Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia and AMD agreed to pay 15% of China chip sales revenue to US government

According to this FT article, Nvidia and AMD have agreed to give the US government 15 per cent of the revenues from chip sales in China, as part of an unusual arrangement with the Trump administration to obtain export licenses for the semiconductors. ▶️ The two chipmakers agreed to the financial arrangement as a condition for obtaining export licences for the Chinese market that were granted last week, according to people familiar with the situation, including a US official. The Financial Times reported on Friday that the commerce department started issuing H20 export licences on Friday, two days after Nvidia chief executive Jensen Huang met President Donald Trump. The US official said the administration had also started issuing licenses for AMD’s China chip. ‼️ The quid pro quo arrangement is unprecedented. According to export control experts, no US company has ever agreed to pay a portion of their revenues to obtain export licences. But the deal fits a pattern in the Trump administration where the president urges companies to take measures, such as domestic investments, for example, to prevent the imposition of tariffs in an effort to bring in jobs and revenue to America. Link to article: https://lnkd.in/eZXmhSBP Source: FT

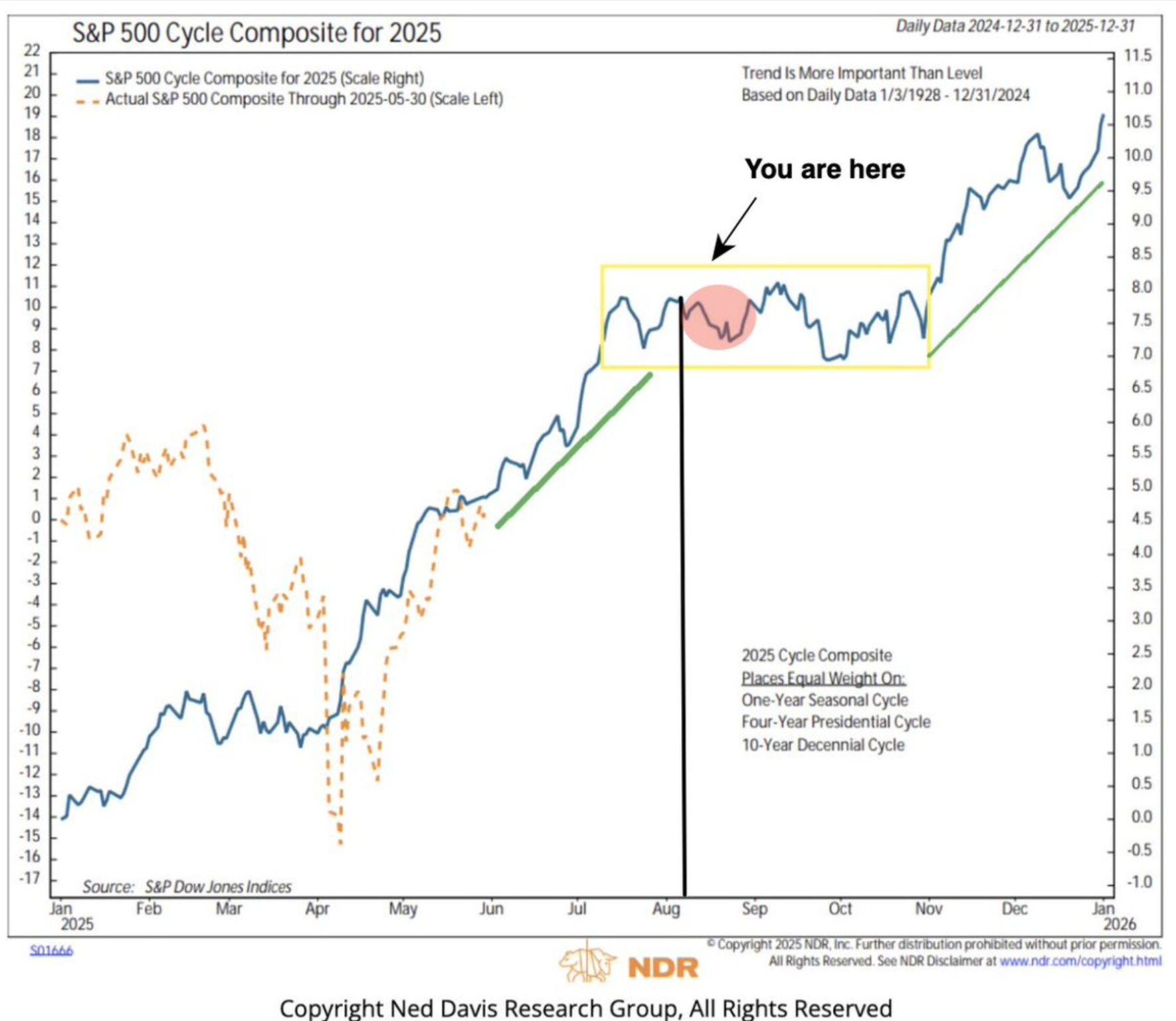

After getting off course in Q1, $SPX has been trending well with the Cycle Composite since.

Will we see a pick up in volatility in the week ahead, in-line with historical cycle? Source: NDR thru Seth Golden

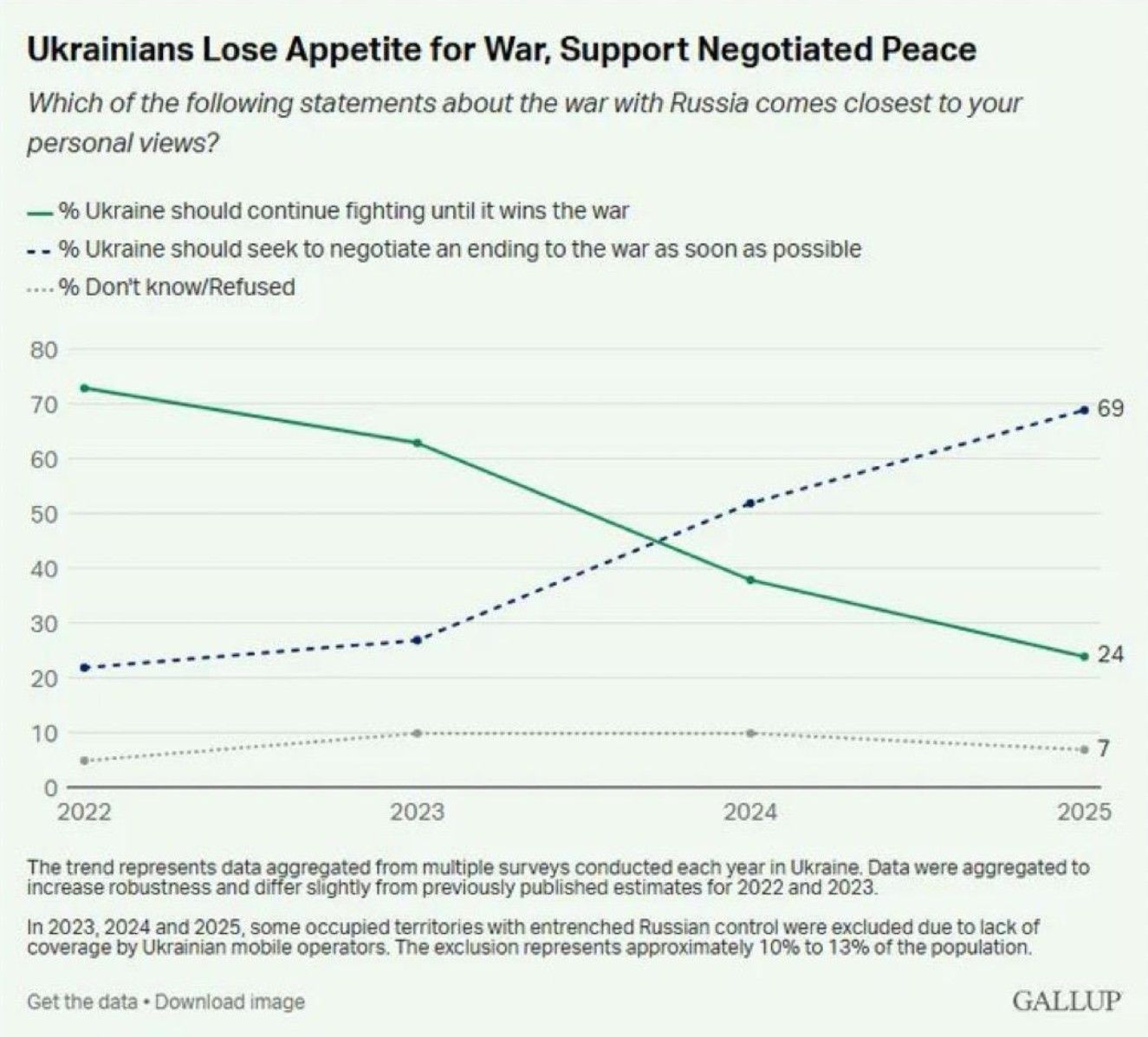

Most Ukrainians now back negotiated peace

Support for “fighting until victory” has fallen from over 70% in 2022 to just 24% in 2025 (and who can blame them?). Meanwhile, 69% now want Ukraine to negotiate an end to the war as soon as possible. A dramatic shift in public sentiment over three years. Source: Gallup thru Mario Nawfal on X

‼️ Why is Switzerland the most impacted by the new tariffs on gold imports?

🔴 The United States has recently imposed tariffs on gold imports, specifically targeting one-kilogram and 100-ounce gold bars, which are common forms for delivery in US futures markets. This policy shift was formalized in a July 31, 2025, US Customs and Border Protection ruling, reclassifying these gold bars under a customs code that is subject to tariffs—contrary to previous exemptions. ▶️The new tariff rate is as high as 39% on affected gold bar imports from certain countries, with hashtag#Switzerland—a major refining hub for London's larger 400-ounce gold bars—expected to be the most impacted. ▶️Traditionally, large gold bars (400-ounce format) are traded in hashtag#London, then shipped via Switzerland for recasting into the smaller kilo bars favored in the US, making the tariff particularly disruptive to established supply chains. ▶️The policy does not make clear whether London-origin 400-ounce bars, if sent directly, are currently subject to tariffs, but most industry analysis suggests that one-kilogram and 100-ounce bars, regardless of their original source, are now covered by the US tariff regime if imported into the United States. ⚠️ In summary, there are now substantial tariffs on gold bars (especially kilo and 100-ounce bars) imported into the US, even if they transit through London or Switzerland. The rule does not differentiate between bars exported directly from London or those refined elsewhere, as it is based on the classification of the bar itself at import

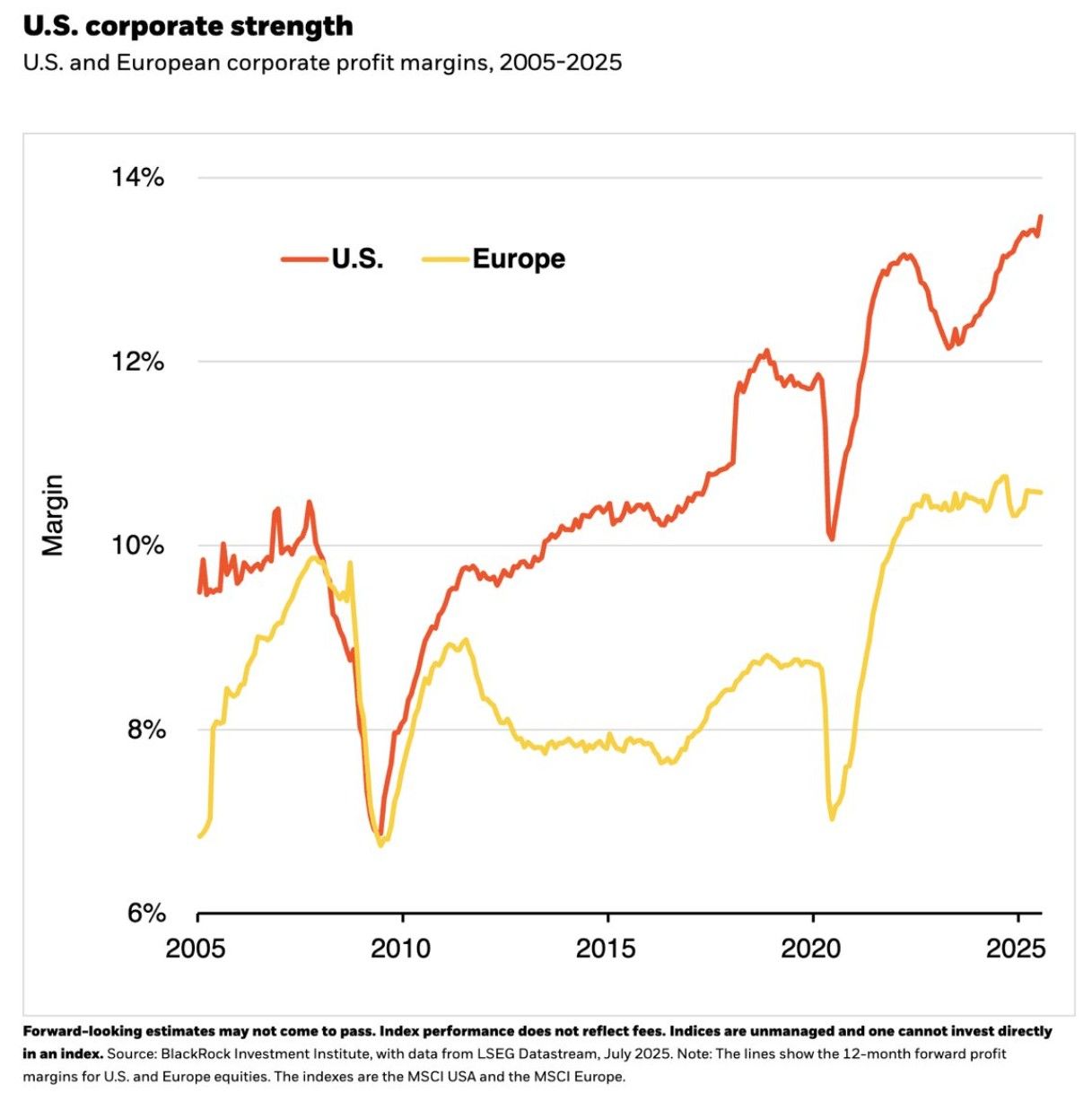

U.S. Corporate Margins are making all-time highs while Europe's are flat

The end of American Exceptionalism??? Source: Barchart, Blackrock

Investing with intelligence

Our latest research, commentary and market outlooks