Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

EU watchdog monitors surge of cash going into biodiversity funds

The surge in money going into biodiversity funds is the "next frontier" of ESG investing and warrants increased monitoring to avoid greenwashing, the European Union's securities regulator said.

The cumulative flow of money into biodiversity funds reached 854 million euros ($931 million) in the two years to June 2023, with 73% of the funds launched since 2022.

Source: Reuters

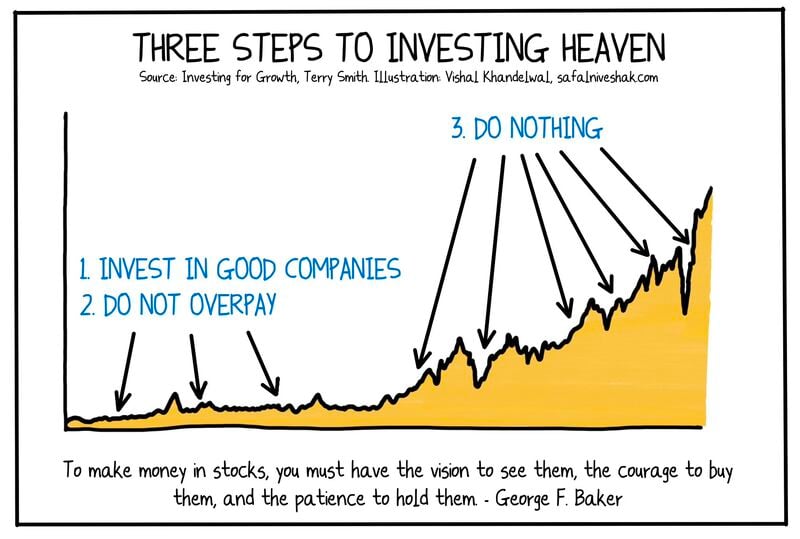

Three steps to investing heaven…

Source - Investing for Growth by Terry Smith thru Vishal Khandelwal

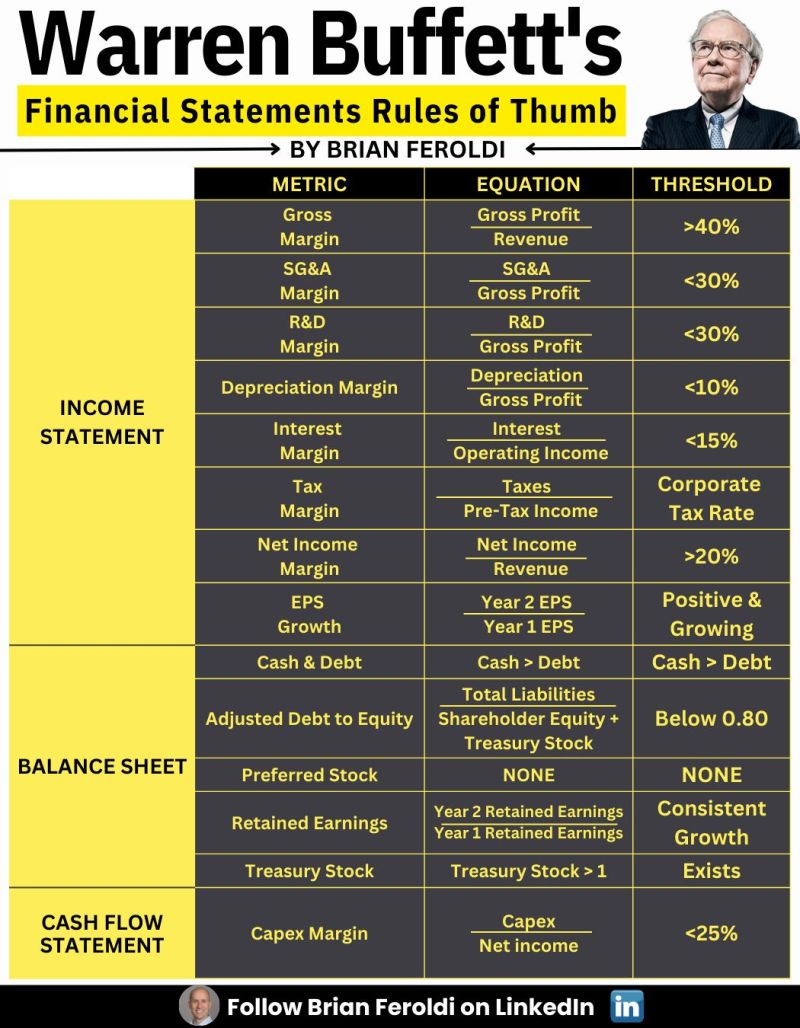

Warren Buffett’s Financial Statement Rules of Thumb

Source: Brian Feroldi

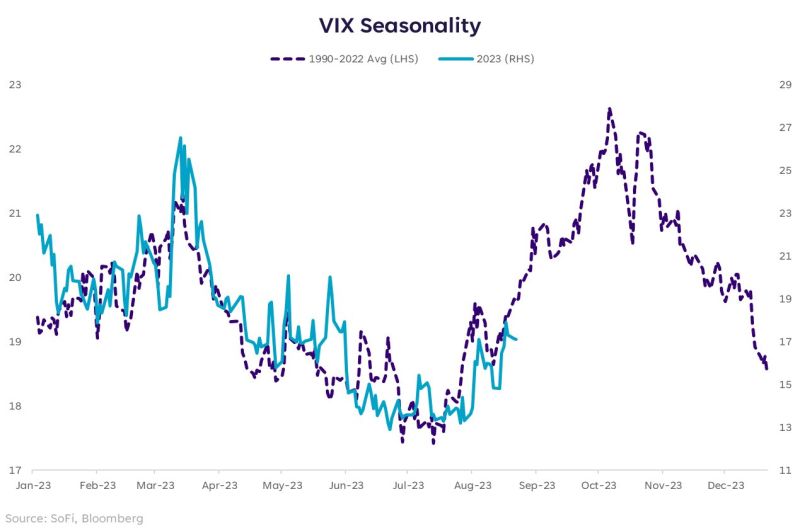

Stock market (sp500) volatility in 2023 has tracked alongside historical seasonality. A continuation of that trend would imply a spike in volatility is coming...

Source: Liz Young, SoFi, Bloomberg

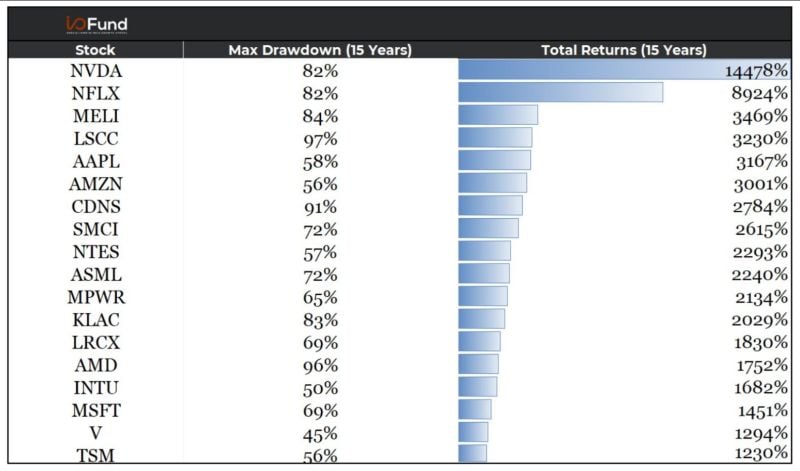

Investing requires patience. Over the past 15 years, investors in these stocks navigated significant drawdowns before reaping substantial gains

The same principle might apply to bitcoin and some cryptocurrencies as well. Source: ycharts, Beth Kindig

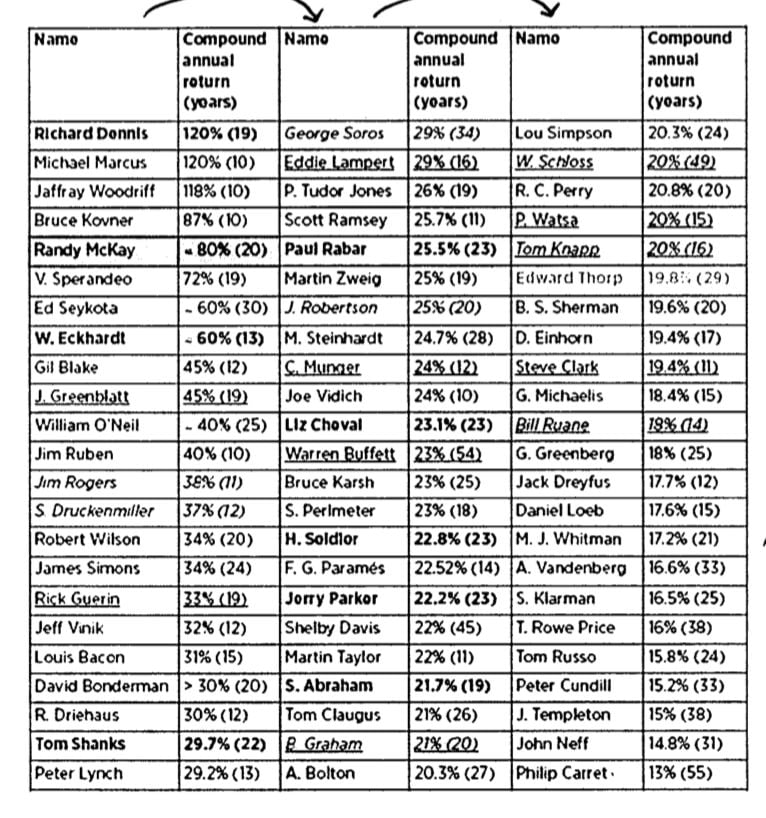

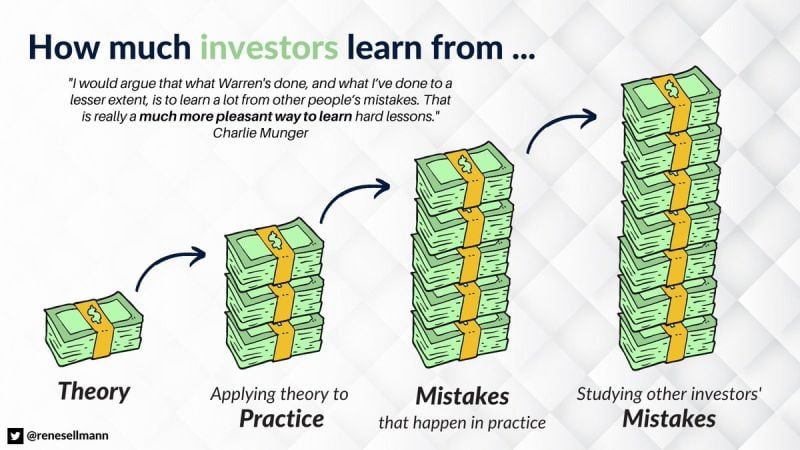

Investors learn the most by studying other investors' mistakes

Source: Brian Feroldi

Investing with intelligence

Our latest research, commentary and market outlooks