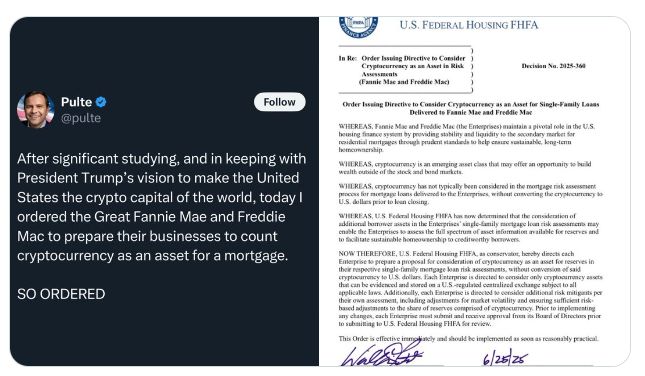

BREAKING: US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Why it happened: - Texas Weather: Severe winter storms forced industrial miners to shut down to save the power grid (or sell their energy back for higher profits). - Price Correction: Bitcoin’s drop toward $60,000 made older rigs unprofitable. Some firms pivoted their hardware toward AI training for better margins. - Regulation: Renewed crackdowns on "gray" mining in Russia and China removed significant hardware from the network. The Result: The network has already begun a "V-shaped" recovery. The lower difficulty has made mining profitable again for the remaining operators, and hashrate is already bouncing back. This is actually one of the sharpest V shape recovery in hashrate we've ever seen. Source: ₿ Isaiah ⚡️ @BitcoinIsaiah

Source: Beth Kindig @Beth_Kindig

- Gold rallied first in 2016 → Bitcoin followed months later (+30x into 2017) - Gold rallied again in 2019 → Bitcoin followed into 2020–21 - In 2025, gold surged to new highs while Bitcoin lagged - Since 2020, BTC–gold correlation: 0.14 Historically, gold has led. Source: Ark Invest Tracker @ArkkDaily