Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

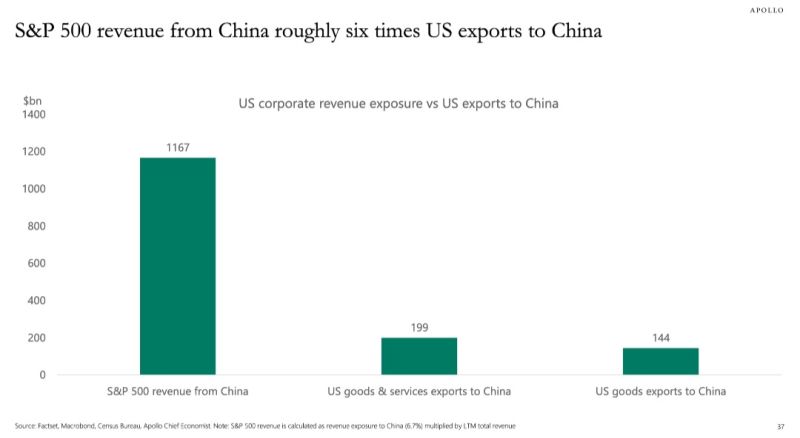

SP500 revenue from China are roughly six times US exports to China

From Torsten Slok, Apollo

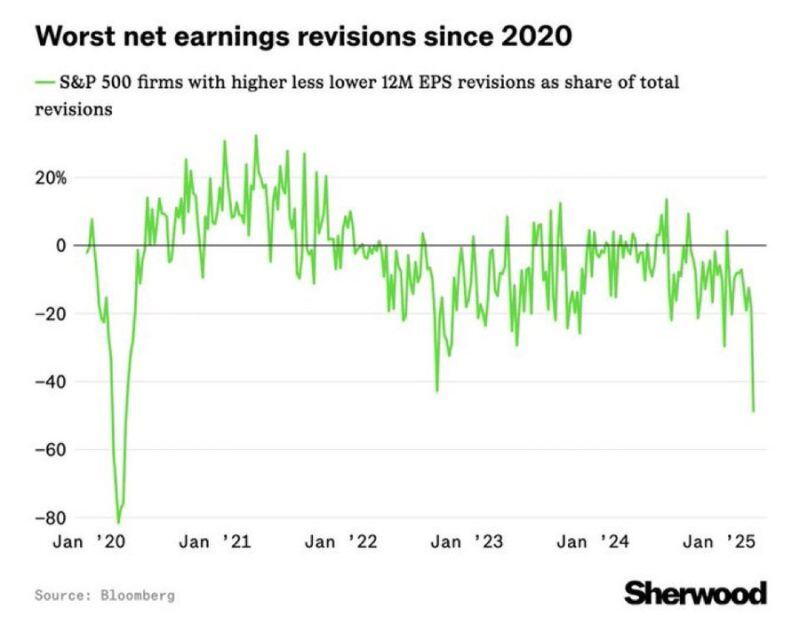

Worst net US earnings revisions since 2020!

Source: Win Smart, CFA @WinfieldSmart

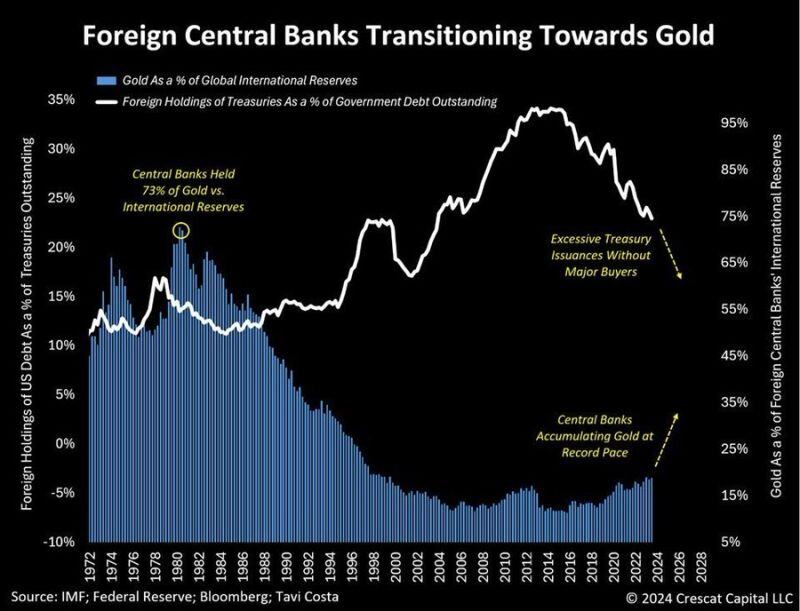

Should investors look at overbought signals on gold or focus on the long-term perspective?

Tavi Costa believes that when it comes to the yellow metal this as one of those key moments when traditional technical analysis like overbought conditions become largely irrelevant. We are likely in the midst of a monetary realignment, and attempting to time short-term corrections based on extreme RSI levels misses the forest for the trees, in his view. "This perspective underestimates the structural macro imbalances that continue to compel governments to accumulate gold" he added. He might be right...

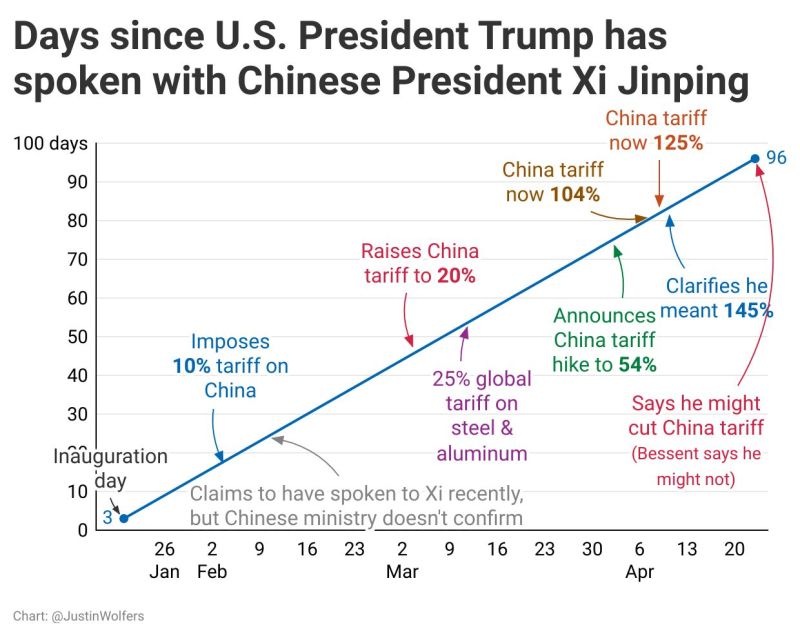

Trump - Xi Jinping summarized in one chart

Source: Justin Wolfers @JustinWolfers on X

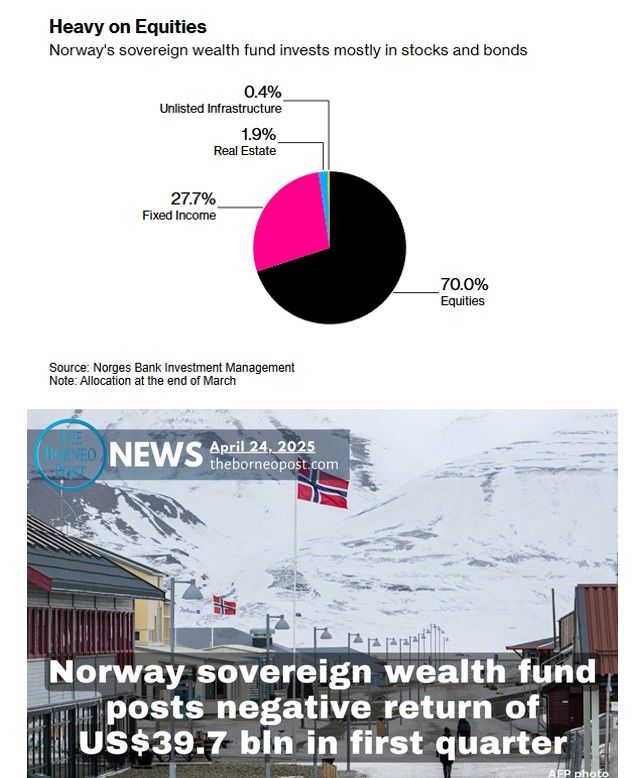

NORWAY’S $1.7T SOVEREIGN WEALTH FUND JUST POSTED A $40B LOSS IN Q1, ITS WORST DROP IN 6 QUARTERS.

The fund, run by Norges Bank Investment Management, pointed to a pullback in tech stocks as the main drag, with equity returns down 1.6%. Holdings like $AAPL, $NVDA, and $TSLA all took a hit. Fixed income helped a bit, returning 1.6%, but it wasn’t enough to offset the slump. CEO Nicolai Tangen said the recent market turmoil, especially after Trump’s tariff hikes, isn’t even fully reflected yet. That early-April tariff spike alone knocked off another $200M. Despite the loss, the fund still outperformed its benchmark by 0.16%. They’ve already started trimming some tech exposure to reduce risk. CFO also confirmed they didn’t make any moves in U.S. Treasuries in April—no buying or selling. The fund's performance is mostly tied to global indexes, so there's limited room for active moves. And while it’s staying out of nuclear weapons makers like Lockheed due to ethical guidelines, there's growing political pressure in Norway to rethink that stance. Source: Wall St Engine, The Borneo Post

Buffett with $334.2 BILLION in cash

Source: Warren Buffett Stock Tracker

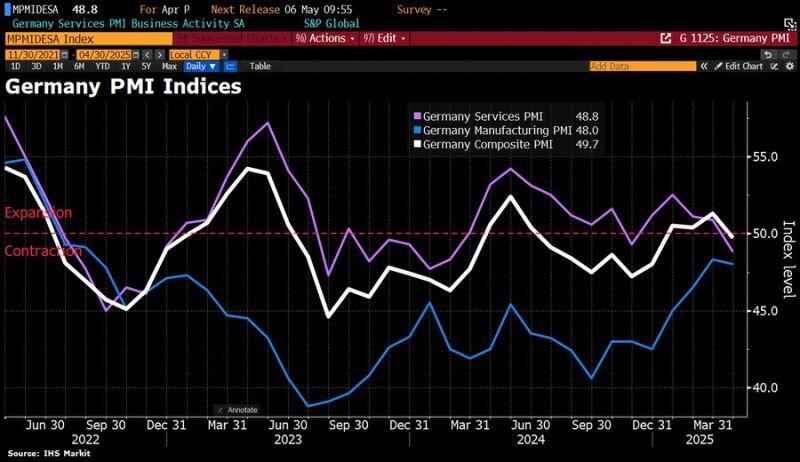

In Germany, the private sector just shrank for 1st time in 4 months.

According to S&P Global, the Composite PMI (a key economic indicator) fell to 49.7 in April, dropping below the critical 50 mark that separates growth from contraction. The services sector was hit especially hard, with its index tumbling to 48.8 – the lowest in 14 months. This drop reflects growing worries about tariffs, as well as broader concerns around Germany’s economic and political future. This unexpected decline adds to an already grim outlook for the German economy, which is considered particularly exposed to global trade tensions. The IMF is now forecasting stagnation for Germany this year. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks