7 Jun 2024

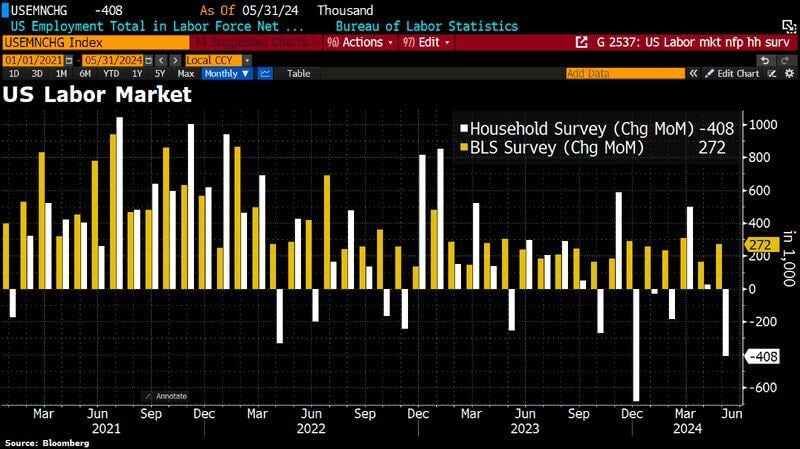

here we go again with jobs numbers that don't add up... The Establishment survey by BLS reports 272k new jobs for May, smashing estimates (+185K consensus) and much strong than April (+165K). The labor market continues to show signs of resiliency in the face of higher Fed interest rates. This seems to decrease the odds that the hashtag#Fed could cut rates in September... BUT:

- Labor force shrank: This is why the US unemployment rate has risen from 3.9% to 4% (first month with 4.0%+ unemployment since February 2022) despite a lower labor participation rate (Indeed, the labor supply as week, and as Unemployment Rate = Number of unemployed / labor force, a weak labor force implies higher unemployment rate despite rise in job creation).

- Wage growth surprised to the upside: this could be linked to a reduction in the supply of labor which might be causing some bottlenecks given the still-robust job creation. Wage growth continues to remain a sticky source of inflation, rising at a 4.1% pace, which is still way too hot for the Fed.

- The Household survey shows a large drop in the number of employed, down 408k jobs (see white bar below).

- Full time jobs actually SHRUNK by 625k (This is the biggest drop in full-time employment since December 2023) while part time jobs rose by 286k.

- Between the household and establishment surveys, the numbers are retarded and unusable. This makes economic data analysis very difficult.

Bottom-line:

Key Takeaway: All things considered, the May jobs report does not point to imminent Fed rate cuts.

The pickup in jobs growth supports the case that the resilient labor market remains strong, and the economy continues to hold up better than expected.

Source: Bloomberg