11 Jun 2024

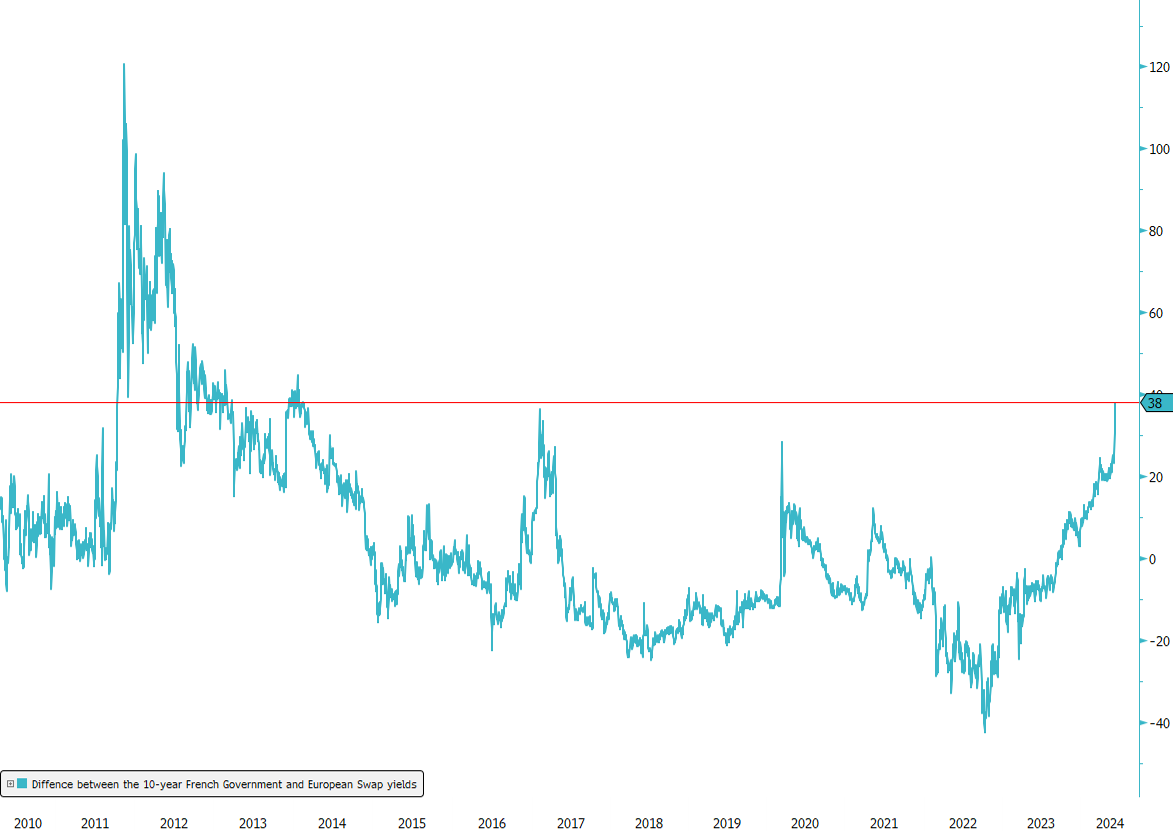

The gap between the 10-year French government bond yield and the 10-year EUR Swap rate, a key benchmark for borrowing costs in Europe, has significantly widened since the recent European elections in France The trend was already "en marche" since S&P recently downgraded France’s credit rating from AA to AA-, following a similar downgrade by Fitch last year. Moody’s has also indicated that the current situation might lead to another downgrade.

While other countries like Ireland and Spain have seen their financial health improve, France seems to be facing more challenges. Political uncertainty and reliance on international investors might cause money to leave France, pushing borrowing costs even higher.

Higher interest rates on French bonds mean that investors want bigger returns because they see more risk in lending money to France. Japanese investors, who own a lot of French bonds, might start investing more in their own country due to rising interest rates there, reducing demand for French bonds. Additionally, some hedge funds are betting against European government bonds, showing a lack of confidence in the stability of European economies, including France.

This trend underscores the growing concerns about France’s economic and political stability in the broader European context.

Source: Bloomberg