10 May 2024

Firm expects $20 billion to $25 billion of foreign inflows

JPMorgan Chase & Co. is on track to include India in its emerging market debt index from June with most of its clients ready to trade despite some “teething issues,” according to the firm’s global head of index research.

The difficulty in setting up to trade in India due to an elaborate documentation process has been one reason why foreign investors have been apprehensive about the nation’s entry into global indexes. Last September, JPMorgan said it would include India in its emerging market bond index, where it will have a maximum weight of 10%.

JPMorgan estimates foreign inflows will be between $20 billion and $25 billion, assuming an index-neutral position, Kim said. The firm estimates its emerging-market bond gauge currently has $216 billion of assets under management, she added.

India’s entry into global bond indexes will open up an insular market where foreigners own just over 2%, helping develop another investor base. It also adds to the growing heft of the nation and its financial markets, which are seen as the next driver of global growth amid China’s economic woes.

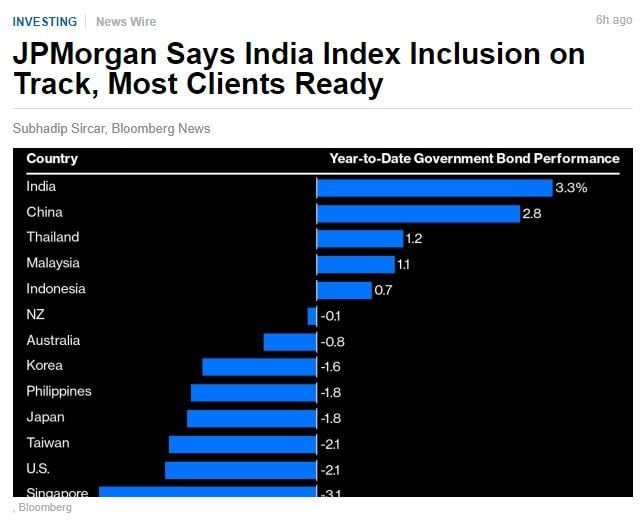

Indian sovereign bonds have seen about $8 billion of inflows into the so-called Fully Accessible Route securities since the JPMorgan announcement, though there were some outflows in April amid a global debt selloff. A Bloomberg gauge of the bonds has outperformed major peers this year.

Source: BNN