Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$LVMH Q2 2023

"Thanks to the desirability of our brands, we approach the second half of the year with confidence and optimism" - Bernard Arnault Organic Growth by Business Group - source: Quartr

Top Cobalt Producers

Colbalt is essential for a series of technologies, from batteries needed for EVs to portable devices like smartphones, tablets, and laptops. The Democratic Republic of Congo (DRC) has long been the world’s largest cobalt producer, accounting for 73% of global output in 2022. However, according to the Cobalt Institute, the DRC’s dominance is projected to decrease to 57% by 2030 as Indonesia ramps up its cobalt production as a byproduct from its rapidly expanding nickel industry. Indonesia accounts for nearly 5% of global cobalt production today, surpassing established producers like Australia and the Philippines. Source: Visual Capitalist, Elements

S&P 500 Forward Earnings Yield

The S&P 500 equity risk premium hit the lowest level in two decades, which will be a headwind for longer-term returns. Source: The Daily Shot

The disconnect between Fed net liquidity (grey) and the S&P 500 (purple) is growing by the day

source: Markets & Mayhem

LVMH, the world's top luxury group, said Tuesday it enjoyed an excellent first half with net profits soaring by 30 percent to 8.48 billion euros thanks to strong growth in Asia and Europe.

Sales at the group whose brands include Louis Vuitton, Dior and Tiffany, rose 15 percent during the January-June period compared with last year, to hit 42.2 billion euros. ONE BUG SURPRISE -> LVMH reported a surprising drop in U.S. sales in the second quarter, as its chief financial officer said “aspirational customers are not shopping as much as they used to.“ LVMH’s U.S. sales slid 1% in the second quarter from the prior-year period. The disappointing results in the U.S. market came after Cartier owner Richemont earlier this month reported a 4% decline in U.S. sales. Richemont shares fell 10% on the news, pressuring other luxury stocks throughout the week as analysts braced for a potential U.S. luxury slowdown. Here are the details by App Economic Insights - LVMH Louis Vuitton Moët Hennessy H1 FY23 Revenue +15% Y/Y to $42.2B. Wines & Spirits -4% to €3.2B. Fashion & Leather goods +17% to €21.1B. Perfumes & Cosmetics +11% to €4.0B. Watches & Jewelry +11% to €5.4B. Selective retailers & other +26% to €8.4B. Source: App Economy Insights, Barron's, CNBC

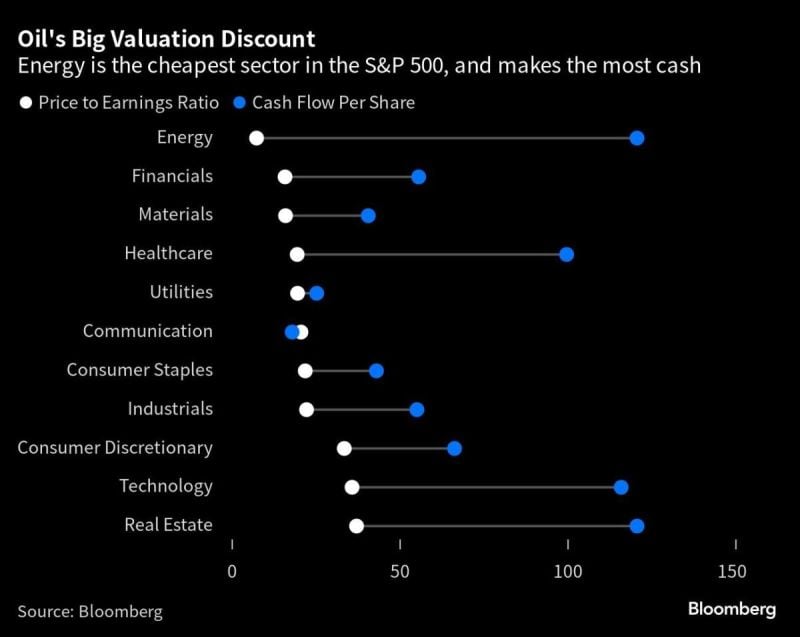

Energy is the least expensive sector in the S&P 500 but generates the most cash.

Perhaps this explains why Warren Buffett continues to increase his position in Occidental Petroleum - source; Barchart, Bloomberg

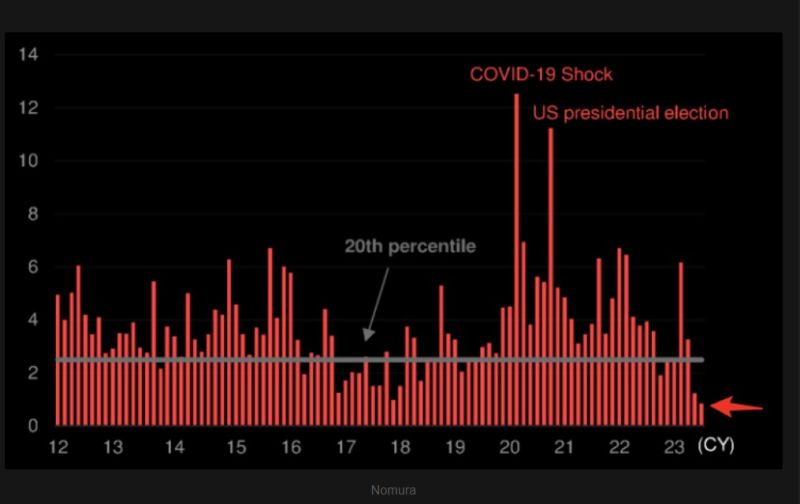

The market has NO FEAR. Extremely little risk priced for the FOMC meeting.

Chart shows SPX 1 week implied volatility skew within one week of FOMC meetings. Source: TME, Nomura

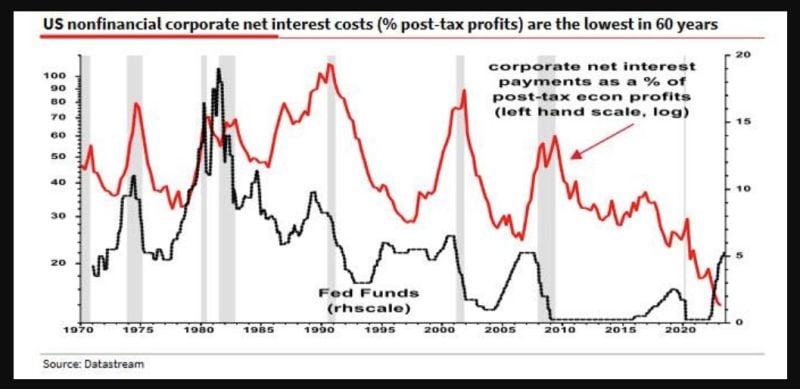

Albert Edwards from SG explains in one chart why this time is different and how the rise #interestrates hasn't triggered a recession yet.

Indeed, as shown on the chart below, Corporate NET interest payments as a % of post-tax economic profits (red line) has been going DOWN despite Fed Funds (black line) going UP! Edwards frames it as such: "We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed (...) something very strange has happened, and it helps explain the recession’s tardy." So what has happened? As Edwards concludes, a sizeable proportion of the "huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits" meaning that corporations continue to benefit from locking in the ultra low rates of 2020 and 2021 even as their cash interest income are soaring. Indeed, as the SocGen strategist adds, "companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual". Putting it all together, Edwards says that "it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession (...) Interest rates simply aren’t working as they once did. It is indeed a mad, mad world" Source: www.zerohedge.com, SocGen

Investing with intelligence

Our latest research, commentary and market outlooks