Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TRUMP: THE BIGGEST BILL IN AMERICAN HISTORY IS COMING

No tax on tips, no tax on Social security, no tax on overtime. "In the coming weeks and months, we will pass the largest tax cuts in American history and that will include no tax on tips, no tax on Social Security, no tax on overtime. It's called the One Big Beautiful Bill, and it will be the biggest bill ever passed in our country's history. It will include the biggest tax cuts, regulation cuts, military supremacy, and just about everything else." Source: @RapidResponse47 thru Mario Nawfal, FoxNews

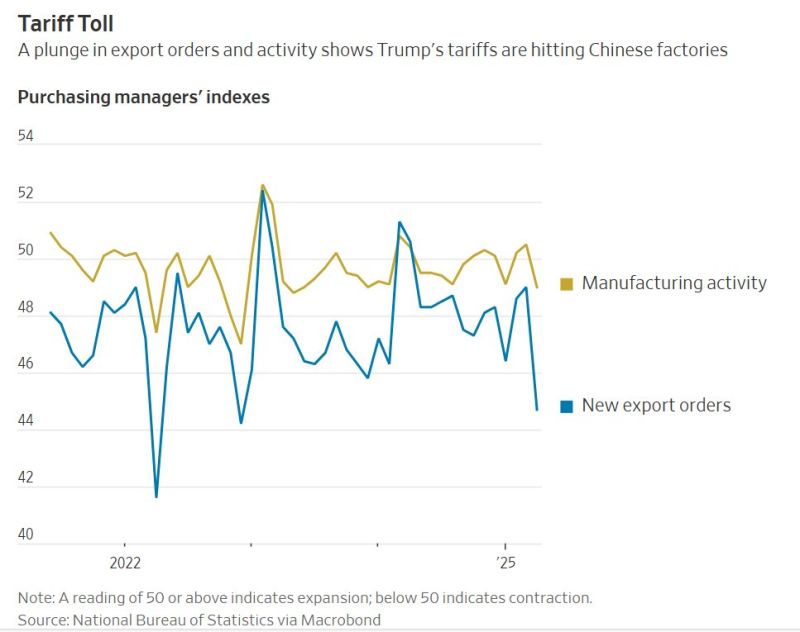

The Wall Street Journal on China's latest economic data:

"A gauge of new export orders fell in April to its lowest reading since Covid-19 was ravaging the country in 2022, while overall manufacturing activity in China was the weakest in more than a year." The sharp declines reflect both the "bring forward" to beat the US tariffs and the impact of these tariffs. Source: Mo El Erian on X, Macrobond

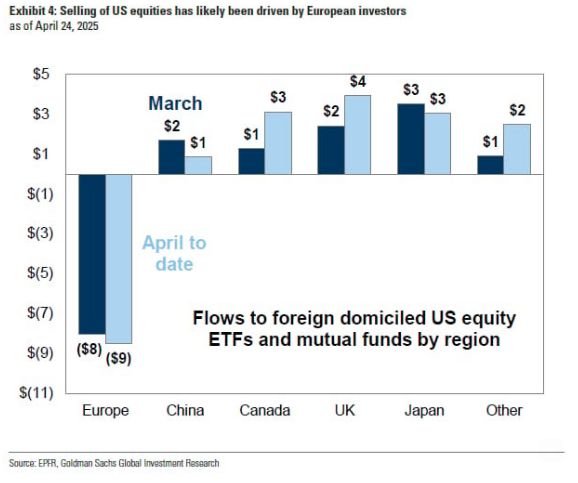

Only European Investors have been dumping U.S. Stocks 🚨

The rest of the world, including China, are buying 📈📈 Source: Barchart, Goldman Sachs, EPFR

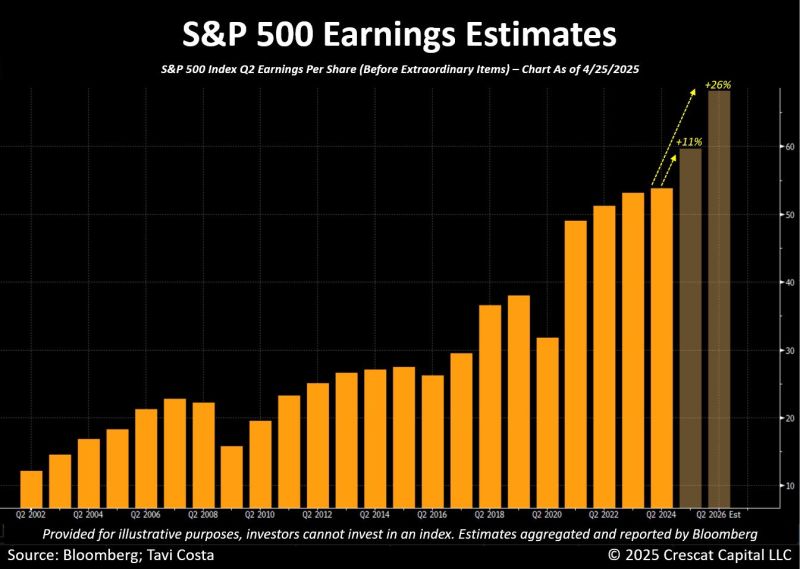

S&P 500 earnings are expected to grow 11% this quarter and another 26% next year.

This probably assumes no recession, because if there is one, a sharp downgrade in earnings estimates is likely. Source. Bloomberg, Tavi Costa

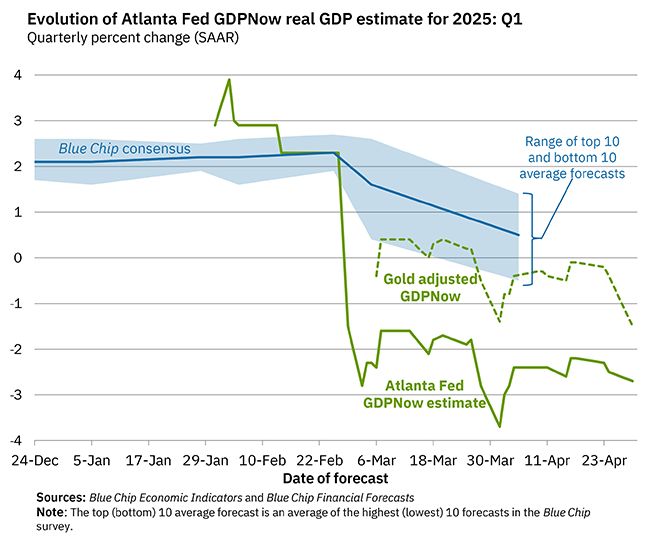

On April 29, the GDPNow model nowcast of real GDP growth in Q1 2025 is -2.7%.

The final alternative model forecast, which adjusts for imports and exports of gold, is -1.5% Source: Atlanta Fed

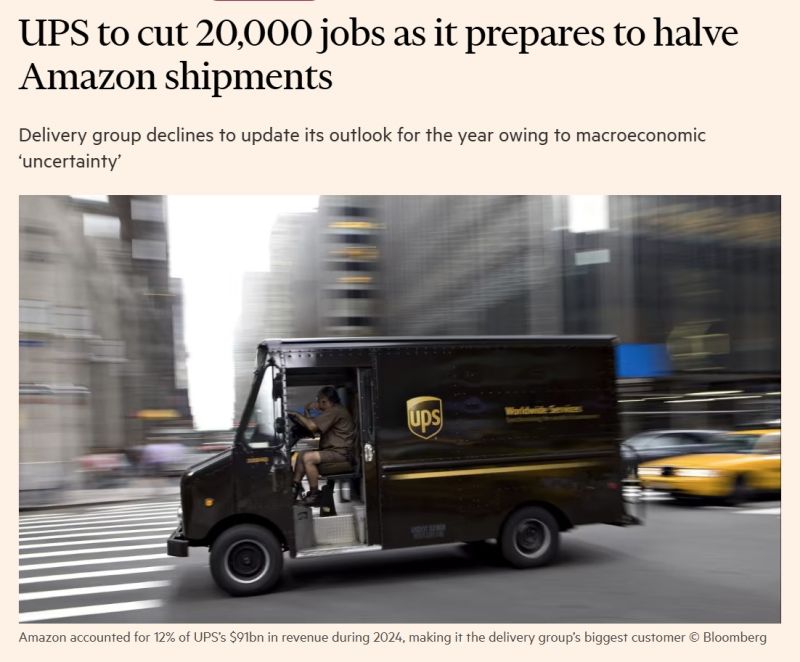

UPS has said it will cut 20,000 jobs this year and close more than 70 buildings

as the logistics group seeks to reduce costs and prepare for a halving in package volume from Amazon, its biggest customer. The job cuts will target workers responsible for delivering packages to customers and supporting UPS’s transportation and logistics services, and come after the group last year cut about 14,000 jobs, primarily in management roles. The latest reduction in headcount is part of UPS’s plan to boost efficiency and consolidate its US domestic network after it said in January it had reached an agreement in principle with its “largest customer” to lower its volume by the second half of 2026.

Investing with intelligence

Our latest research, commentary and market outlooks