The Most Important Investing Theme of 2026 is HALO

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

See below chart with SK Hynix, Samsung or Advantest all sky rocketing. Meanwhile, Nvidia $NVDA (below line in yellow) remains stuck Source: LESG, TME

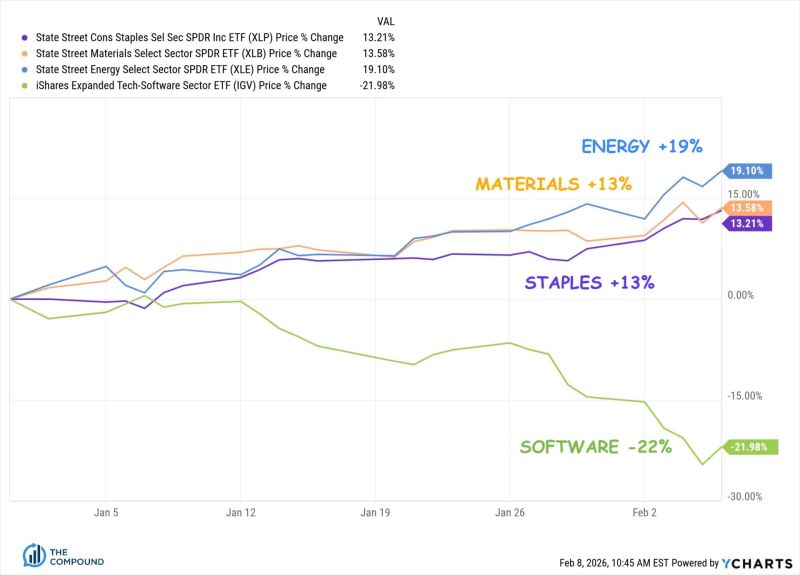

🚨 The "Software is Dead" Narrative is Wrong. You’re Just Looking at the Wrong Software. The market is panicking. The $IGV hashtag#etf is down 30%. The headlines say AI is writing code now, so software companies are toast. 📉 They’re making a massive Category Error. If you're investing without looking at the "plumbing," you're missing the biggest bifurcation of the decade. Here is how the "Singularity" is actually playing out: 1. The Victim: Human-UI SaaS (Type 1) 🖱️ If your software requires a human to stare at a dashboard for 8 hours, you have a target on your back. The Logic: AI agents replace humans. One less Customer Service rep = one less Zendesk seat. One less PM = one less Monday.com seat. The Result: Seat-based SaaS compresses as headcount shrinks. 2. The Winner: Bot-Infrastructure (Type 2) 🤖 AI agents don't have eyes. They use APIs. They don't click; they call. The Logic: One human generates a few clicks an hour. One AI agent generates thousands of API calls per minute. The Winners: The "Tollbooth Operators"—Okta, MongoDB, Snowflake, Datadog. They don't care if the user is a human or a bot; they charge per unit of consumption. Bots consume orders of magnitude more than we do. 🪦 The Real Casualty: The "Body Shops" The IT outsourcing model (Infosys, Wipro, Cognizant) is built on Labor Arbitrage. Hire for $15/hr in Bangalore, bill for $80/hr in NYC. The Problem: AI makes labor arbitrage worthless. You can’t get cheaper than "nearly free." The Proof: India's Big 4 are already cutting thousands of heads. The hiring machine has stopped. 🛑 The Bottom Line: The market is selling "Technology" as a monolith. This is a mistake. AI replaces Road Workers (IT services/Human-UI). AI pays Tolls (Infrastructure/APIs). The Play: Buy the dip in APIs. Short the slides. The infrastructure layer is the only place to hide when the bots take over.

Here are the most popular stocks that report earnings this week February 9th - February 13th. Source: Earnings Hub