6 Aug 2025

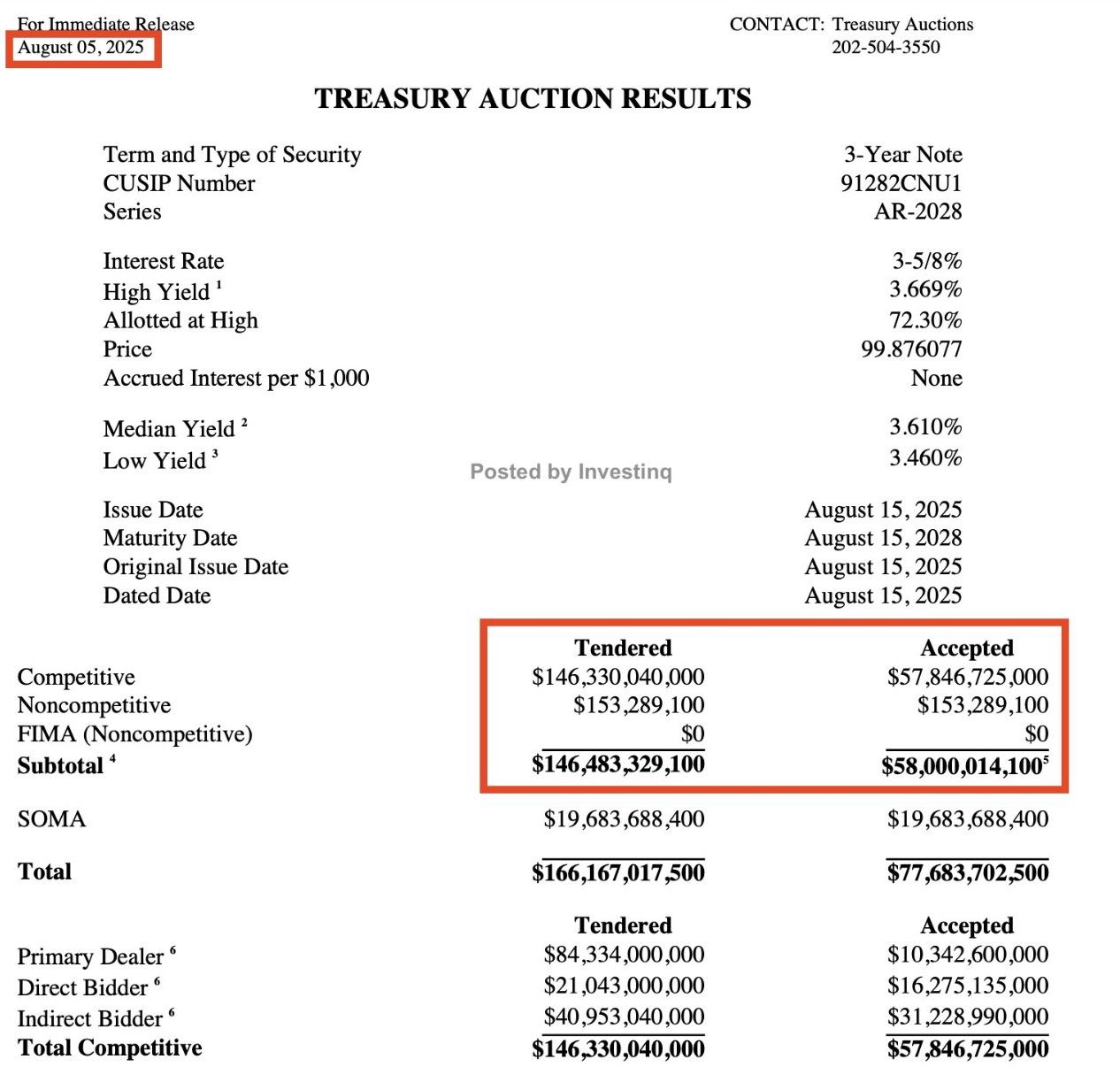

🚨 The U.S. tried to raise $58 billion and demand came in cold. Foreign demand hit a low, and big banks had to step up.

This auction’s bid-to-cover ratio was 2.53. That means: for every $1 the government wanted to borrow, $2.53 was offered.

Sounds healthy but what matters is who’s bidding, not just how much.

Indeed, foreign buyers took 54%, their lowest share in over a year.

So if foreigners are stepping back… who’s stepping in? U.S. investors (directs) who took 28% near record high. That means that US Pensions, insurance companies, and hedge funds are the ones who filled the gap.

Big banks got stuck with 18%, which is not great.

Despite the weak 3-year demand, the 10-year yield didn’t move much staying around 4.20%. Why? Because the market already expected this weak auction. And everyone’s watching the Federal Reserve instead.

But if auctions continue to be on the weak side, things might start to become more difficult for the US Treasury, especially on longer maturities.

Source: StockMarket.News on X