Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Billion dollar companies with no revenues.

$RGC Regencell Bioscience $QMMM QMMM $DGNX Diginex $TMC TMC the metals company $OKLO Oklo $TMQ Trilogy Metals $ASTS AST SpaceMobile $RGTI Rigetti Computing $QS QuantumScape $CRML Critical Metals $LAC Lithium Americas $PPTA Perpetua Resources $USAR USA Rare Earth $JOBY Joby Aviation $NNE NANO Nuclear Energy $NXE NexGen Energy $ACHR Archer Aviation $QUBT Quantum Computing $SERV Serve Robotics Source: Lin @Speculator_io

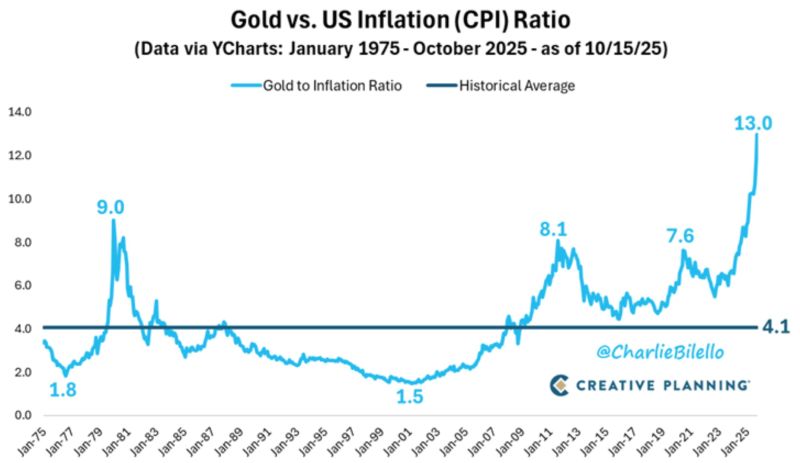

Relative to inflation, Gold has never been higher than it is today. 13x vs. 9x at the peak in 1980.

Source: Charlie Bilello

The U.S. government shutdown is now in its third week after the Senate again rejected a temporary funding bill.

Polymarket odds now show a 73% chance the shutdown lasts over a month. Source: Cointelegraph, Polymarkets

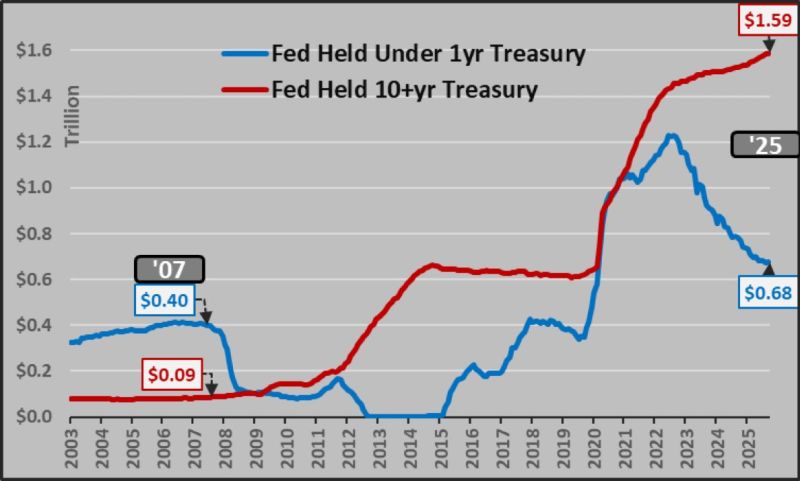

Really important chart from @Econimica

QT NEVER happened in 10+yr USTs post-2022. The Fed still holds a large amount of long-term debt. The QT mainly took place through short-term Treasuries (the blue line). As explained by StockMarket.news, over the last few years, the Fed has been draining some money out of the system but doing it in a very controlled way. It’s avoiding a big sell-off in long-term bonds because that could cause interest rates to spike and hurt the economy. So while it looks like the Fed is being tough with QT, the reality is softer the real tightening is happening with short-term bonds, while the long-term side still has a safety net. It’s a reminder that even when the Fed says it’s tightening, it’s still making sure the markets don’t fall apart.

Silver to hit $100 by the end of 2026 says BNP Paribas and Solomon Global

Source: Barchart

China's deflationary vortex is getting worse:

*CHINA SEPT. CONSUMER PRICES FALL 0.3% Y/Y; EST. -0.2% *CHINA SEPT. PRODUCER PRICES FALL 2.3% Y/Y; EST. -2.3%

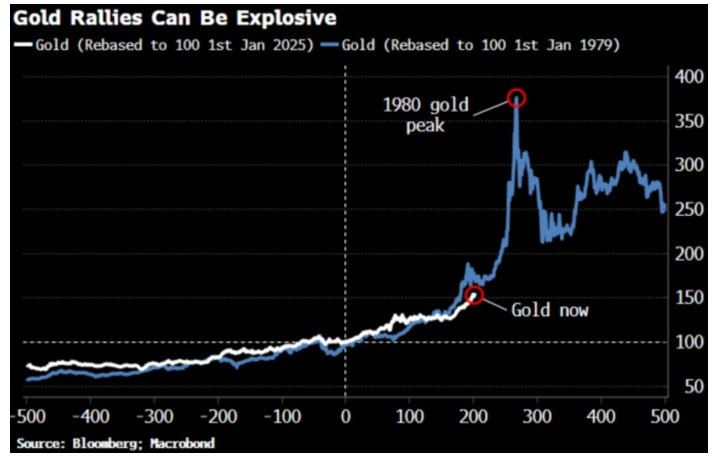

Will gold rally be as explosive as the one in the 80s ???

Source: Macrobond, Bloomberg, Incrementum AG

Investing with intelligence

Our latest research, commentary and market outlooks