Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Weekly liquidity update (by our Chief Economist Adrien Pichoud)

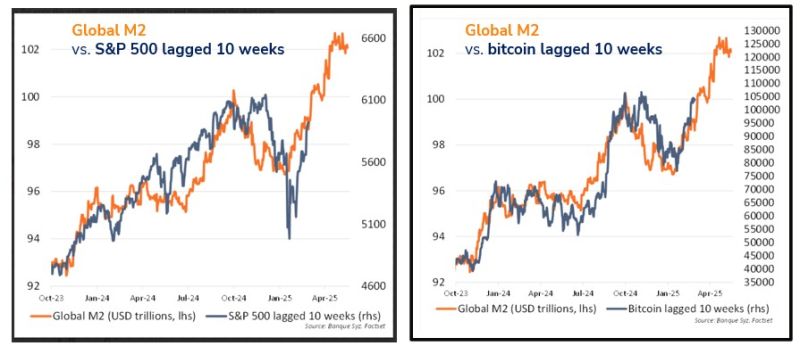

➡️ Global M2 proxy flat again this week, still supportive for equities and bitcoin over the short-term ➡️ The S&P500 has been “catching up” our global M2 proxy. Our Global M2 proxy continues to point to supportive liquidity dynamics for risk assets in the weeks ahead. ➡️ The link between our Global M2 proxy and the Bitcoin continues to hold remarkably well and to point to more upside potential for the BTC. NB: These are NOT investment recommendations. A broad range of factors need to be taken into account before taking any investment decisions

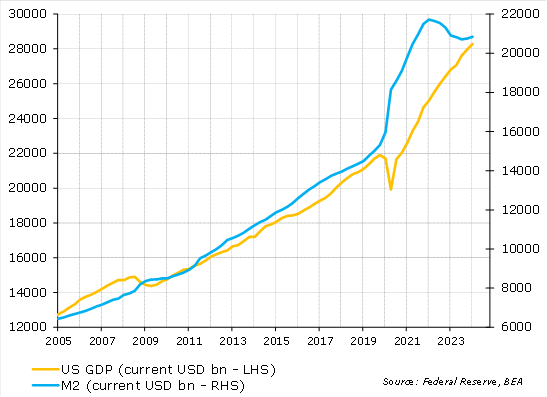

The US money supply is back in line with the size of the economy, after the excesses of the pandemic period

Time for the Fed to take its foot off the brake pedal regarding liquidity Source: US Federal Reserve, BEA

Investing with intelligence

Our latest research, commentary and market outlooks