Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

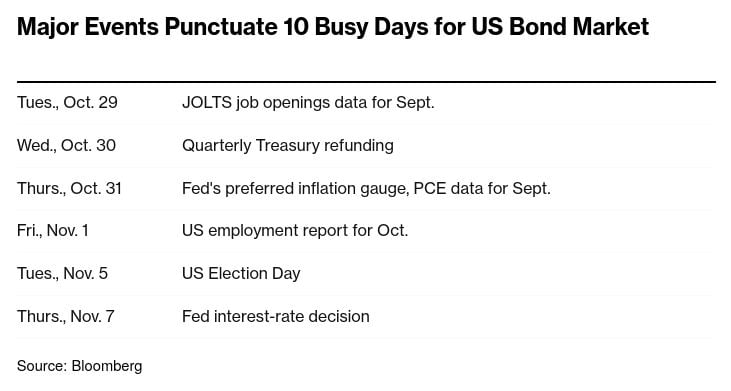

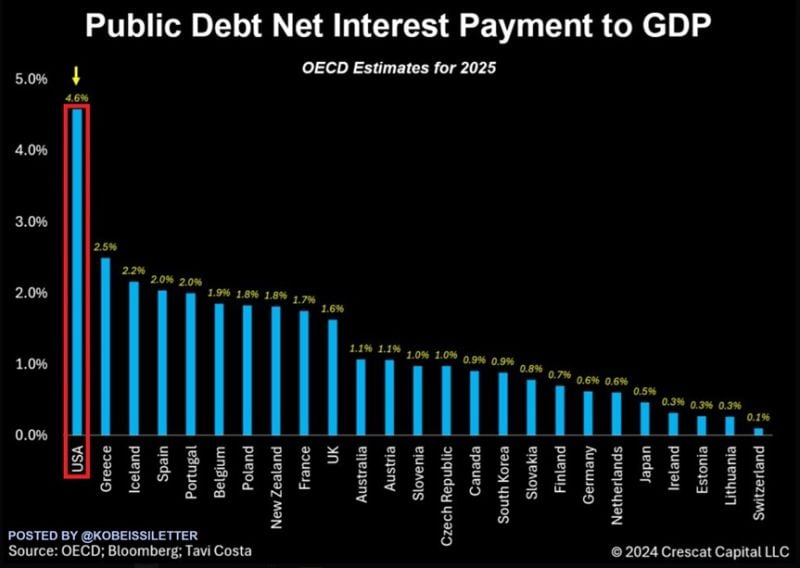

As the market has now fully priced in a second trump presidency, the S&P500 is about to enter the best 3 month period of the year: November - January.

Below is the cycle composite for the SP500... (The trend is more important than the level). Source: J-C Parets

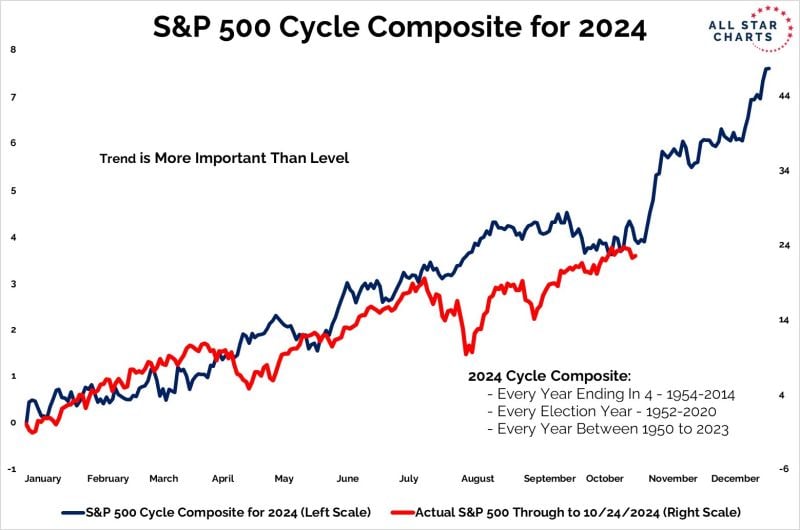

🚨US FEDERAL DEBT IS SKYROCKETING🚨

The US public debt just hit another RECORD of $35.8 TRILLION. In less than a month, the total debt SPIKED by $700 BILLION. This is $23 BILLION A DAY. To make things worse, these forecasts assume lower interest rates over the next year... Source: Global Markets Investor

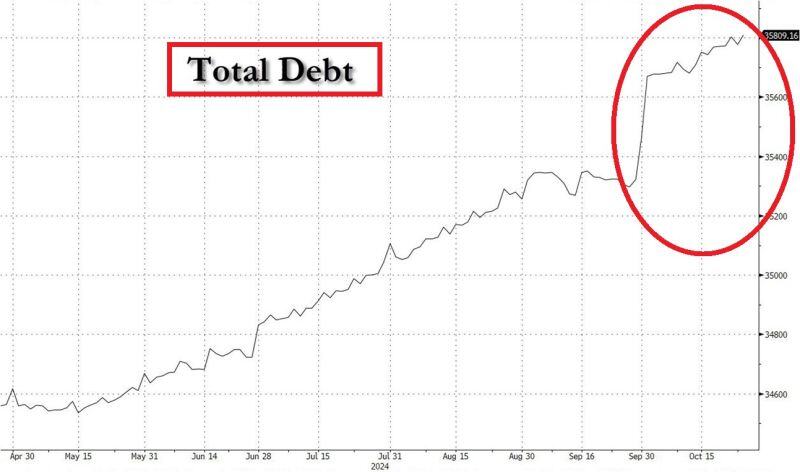

The US public debt situation is going to get worse:

US net interest payments as a share of GDP are expected to reach a record 4.6% next year. That would more than DOUBLE World War 2 levels and exceed the all-time highs seen in the 1990s. This is also much higher than net interest as a % of GDP in all 38 OECD countries. Countries with relatively high interest such as Greece, Ireland, Spain, and Portugal are expected to reach interest-to-GDP ratios that are HALF the size of the US. To make things worse, these forecasts assume lower interest rates over the next year. Source: The Kobeissi Letter, OECD, Tavi Costa

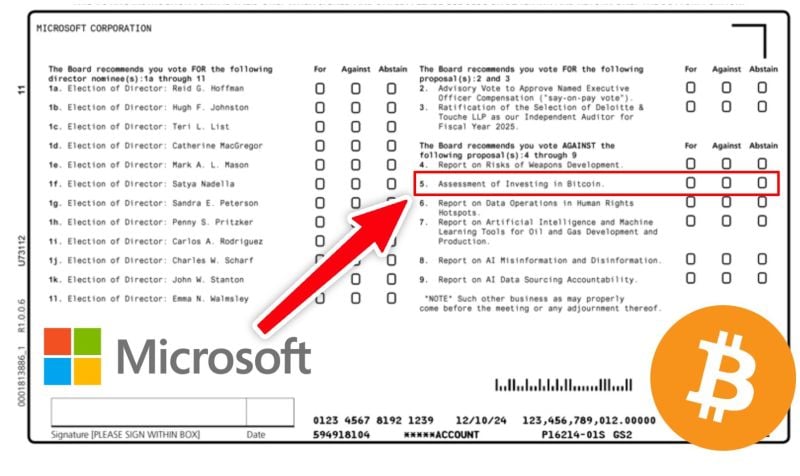

👉 JUST IN: Microsoft asks shareholders to vote on whether to consider investing in Bitcoin!

Source: Swan on X

JUST IN: Chinese President Xi Jinping says BRICS must promote a new financial system.

"There is an urgent need to reform the international financial architecture, and BRICS must play a leading role in promoting a new system that better reflects the profound changes in the international economic balance of power."

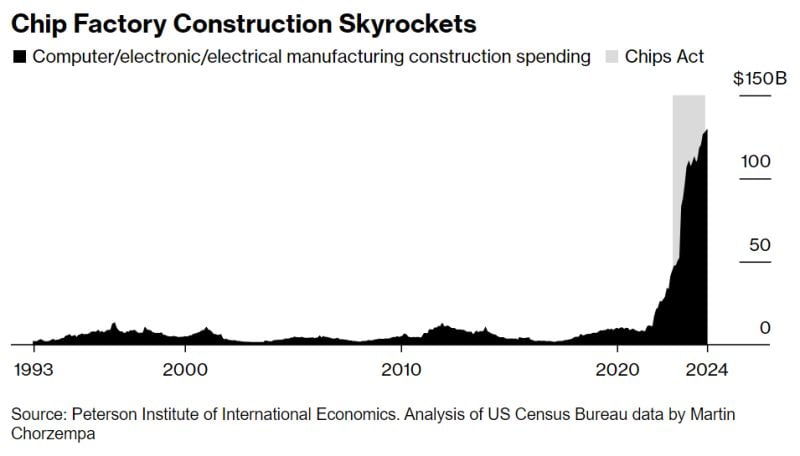

US Chips Act is fuelling boom in chip factory construction on American soil

• Major semiconductor firms have announced more than US$400bn in planned US investment • Boom means Chips Act could come with US$85bn price tag - instead of US$24bn as planned originally Source: Agathe Demarais @AgatheDemarais on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks