The Chart of the week

Inflation expectations in Japan are rising and driving the rise in JGB yields

The rise in Japanese Government Bonds’ yield has been one of the major developments across fixed income markets in the recent months. The 10-year JGB yield hit 2.35% last week, its highest level since 1999.

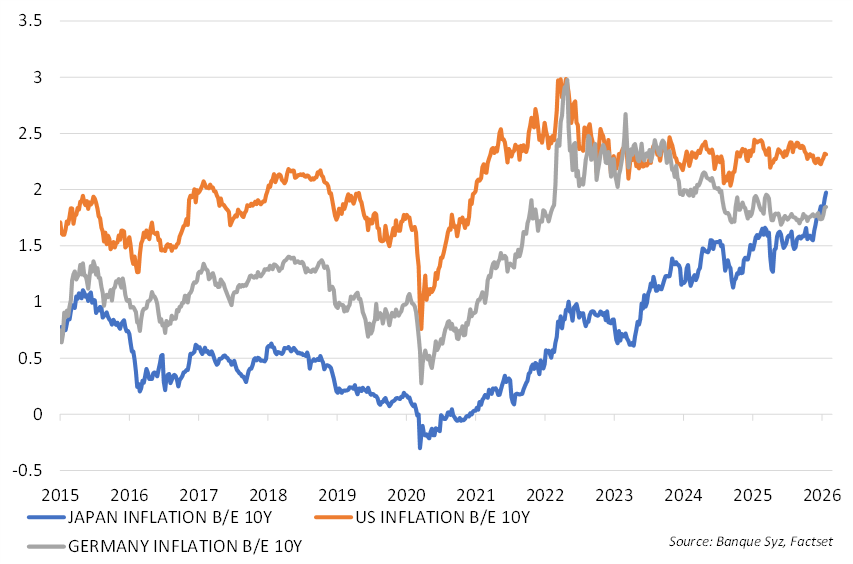

This rise in Japanese yields has been essentially driven by the awakening of inflation expectations in the Land of the Rising Sun. Market-based inflation expectations have been steadily rising and have just reached 2% for the first time in at least two decades. They are now aligned with the BoJ’s 2% inflation target and suggest that markets have finally become convinced that the long deflation era was over in Japan.

Real yields (nominal JGB yields minus inflation expectations) are also trending up in Japan in parallel of the rise in inflation expectations, but in a more gradual way: the real yield of JGB 10-year bonds has risen from -0.35% a year ago to close to +0.3% now.

This upward trend in inflation expectations is not visible yet in the US and European markets. Long-term inflation expectations remain broadly anchored around the 2% level (slightly above in the US, slightly below in Europe), suggesting that markets still believe in the Fed’s and ECB’s credibility for defending their 2% inflation target over the medium and long-term. Profligate fiscal policy and public debt dynamics, along with political interferences around monetary policy in the US, are a potential threat to this anchoring of long-term inflation expectations but they are not yet reflected in market-based inflation expectations.

.png)