14 Feb 2024

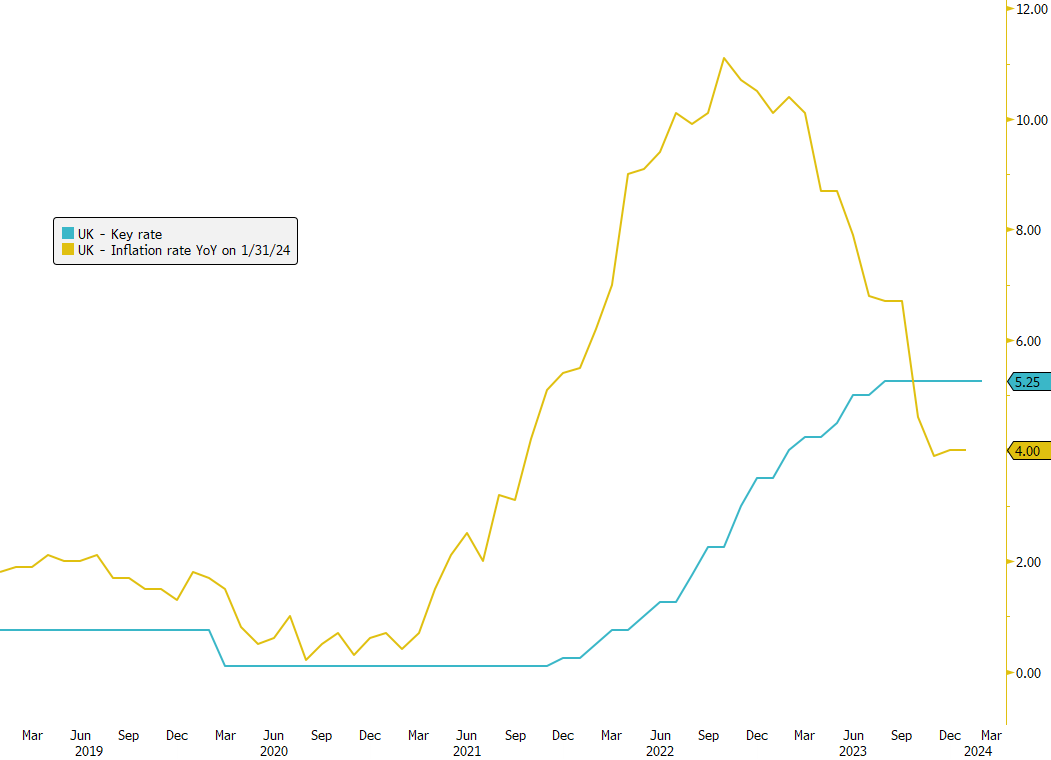

UK inflation remained weaker than anticipated in January, holding steady at 4% year-on-year, defying forecasts of a rise to 4.1%. This unexpected outcome suggests reduced pressure on the Bank of England (BoE) from underlying price increases. Notably, services inflation reached 6.5%, slightly below the BoE's projections.

Despite the stable headline rates, the BoE remains cautious amidst labor market tightness and signs of economic recovery. As a result, traders have adjusted their expectations for rate cuts, now anticipating two cuts for the year, with the first expected in September.

However, amidst this cautious sentiment, the UK bond market could emerge as an attractive opportunity. Expected decreases in the Consumer Price Index (CPI) signal potential inflationary relief, supporting the case for Bank of England rate cuts by mid-2024. Furthermore, appealing yields following recent market pullbacks add to the attractiveness of the UK bond market as an investment avenue.

It's worth noting that the market does not anticipate a rate cut until the first half of 2024, providing investors with ample time to position themselves strategically.

#UKInflation #BankOfEngland #InvestmentOpportunity #BondMarket #EconomicOutlook