Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

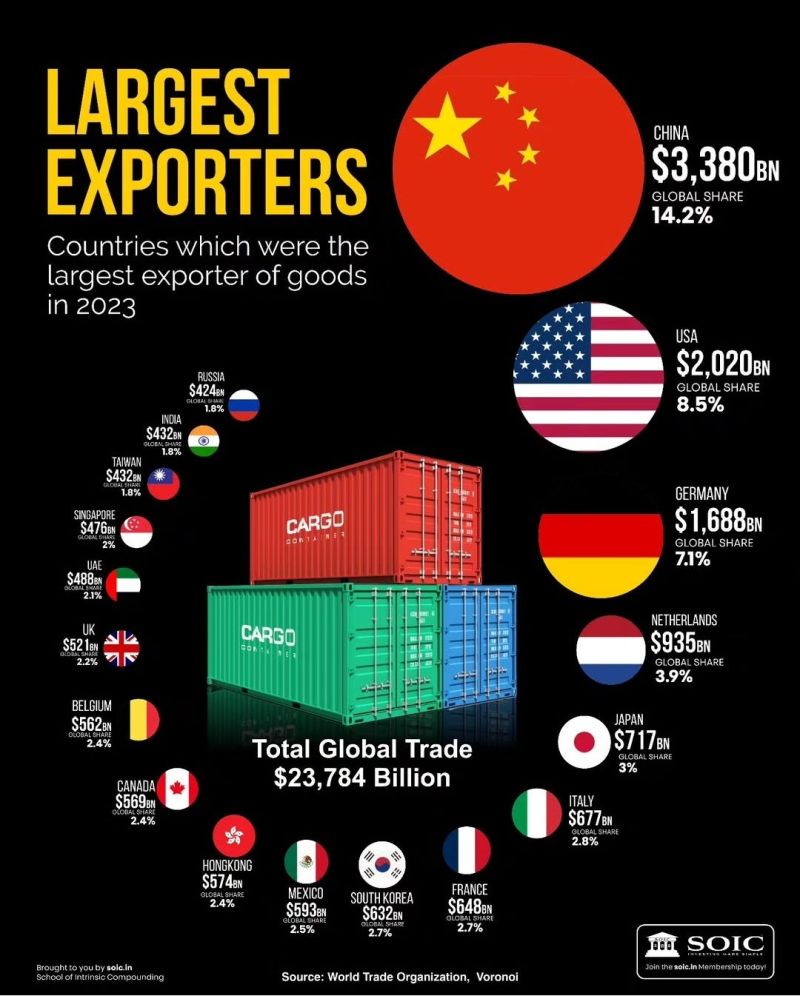

China is, by far, the largest exporter.

Source: Jason Smith @ShangguanJiewen on X

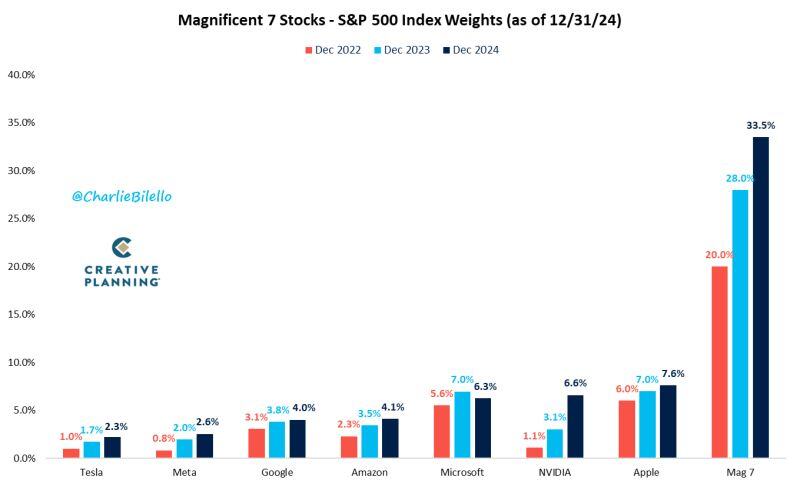

Over a third of the S&P 500 is now concentrated in the "Magnificent Seven" stocks, up from a fifth of the index two years ago.

Source: Charlie Bilello

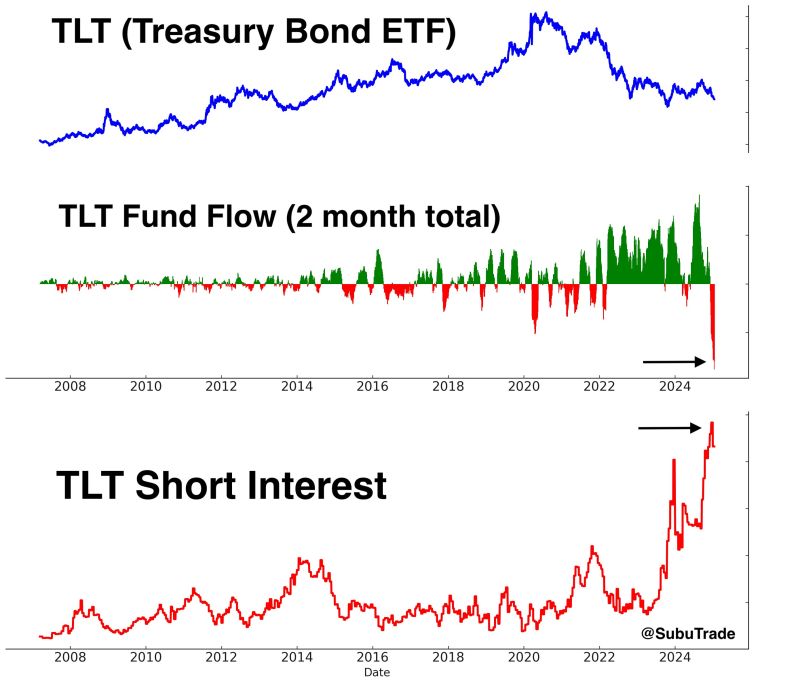

Will we see a short-covering rally in bonds?

In case you missed it: - $TLT short interest is near RECORD highs, while... - TLT has seen massive outflows Bond market shorts are about to get squeezed. A rally in bonds could be bullish for stocks. Source: Subu Trade

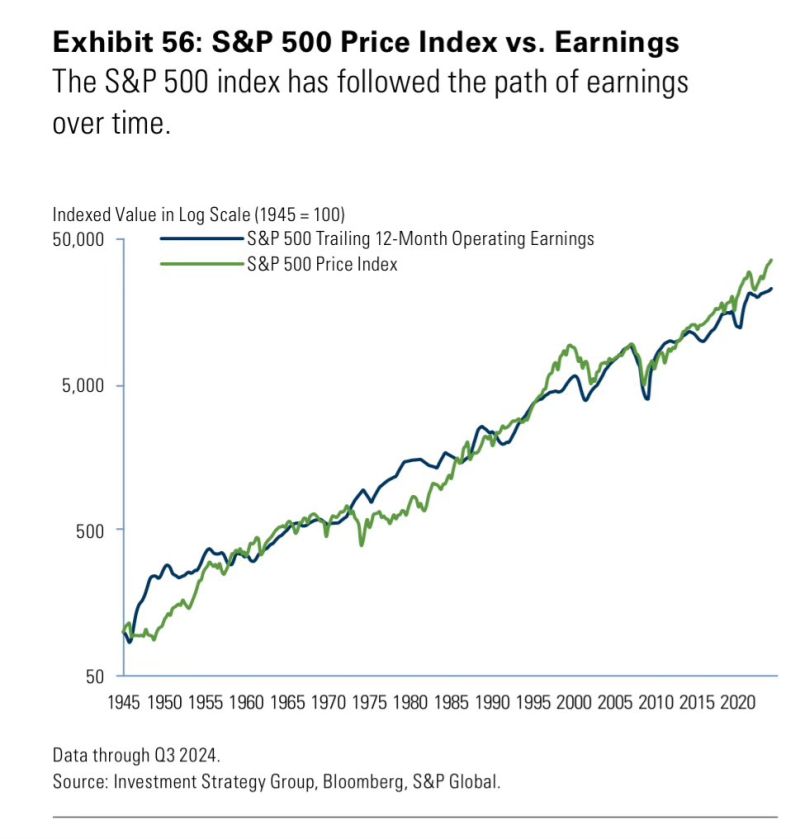

Earnings do matter

Source: Investment Strategy Group, Bloomberg, S&P Global

Donald Trump's new SEC to begin overhauling the agency's crypto policies "as early as next week" 👀

Source: Reuters

Yesterday, the easing of US inflation fears sparked a huge surge higher in rate-cut expectations for 2025 (back up to 40bps from 28bps)...

Source: Bloomberg, zerohedge

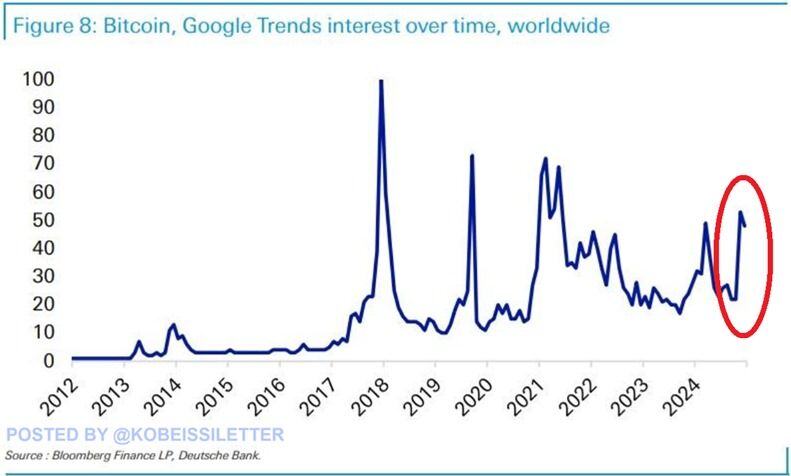

BREAKING: Google Trends interest about bitcoin are currently at their highest level since 2021.

Worldwide searches for the Bitcoin have doubled over the last several weeks. However, search interest is still below the December 2017 peak and spikes seen in 2019 and 2021. Since November 1st, Bitcoin prices have surged 42.5% and are trading near $100,000. Source: The Kobeissi Letter

I love this one... It also explains why Americans are so successful.

They are not afraid of trying and failing. In Europe, failure is too often not accepted Source: Stock Talk

Investing with intelligence

Our latest research, commentary and market outlooks