14 Aug 2023

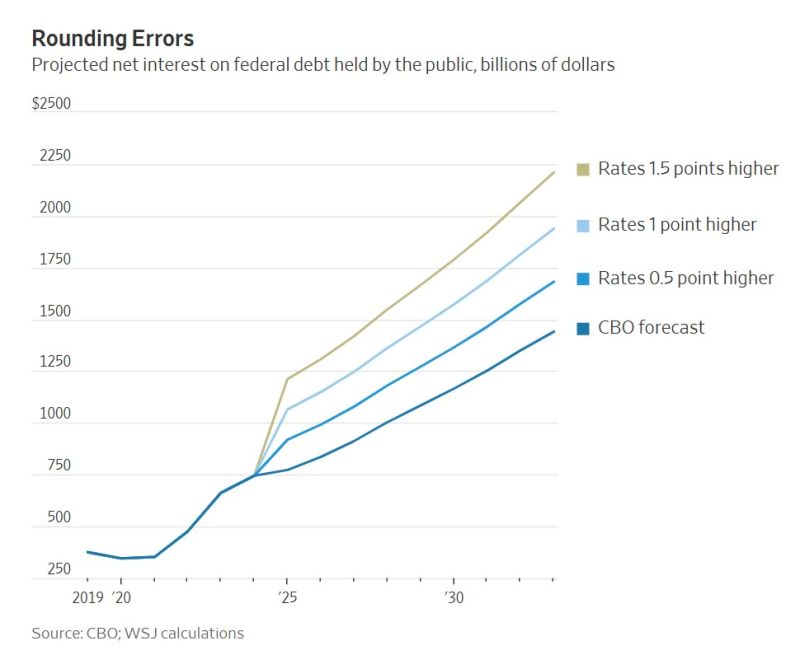

Here's an extract: "Consider that around three-quarters of Treasuries must be rolled over within five years. Say you added just 1 percentage point to the average interest rate in the CBO’s forecast and kept every other number unchanged. That would result in an additional $3.5 trillion in federal debt by 2033. The government’s annual interest bill alone would then be about $2 trillion. For perspective, individual income taxes are set to bring in only $2.5 trillion this year.

Compound interest has a way of quickly making a bad situation worse—the sort of vicious spiral that has caused investors to flee countries such as Argentina and Russia. Having the world’s reserve currency and a printing press that allows it to never actually default makes America’s situation far better, though not consequence-free.

Just letting rates rise high enough to attract more and more of the world’s savings might work for a while, but not without crushing the stock and housing markets. Or the Fed could step in and buy enough bonds to lower rates, rekindling inflation and depressing real returns on bonds".