4 Aug 2025

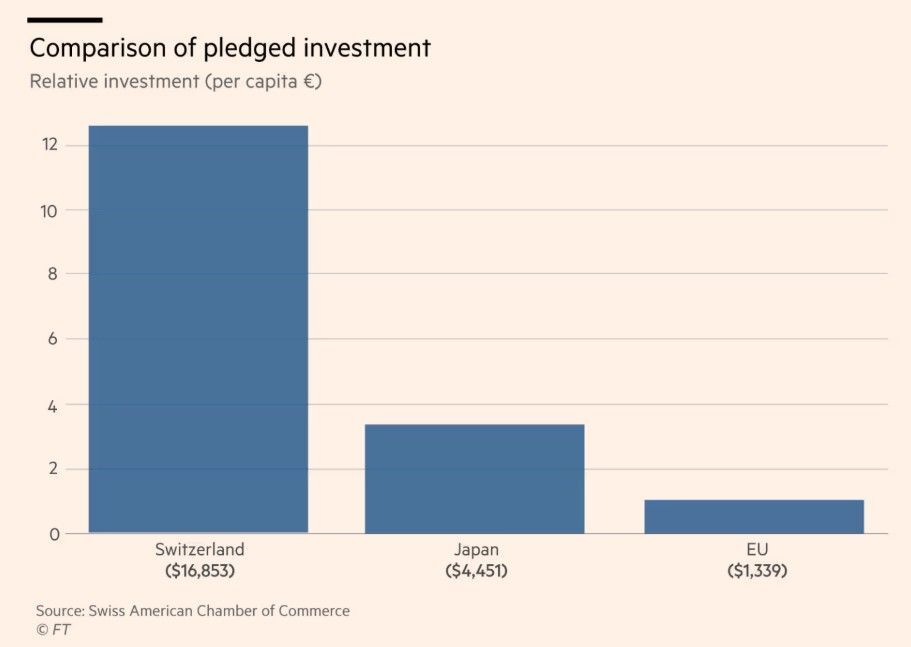

Switzerland said it was confident about securing an early trade deal as it was willing to pledge nearly $150bn in US-bound investment (which is huge on relative terms). “We have nine million people in Switzerland, yet our investment pledge per capita is much more than what Japan or the EU have pledged. If we talk about a $40bn trade deficit, one has to put that [in] perspective,” said Rahul Sahgal, chief executive of the Swiss-American Chamber of Commerce.

Let’s also keep in mind that we are also a huge investor in the US, with Nestlé, Roche and Novartis employing thousands of Americans. Gold exports — often transiting through Switzerland for refining or trade — are largely responsible for the country’s trade imbalance with the US. Yet both gold and pharmaceutical products are exempt from Trump’s “reciprocal tariffs.

Pharmaceutical sector could be the tipping point: Switzerland’s pharma sector sends about 60% of its exports to the US. Novartis and Roche’s US subsidiary Genentech were among the pharmaceutical companies that received letters from the Trump administration this week demanding that they lower drug prices. Swiss watchmaker Breitling’s CEO Georges Kern said his country was being “held hostage” by the pharmaceutical industry that had irritated Trump.

Source: FT