Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

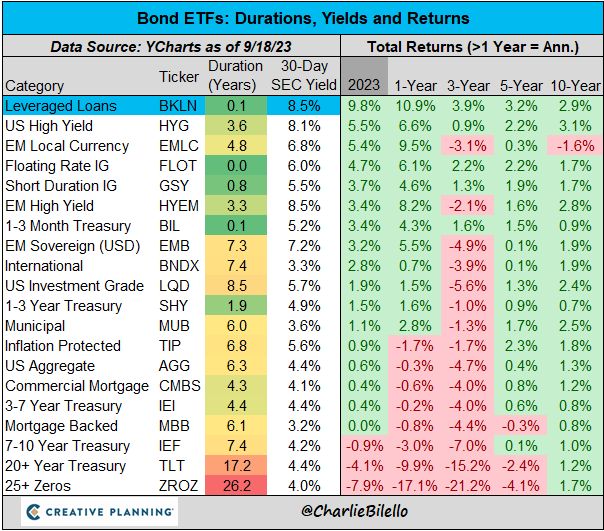

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

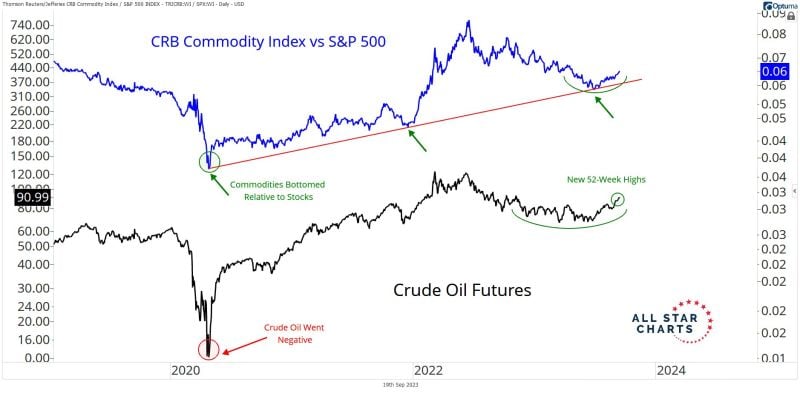

With the rise of oil prices, there is currently a revival of the "commodities super-cycle thesis"...

Source: J-C Parets

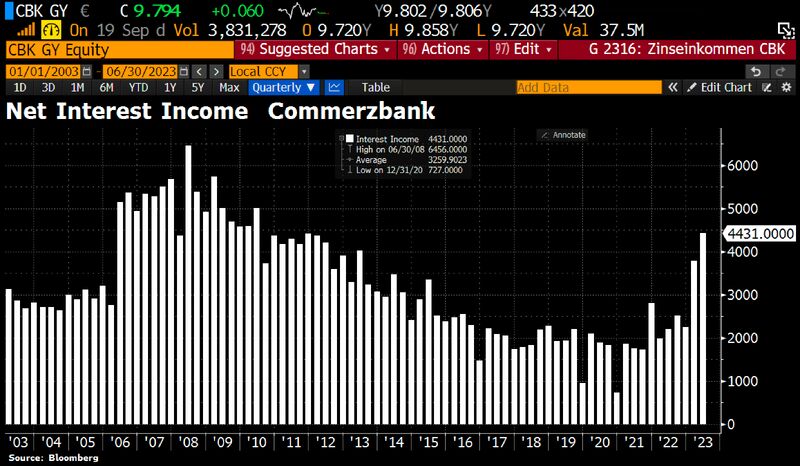

German banks are NOT passing on the increased interest rates to their customers

Commerzbank, Germany's 2n-largest retail bank, has announced it will increase net interest income to €8bn. Commerzbank has increased its deposit beta - a measure of how much of a rate increase it passes along to savers - slower than initially expected. The bank will end this year with something around a deposit beta of avg 40%. Source: HolgerZ, Bloomberg

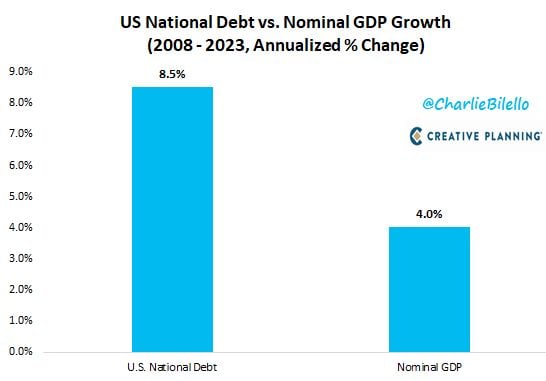

Over the last 15 years, the US National Debt has increased at a rate of 8.5% per year versus an increase in economic growth (nominal GDP) of 4.0% per year

Source: Charlie Bilello

United Auto Workers (UAW) threaten to expand strike, according to WSJ

4 days after workers at Ford, Stellantis, and GM went on strike, strikers are threatening to expand. Currently, 13,000 out of 144,000 UAW workers are on strike. A strike by the entire UAW would cost US automakers nearly $600 million PER DAY. This is the first time in history that all 3 US automakers are on strike. Source: The Kobeissi Letter

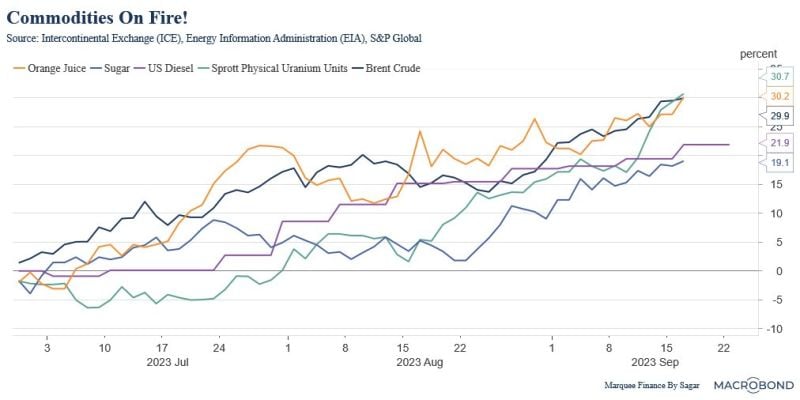

Since the June bottom, crude oil, uranium, sugar and orange juice are up 20-30%. Is the risk of a second wave increasing?

Source: The Macro Guy

Is the US IPO market coming back to life?

Instacart sold 22 million shares at $30 each in an initial public offering on Monday, raising $423 million in the process. The offering, which values the grocery delivery company at around $10 billion, is the second high-profile IPO in a matter of days, after British chipmaker Arm had made its trading debut on the Nasdaq stock exchange last Thursday. With Klaviyo, a marketing automation company, also planning to raise up to $550 million in its initial public offering on Tuesday, this week is a clear sign of life from the U.S. IPO market, which had dried up completely in 2022 after a record-breaking 2021. According to Dealogic data analysed by EY, IPO activity already picked up slightly in the first half of the year, as companies raised $10.1 billion in 63 initial public offerings in the U.S., compared to $4.7 billion in 51 IPOs in the first six months of 2022. With inflation looking likely to have peaked, rate hikes nearing an end and equities having rebounded from last year’s lows, the market backdrop looks more positive now that it did at any time in the past 18 months. Source: Statista

Investing with intelligence

Our latest research, commentary and market outlooks