Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

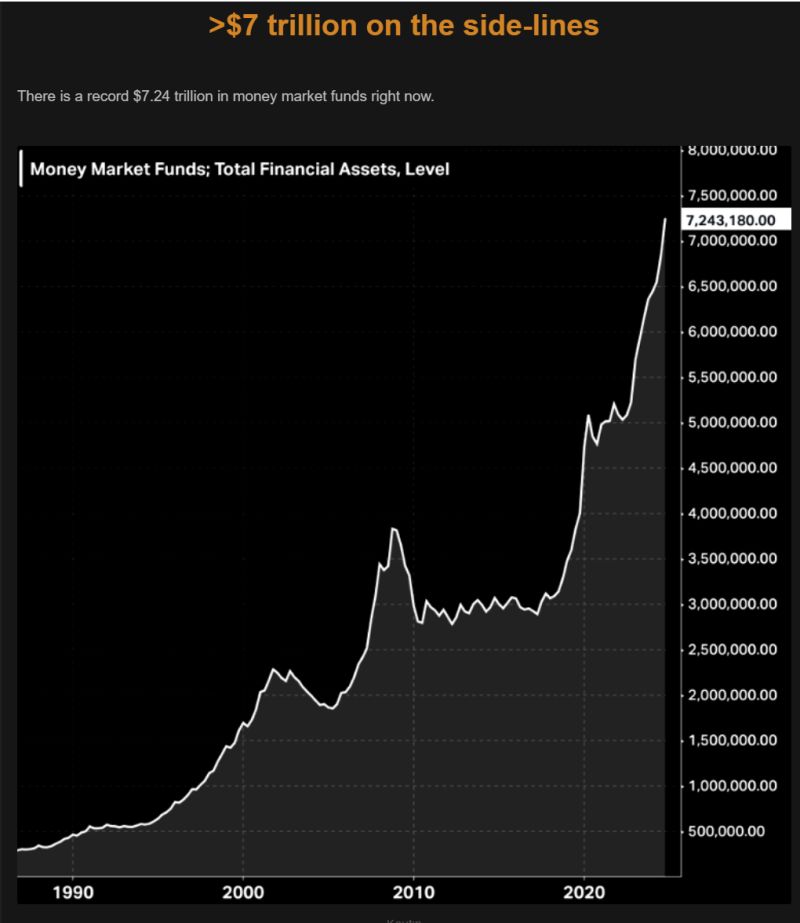

Don't forget... There is more than $7 trillion in money market funds right now.

Fresh dry powder on the side-lines... Source: The Market Ear

It’s time to stop looking at real yields to determine gold price...

Source: Michel A.Arouet

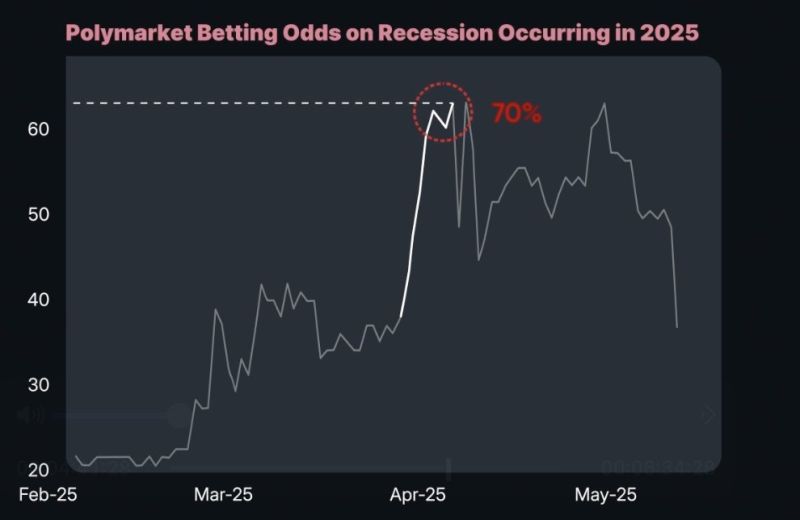

Recession fears are falling very quickly

On April 2nd, betting markets put the odds of a 2025 recession at nearly 70% Source: Bravos Research

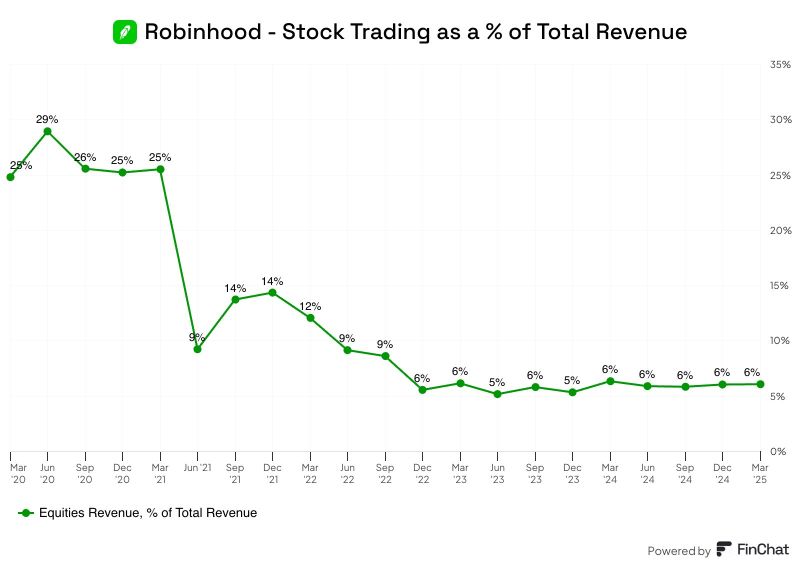

Only 6% of Robinhood's revenue from stock trading, down from 25% five years ago.

The remainder comes from: Interest Revenue: 31% Cryptocurrency: 27% Options: 26% Other: 10% $HOOD Source: FinChat @finchat_io

Interesting.. We were told people in the US were going to stop traveling, summer vacations were over, something like that...

Source: Eric Balchunas

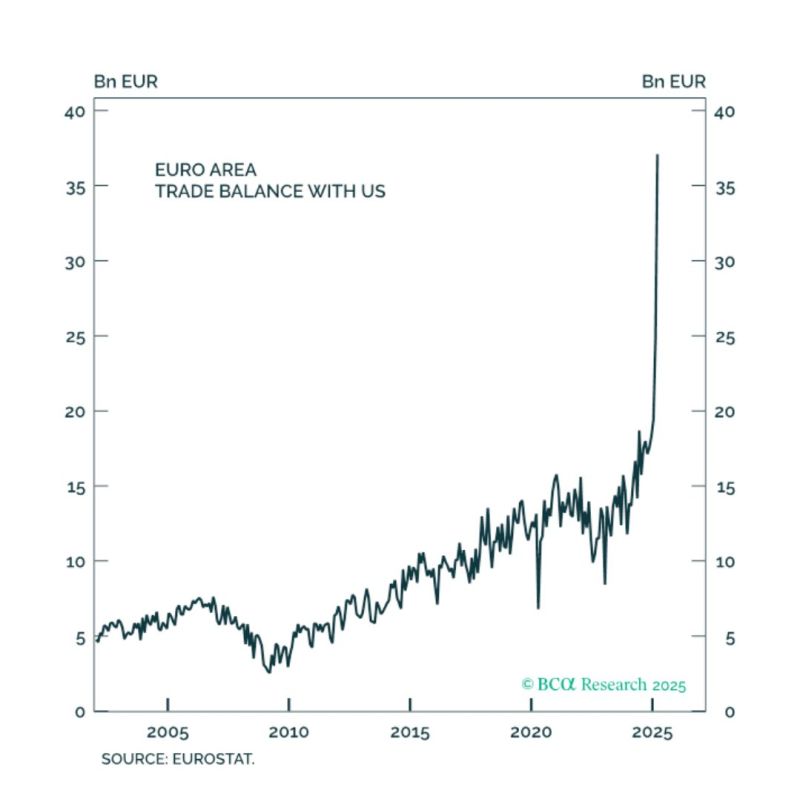

In case you were wondering why European growth seemed abnormally strong in Q1.

Source: BCA

A Taiwanese official said Chinese air force and missile units that would take part in an invasion had improved to the point where they could 'switch from peacetime to war operations any time'.

Link >>>https://lnkd.in/epE_ri2X Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks