partners would increase costs and disrupt business, one expert said, adding that “even the threat of tariffs can have a chilling effect”. A former US trade official agreed the disruption would be significant, especially given the degree of integration in North American manufacturing across sectors such as the automotive industry. He added that “tariffs are inflationary and will drive up prices”.

"Tariffs can’t be inflationary because if the price of one thing goes up, unless you give people more money, then they have less money to spend on other things, so there is no net inflation.” Source: Geiger Capital