Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What were hedge funds buying in Q2?

(source: App Economy Insights) Here are some findings when diving into 13F: 🤖 AI models ⚙️ Semiconductors 🎤 A bit of Taylor Swift 💊 And... weight-loss drugs?!

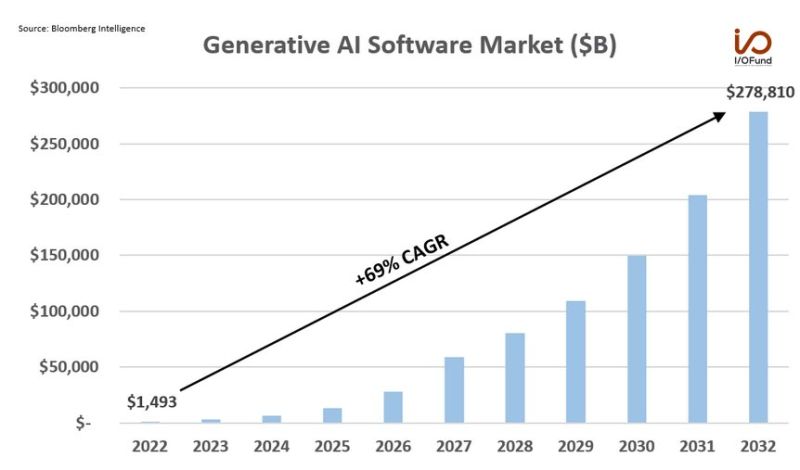

The generative AI software market is forecast to rapidly grow from $1.5B in 2022 to nearly $280B in 2032

Representing a 69% CAGR – driven by AI assistants and workload infrastructure software, which could contribute $160B combined. Source: Bloomberg, Beth Kindig Potential winners? $META $ADBE $NVDA $MSFT (not an investment recommendation)

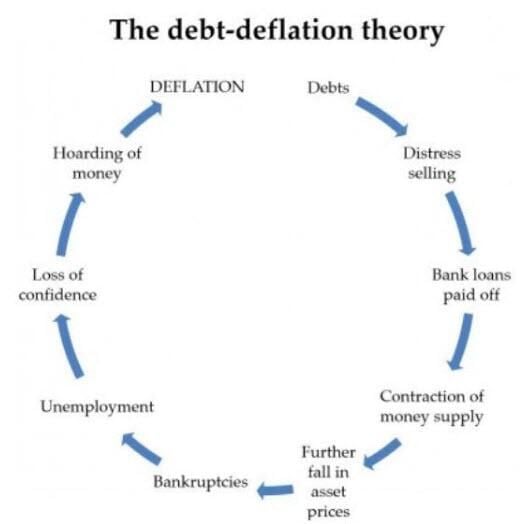

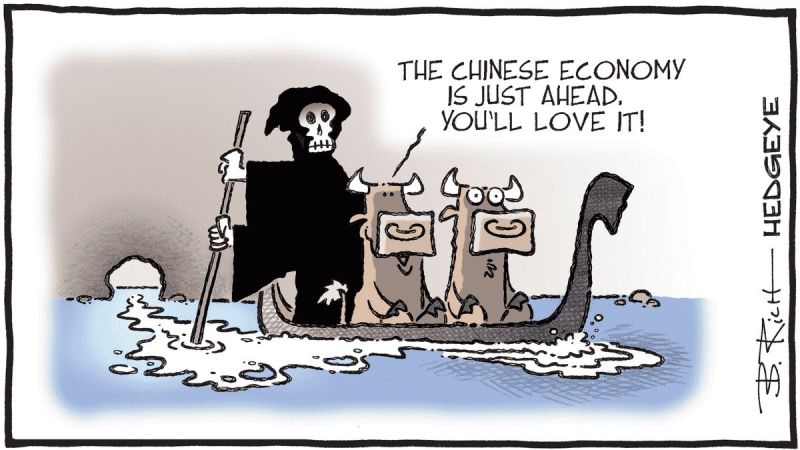

In 2009 China sparked global reflation. In 2023, could China to spark global deflation?

Source: www.zerohedge.com

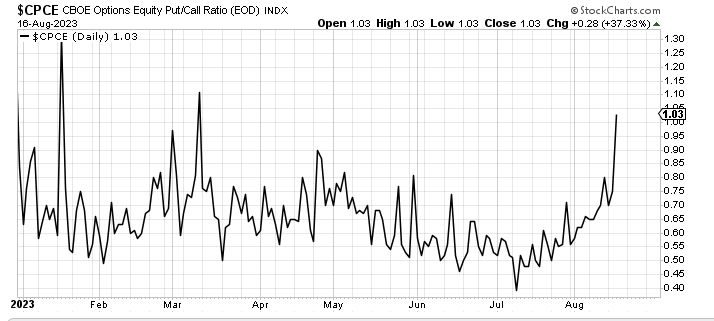

At least a positive (contrarian) news

The SPX Put to call ratio is at its highest since the SVB banking crisis. In a short term view, the 'PUT BUS' is getting crowded and a crowded trade is usually not a good trade. Source: JC Investment

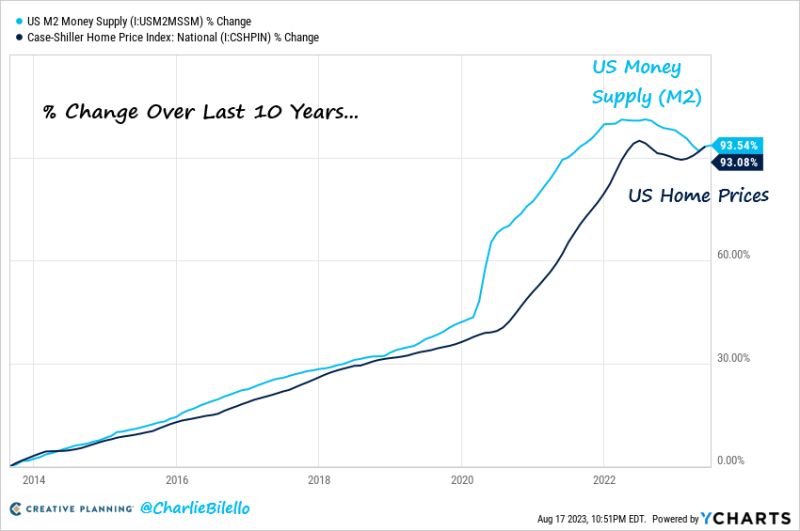

"inflation is always and everywhere a monetary phenomenon." - Milton Friedman

Source: Charlie Bilello

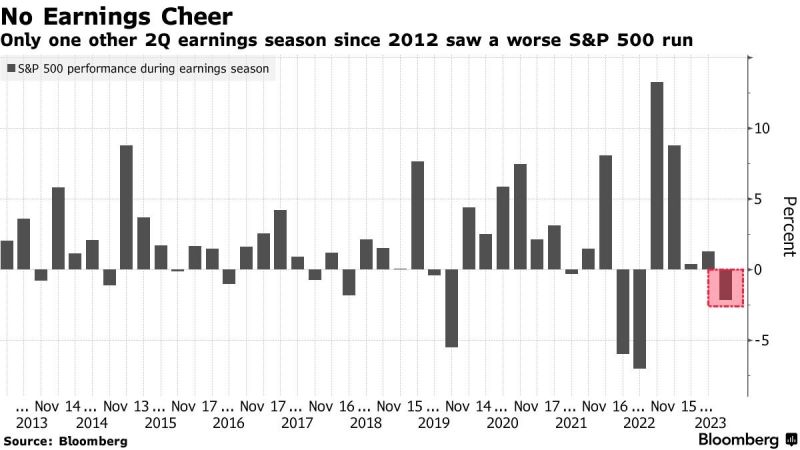

More than 80% of SP500 companies that have reported so far have beaten profit expectations but the returns are setting this up to be one of the worst earnings seasons over the last 11 years

Source: Bloomberg

The fact that Chinese State property developers are also in big troubles complicates the issue for the China real estate

Mainly, as it reduces their ability to support the sector by taking over incomplete projects by private sector. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks