3 Nov 2023

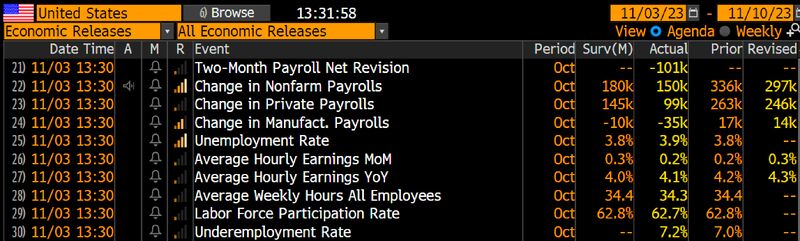

Nonfarm payrolls increased by 150,000 for the month, the Labor Department reported Friday, against the Dow Jones consensus forecast for an increase of 170,000. The United Auto Workers strikes were primarily responsible for the gap as the impasse meant a net loss of jobs for the manufacturing industry.

The unemployment rate rose to 3.9%, against expectations that it would hold steady at 3.8%. Employment as measured in the household survey, which is used to compute the unemployment rate, showed a decline of 348,000 workers, while the rolls of the unemployed rose by 146,000.

A more encompassing jobless rate that includes discouraged workers and those holding part-time positions for economic reasons rose to 7.2%, an increase of 0.2 percentage point.

Meanwhile, Household Survey showed a huge 348k loss in jobs during October.

Dollar drops, Bond yields slide following VERY disappointing US jobs data which fuel bets Fed is done

Source: CNBC, Bloomberg