Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

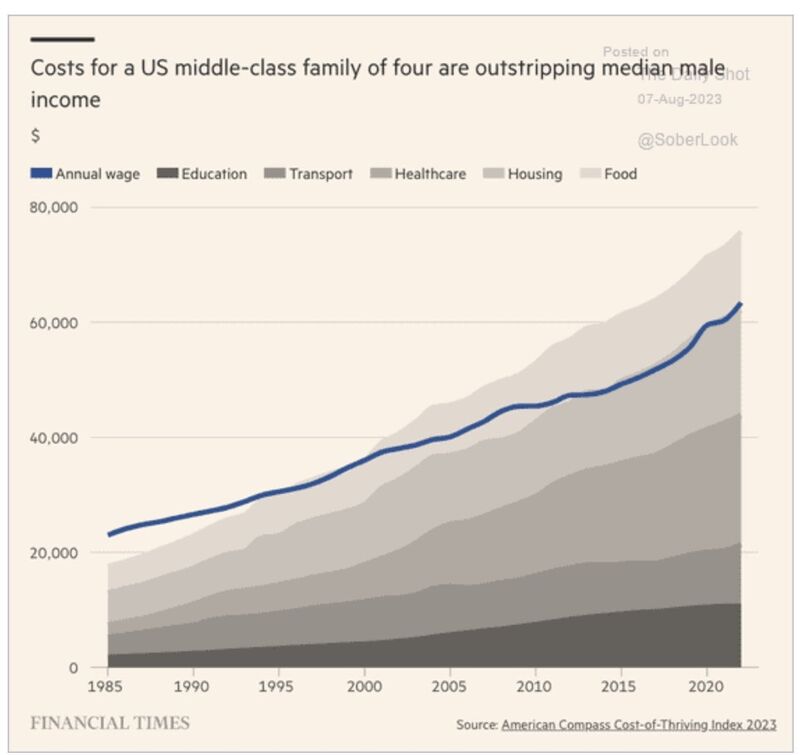

Financial demands of supporting a US family of 4 have surpassed what a single salary can adequately provide

Source: FT

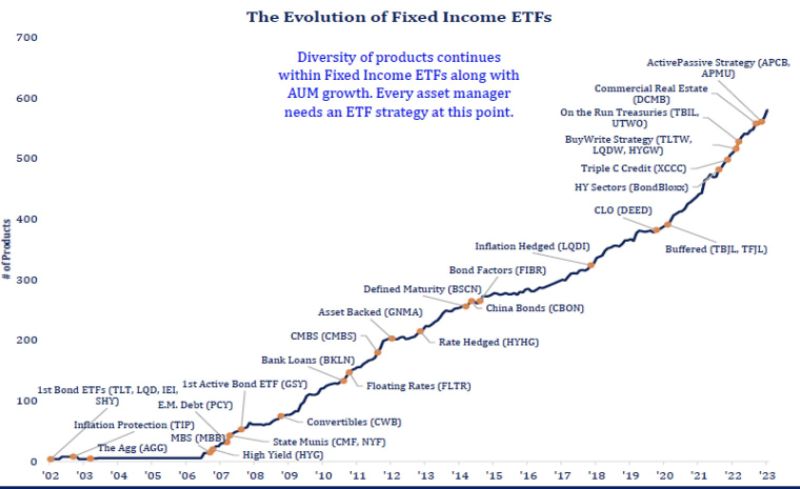

The evolution of fixed income ETFs in one picture...

This chart really shows off how far things have come in 20 years and how far the ETF industry goes with an asset class. Source: Todd Sohn thru Eric Balchunas

Total credit card indebtedness increased by $45 billion in the April-through-June period, an increase of more than 4%

That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003. The increase in the category was the most notable area as total household debt edged higher by about $16 billion to $17.06 trillion, also a fresh record. As card use grew, so did the delinquency rate. The Fed’s measure of credit card debt 30 or more days late rose to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%. Source: CNBC

The trend is your friend until it ends??? Apple ($AAPL)

Source: Tradingview

Italian banks slump after government introduces windfall tax

Deputy PM Salvini announced a 40% levy on extra profits of lenders for 2023 as part of a wide-ranging decree approved at a cabinet meeting. Analysts estimate it will wipe 19% from bank earnings. Levy targets higher interest incomes following rate hikes by ECB. Source: Bloomberg, HolgerZ

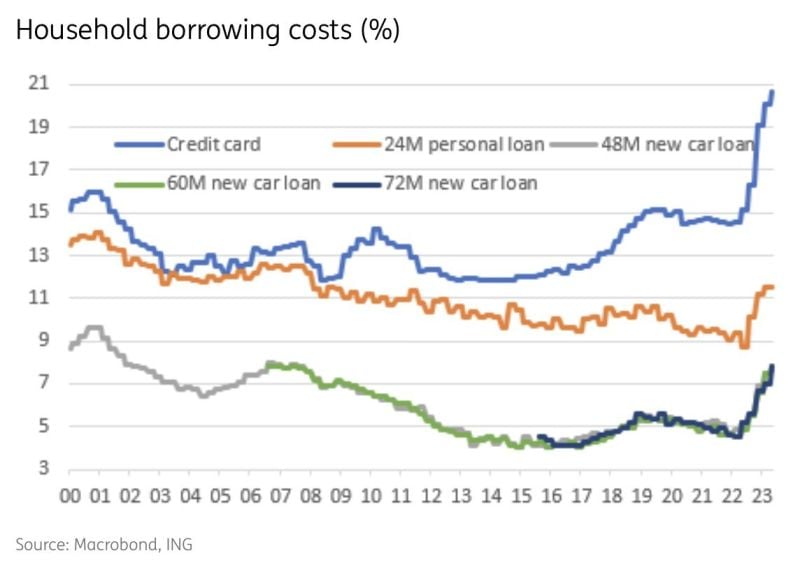

In the US, interest rates on household items are skyrocketing

In just 1 year, the average interest rate on credit card debt has gone from 14% to 21%+. New car loan rates went from 4% to 8% while used car loan rates are at 12%+. Mortgage rates are at a fresh high of 7.2%, up from 2.7% in 2021. Will the US consumer be able to absorb all these debt servicing costs? Source: The Kobeissi Letter, Macrobond, IN

Moody's has cut credit ratings of several small to mid-sized US banks on Monday

Moody's said it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength will likely be tested by funding risks and weaker profitability. This does not come as a surprise to us as US banks are facing several headwinds at the time being: 1) Inverted yield curve and lower trading / M&A activity weighing on profitability; 2) Deteriorating loan book quality due to Commercial real estate exposure but also US consumers starting to being hit by rising debt costs (credit card, mortgages, etc.); 3) Deposits withdrawals. Source: reuters

Investing with intelligence

Our latest research, commentary and market outlooks