25 Nov 2025

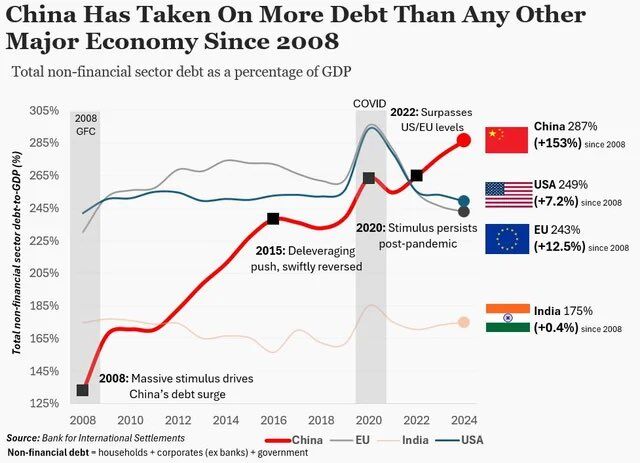

China’s government debt has exploded — up to $18.7 trillion in 2025, growing 13.6% a year.

But here’s the twist:

👉 98% of that debt is owed to China’s own banks, companies, and citizens.

Not to foreign governments. Not to global investors.

Compare that to the U.S., where ~24% of public debt is held overseas.

And that one difference changes everything.

🔍 Why China’s Debt Works Differently

Because the debt is domestic:

China can control its crisis responses

Beijing can extend payments, adjust rates, restructure debt

There’s no risk of foreign investors dumping Chinese bonds

The currency is less exposed to sudden global panic

In other words:

China can fix China’s debt. The U.S. can’t always fix U.S. debt.

🇺🇸 The U.S. Advantage — and the Weak Spot

The U.S. benefits because the dollar is the world’s reserve currency, so global demand keeps borrowing costs low.

But the trade-off?

America depends on continued trust from foreign buyers.

If that confidence ever wobbles, financing gets harder — fast.

⚖️ The Trade-Off

China = more control, less external risk… but must fix its own bubbles internally.

U.S. = global trust, cheap borrowing… but more exposed if the world’s confidence cracks.

Two superpowers, two debt systems, two very different risk profiles — and both will shape the next decade of global finance.

Source: StockMarket.news