5 Nov 2025

💥 Is there a banking crisis? Nope.

💵 A dollar funding crisis? Not really — at least, not yet.

🏦 Is the Fed secretly doing QE again? Also no.

So… what’s actually going on?

Here’s the real story 👇

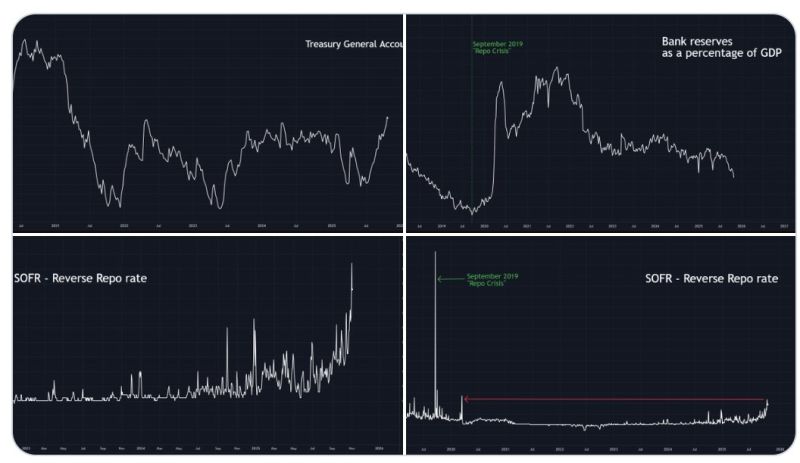

After the U.S. government raised the debt ceiling in June, it started rebuilding its Treasury General Account (TGA) — basically Uncle Sam’s checking account at the Federal Reserve.

The target? $850 billion.

When money flows into that account, it’s pulled out of the financial system.

Think of it as a liquidity drain — cash that could’ve been circulating in markets is now just… sitting there.

💧 Roughly $700 billion has been drained so far.

And when that happens, bank reserves fall — which is exactly what we’re seeing today.

Reserves are now sitting near multi-year lows (as a % of GDP).

Less liquidity = more pressure in dollar funding markets.

We can actually see that stress:

➡️ SOFR (the Secured Overnight Financing Rate — basically what banks pay to borrow short-term dollars) has ticked higher.

Is it panic time?

Not really. The current move is small compared to the September 2019 Repo Crisis, when the entire funding market froze and the Fed had to pivot hard from QT to QE overnight.

So no, there’s no crisis — but there is a tightening squeeze in the plumbing of the financial system.

Source: Tomas

@TomasOnMarkets