Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

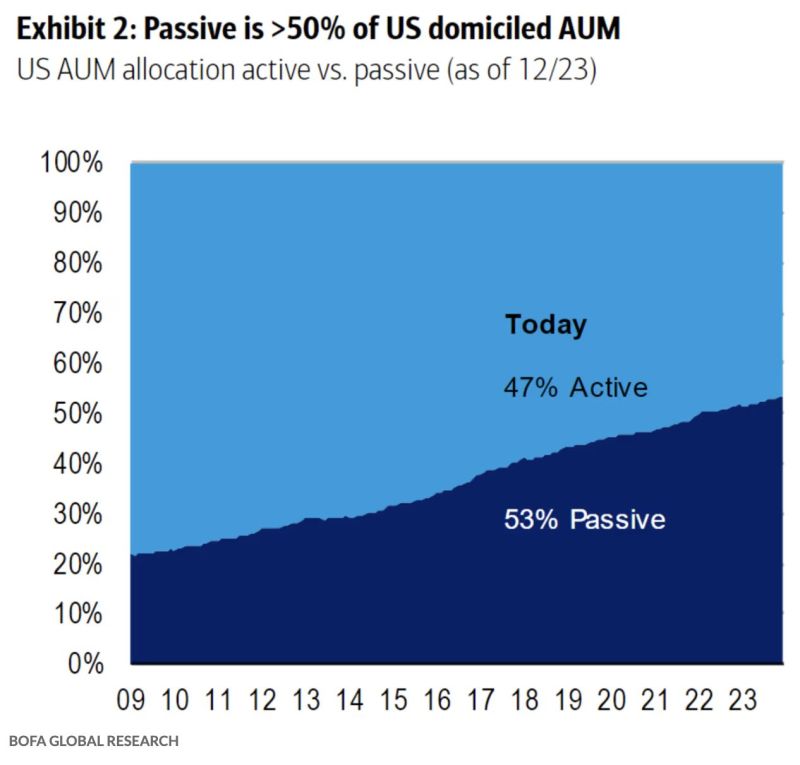

Passive funds have overtaken active.

That’s changed a lot because the number of active managers is down a lot, David Einhorn says in MIB podcast: "There’s entire segments now mostly in the smaller part of the market where there’s literally nobody paying any attention...I view the markets as fundamentally broken". Source: HolgerZ, BofA

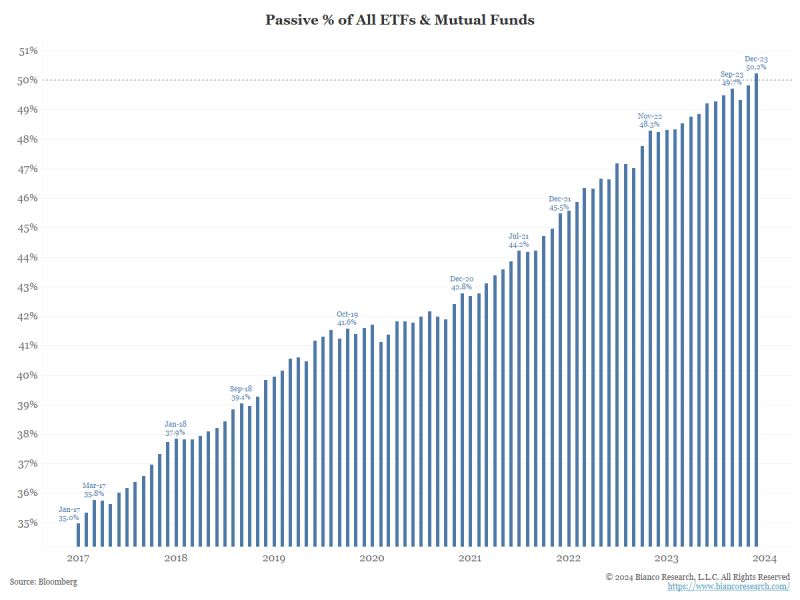

According to Bloomberg's estimates, passively managed money just exceeded 50% of all assets.

Money management just crossed the Rubicon. Source: Bianco Research

Asset Managers are the most long U.S. Equity Futures in at least the last 15 years.

Source: barchart

What a tweet by Franklin Templeton

A $1.5T and 77-years old leading assetmanager...

According to Darwin's Origin of Species, the species that survives is the one that is able best to ADAPT and ADJUST to the changing environment in which it finds itself.

See below the twitter profile of Franklin Templeton, a 77 vyears old asset manager with $1.5T assets under management.

A tale of two type of investors...

who will be right? Hedge Funds continue to short treasuries at historic levels while asset managers are building their largest long positions ever recorded! Source: FT, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks