31 Jul 2024

Here’s how the company did, compared with the LSEG consensus:

-> Earnings per share: $2.95 vs. $2.93 expected

-> Revenue: $64.73 billion vs. $64.39 billion expected

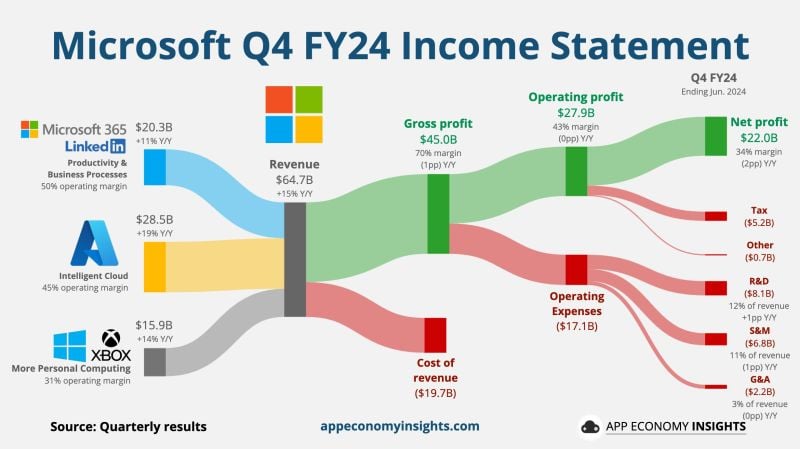

Microsoft’s revenue increased 15% year over year in the fiscal fourth quarter, which ended on June 30, according to a statement. Net income, at $22.04 billion, was up from $20.08 billion, or $2.69 per share, in the year-ago quarter.

The company’s top segment, Intelligent Cloud, generated $28.52 billion in revenue. It includes the Azure public cloud, Windows Server, Nuance and GitHub. The total was up about 19% and below the $28.68 billion consensus among analysts surveyed by StreetAccount. GitHub’s revenue is now at an annual run rate exceeding $2 billion, Microsoft CEO Satya Nadella said on a conference call with analysts.

Revenue from Azure and other cloud services grew 29% during the quarter. Analysts polled by CNBC and StreetAccount had expected 31% growth. Microsoft’s Azure number hadn’t fallen short of consensus since 2022. Microsoft doesn’t disclose revenue from the category in dollars.

In a nutshell:

$MSFT Microsoft Q4 FY24 (ending in June):

☁️ Azure +30% Y/Y fx neutral (vs. 31% in Q3).

• Revenue +15% Y/Y to $64.7B ($0.3B beat).

• Gross margin 70% (-1pp Y/Y)

• Operating margin 43% (flat Y/Y).

• EPS $2.95 ($0.02 beat).

Source: CNBC, App Economy Insights