In case you missed it...

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Rate hike? Yes. Market crash? No. In fact, it’s the exact opposite. Here is why the "Carry Trade Collapse" everyone feared just got cancelled (for now). The Headline: The BOJ raised rates by 25 bps to 0.75%. It was priced in, expected, and delivered with a heavy dose of "don't panic." Why the markets are rallying: The BoJ basically told the world: "We’re raising rates, but we aren't pulling the rug." Real Rates stay LOW: The BOJ explicitly stated that real interest rates will remain at significantly low levels. This is classic Financial Repression. Accommodative Stance: Even with the hike, the monetary environment remains "supportive." They are still cheering for the economy. The Stimulus Paradox: While the BOJ lifts rates, the Japanese government is simultaneously releasing a massive stimulus package. The "Risk-On" Reaction: Usually, a rate hike strengthens a currency. But today? The Yen is weakening. 📉 This is the "Green Light" for risk assets. If the Yen doesn't spike, the Yen Carry Trade doesn't unwind. The result: Equities: UP 📈 Bitcoin: UP 🚀 Bond Yields: UP 📊 (10 year ABOVE 2%) Yen: DOWN (156) The Takeaway: Governor Ueda is playing a dangerous game of balance, but for today, he’s the market's best friend. Liquidity is still flowing, the "cheap money" isn't disappearing overnight, and the global carry trade lives to see another day. Is this the "Goldilocks" scenario for the end of 2025, or is the market ignoring a looming Yen spike? Source: FinancialJuice @financialjuice SWING BLASTER 🥷🕉️🔱 @swing_blaster

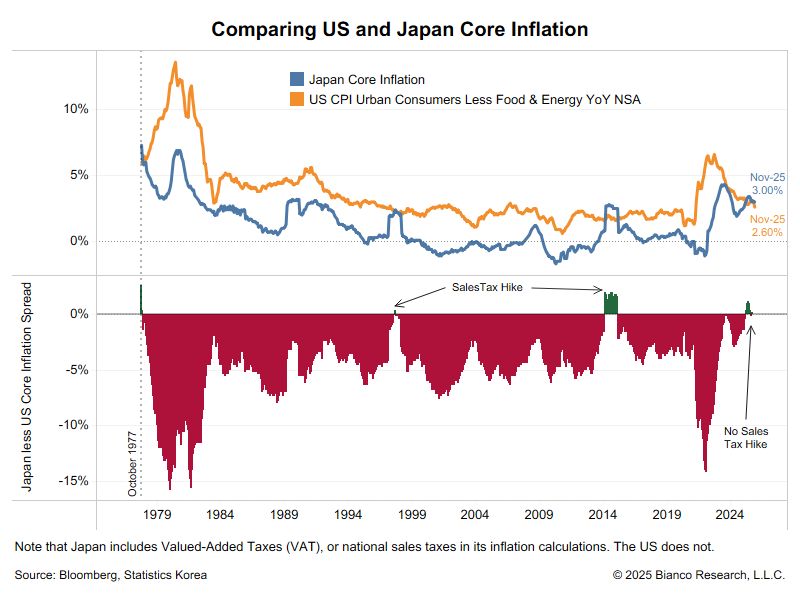

CPI: 2.7% vs. 3.1% expected (3.0% previous) Core CPI: 2.6% vs. 3.0% expected (3.0% previous) This shows inflation is cooling down. FED now has more room for rate cuts and monetary easing. JANUARY RATE-CUT ODDS EDGE HIGHER November CPI undershot expectations, with headline inflation at 2.7% YoY and core CPI slowing to 2.6%, the lowest since March 2021. Markets are reacting modestly. Kalshi pricing shows the probability of a 25 bp Fed cut in January pushing higher, though a hold remains the base case. The data supports the easing trend, but January still appears borderline for action. Source: *Walter Bloomberg @DeItaone

Last night, President Trump took to the airwaves for a primetime address that has everyone talking. Whether you agree with the strategy or not, there are some massive leadership lessons—and market-shifting announcements—we can’t ignore. Here is the breakdown of the "Second Term Revitalization" speech: 🚀 The Big Economic Bet: Trump is doubling down on tariffs as the engine for a "boom the likes of which the world has never seen." Despite a 3% CPI, the administration is betting on a radical shift in domestic investment. 📉 The Interest Rate Pivot: A new Federal Reserve Chair is coming. The criteria? Someone who believes in lowering rates "by a lot." This is a clear signal to the markets: the administration wants borrowing costs and mortgage payments down, now. 🎖️ The "Warrior Dividend": In a move to honor the upcoming 250th anniversary of the USA, Trump announced a $1,776 bonus for military members. A strategic play to shore up support within the ranks. 💊 Healthcare & Disruptive Innovation: Rejecting the extension of current subsidies, the plan is now direct-to-consumer. "I want the money to go directly to the people." It’s a bold move toward a market-driven healthcare model. The Reality Check: The address comes at a high-stakes moment. With a 54% disapproval rating and internal White House friction making headlines, the "rushed and combative" tone of the speech shows a leader under immense pressure to deliver results—fast. Leadership isn’t just about the vision; it’s about the execution. The world is watching to see if these "Grand Slams" translate into relief for the American household. Source: FT