Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

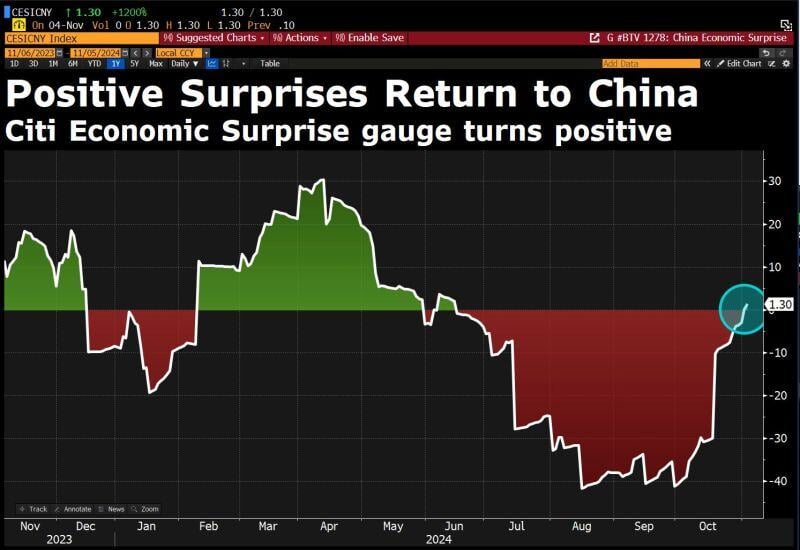

China economic surprise index turns positive

Source: David Ingles, Bloomberg

When to expect swing state results (could take days)

Source: ian bremmer @ianbremmer

Quarterly revenue growth almost as parabolic as the stock price. 💸 $NVDA

Source: TrendSpider

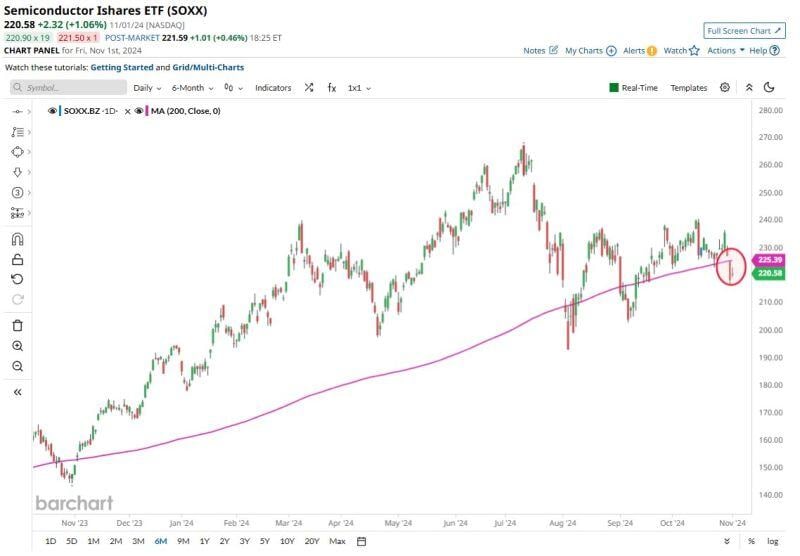

Semiconductor Stocks $SOXX have broken below the 200D moving average for only the 3rd time this year - Uh Oh

Source: Barchart

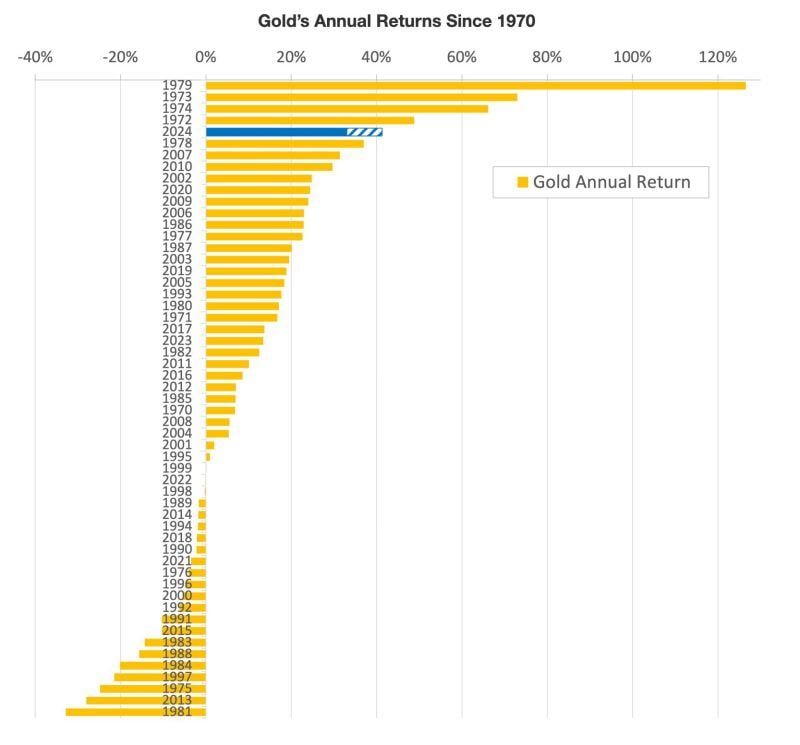

Gold's best year since 1979!

There have been only four times in history where gold has delivered stronger returns: 1979: +126.5% 1973: +73% 1974: +66.1% 1972: +48.8% Source: GoldSilver

Investing with intelligence

Our latest research, commentary and market outlooks