Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

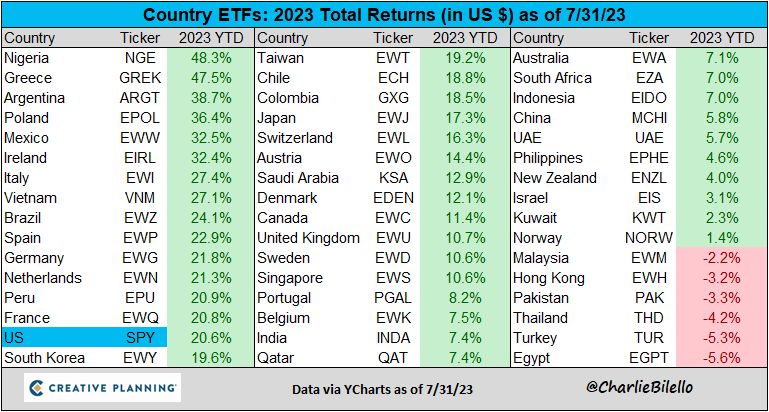

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

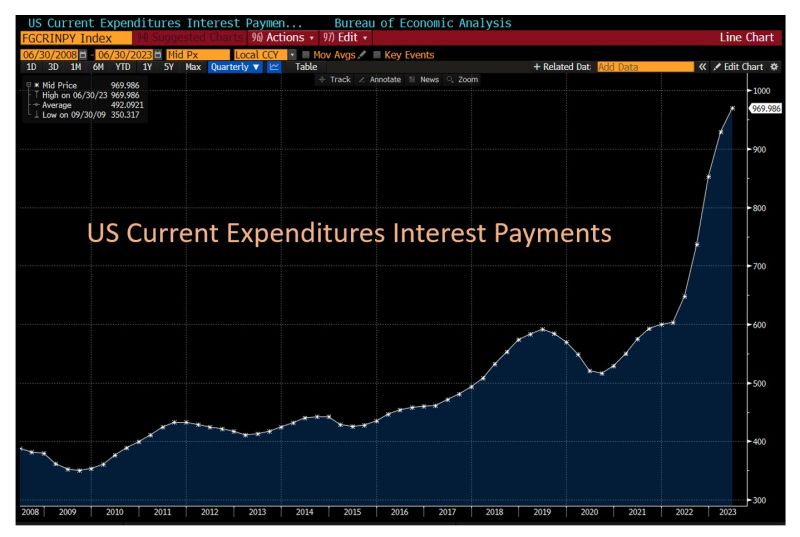

US interest expenses have surged by about 50% in the past year, to nearly $1 trillion on an annualized basis

Source: Lisa Ambramowicz, Bloomberg

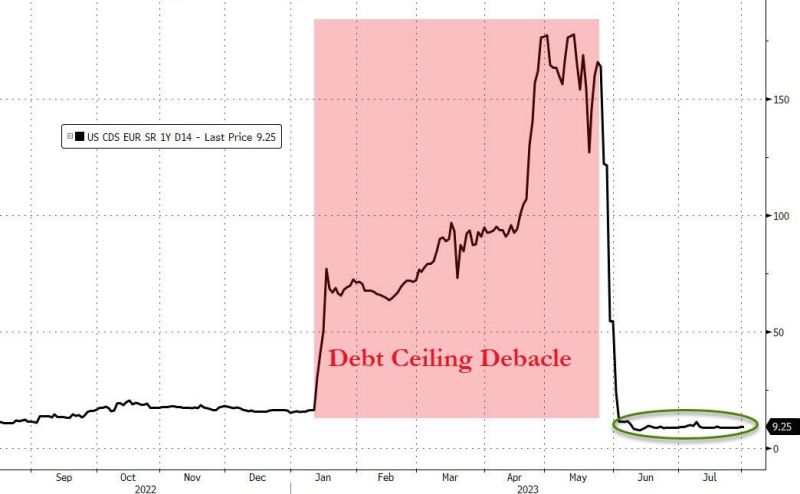

Note that US Sovereign risk (aka CDS on 1-year US Treasury) was completely unmoved by the Fitch downgrade.

Source: Bloomberg, www.zerohedge.com

Treasuries haven’t been this ineffective as a stock hedge since the 1990s. The one-month correlation between the two assets is now at its highest reading since 1996

Source: Lisa Abramowicz, Bloomberg

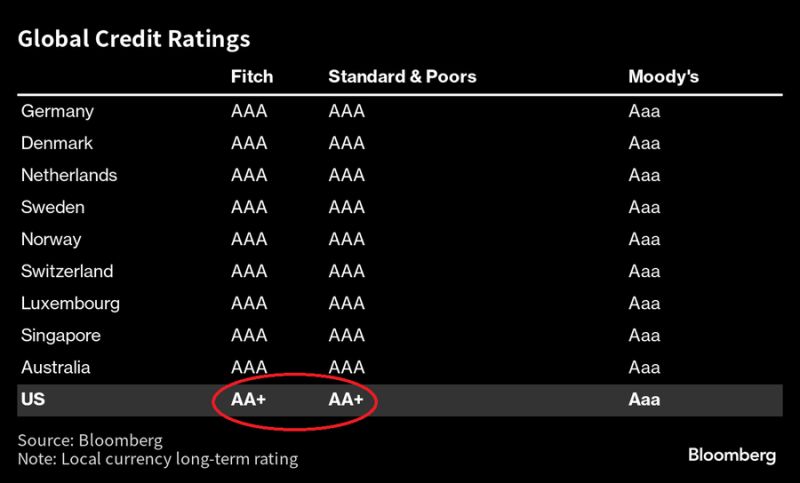

Who is left in the AAA club? (the US is now split-rated AA+)

Source: Jim Bianco, Bloomberg

The survivorship bias

It is a sample bias that occurs when we assess only successful outcomes and disregard failures. See below example with strikes on returning and non-returning planes during WWII Source: Mnke Daniel

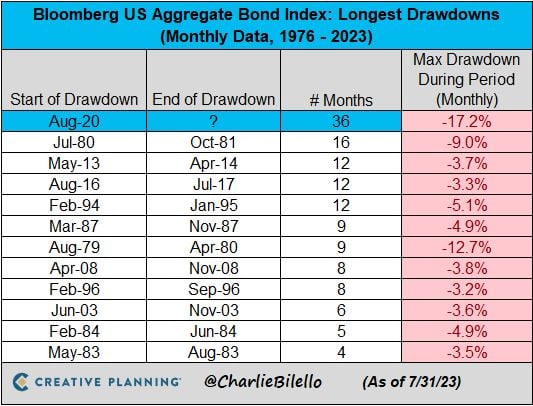

The US bond Market has now been in a drawdown for 3 years, by far the longest in history

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks