Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

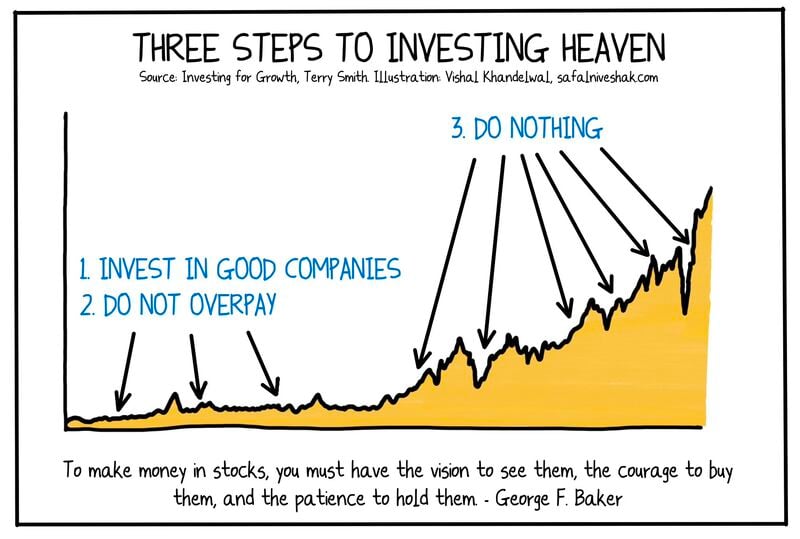

Three steps to investing heaven…

Source - Investing for Growth by Terry Smith thru Vishal Khandelwal

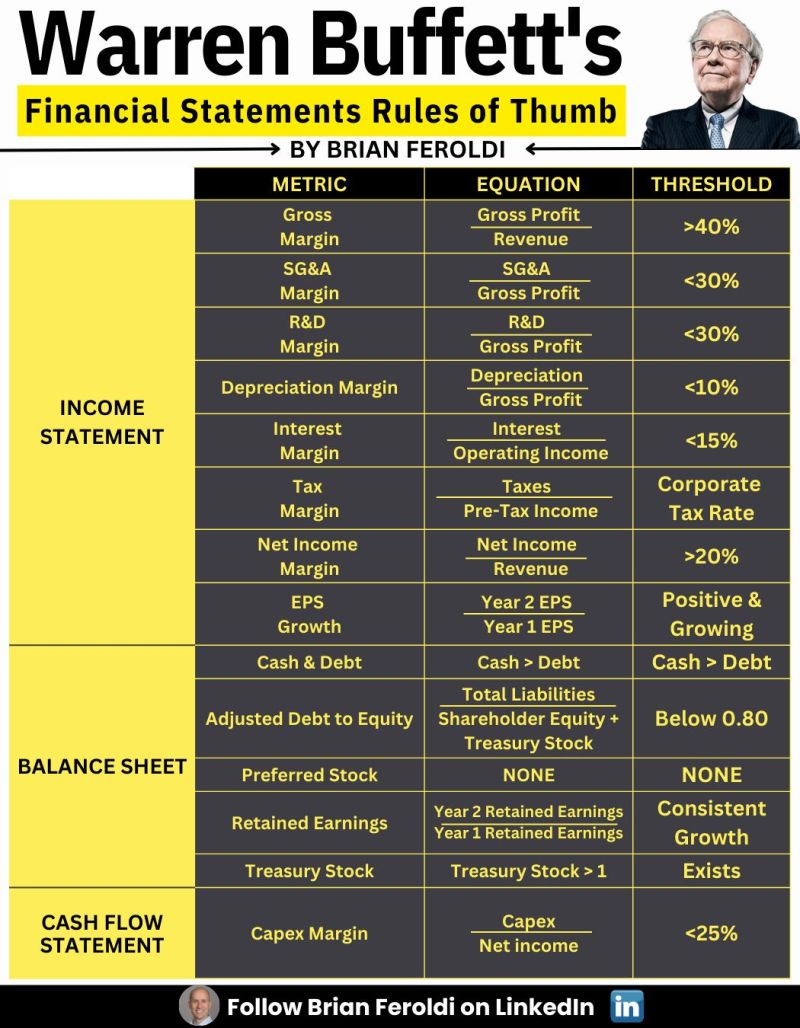

Warren Buffett’s Financial Statement Rules of Thumb

Source: Brian Feroldi

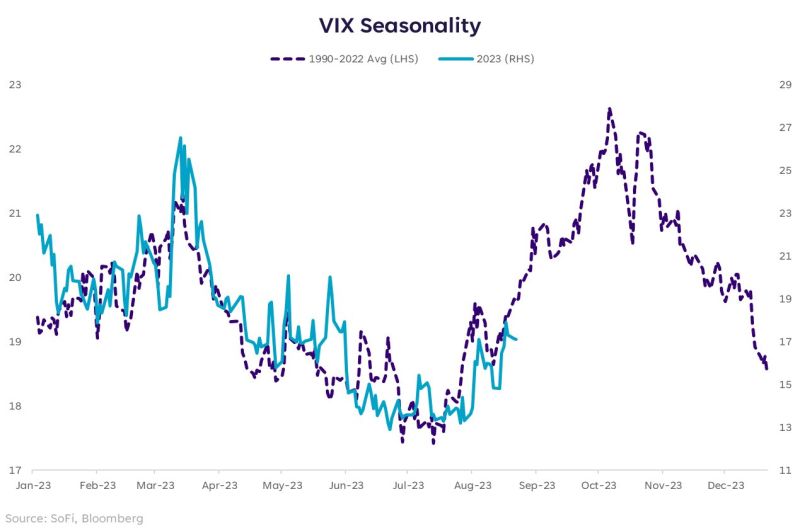

Stock market (sp500) volatility in 2023 has tracked alongside historical seasonality. A continuation of that trend would imply a spike in volatility is coming...

Source: Liz Young, SoFi, Bloomberg

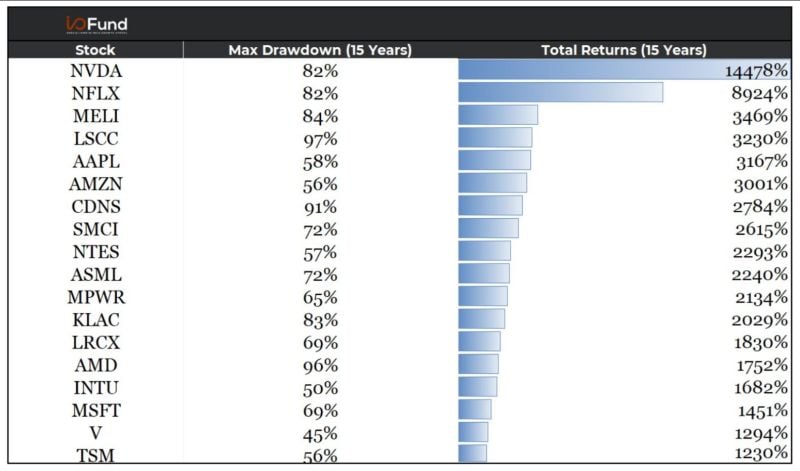

Investing requires patience. Over the past 15 years, investors in these stocks navigated significant drawdowns before reaping substantial gains

The same principle might apply to bitcoin and some cryptocurrencies as well. Source: ycharts, Beth Kindig

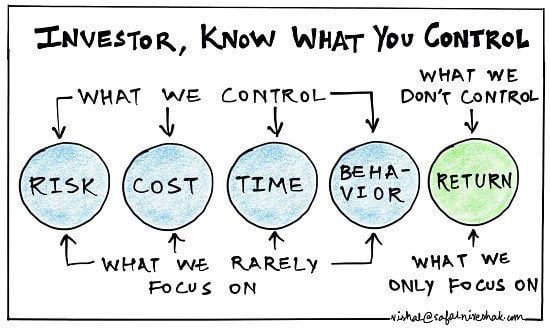

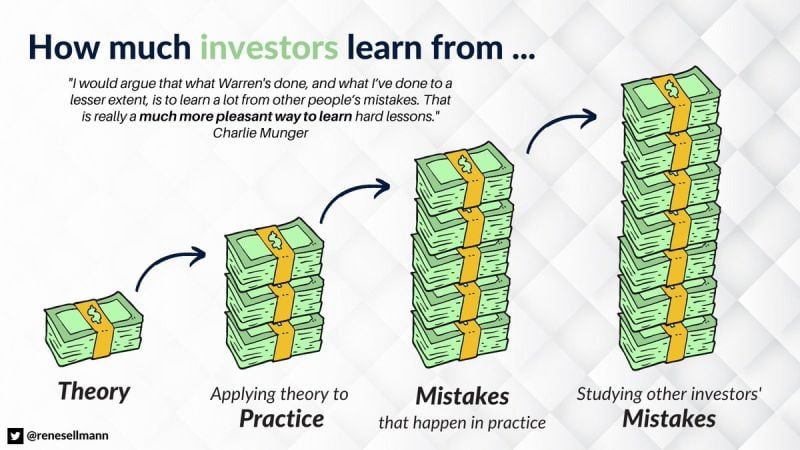

Investors learn the most by studying other investors' mistakes

Source: Brian Feroldi

Bespokeinvest posted: "Here's one way to think about investing in equities and "buy and hold."

Casinos make money by making sure bettors eventually lose more often than they win. The stock market is the opposite. The longer you play, the better your odds. Historically, the odds of the S&P 500 being up over any one-month time frame have been 62.6%. Over a year, the odds of being up jump to 74.6%, and over eight years, they jump to 97%. Since 1928, all 16+ year time frames have seen positive returns. Check out this chart Bespokeinvest created to help people visualize this data a couple of years ago (updated through July 2023):

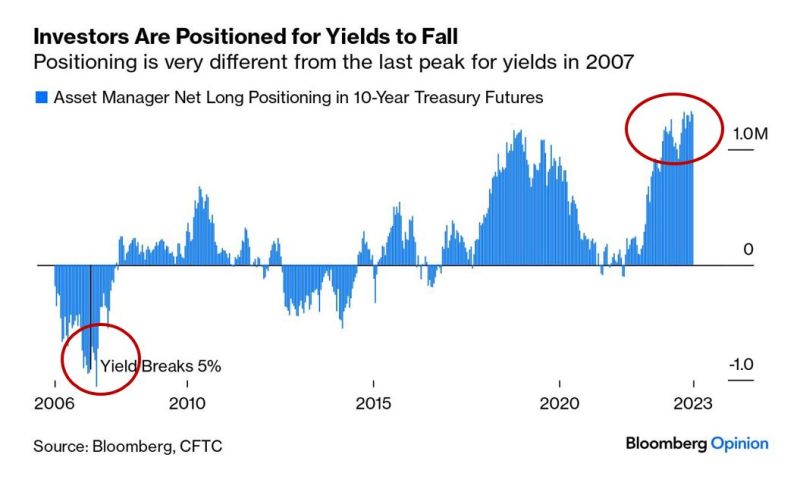

Why this time is different (I know this is a dangerous sentence...)

Asset managers are very long 10-year futures, expecting yields to fall from here! This is a very different set-up than in 2007 when asset managers were expecting #yields to rise... Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks