Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

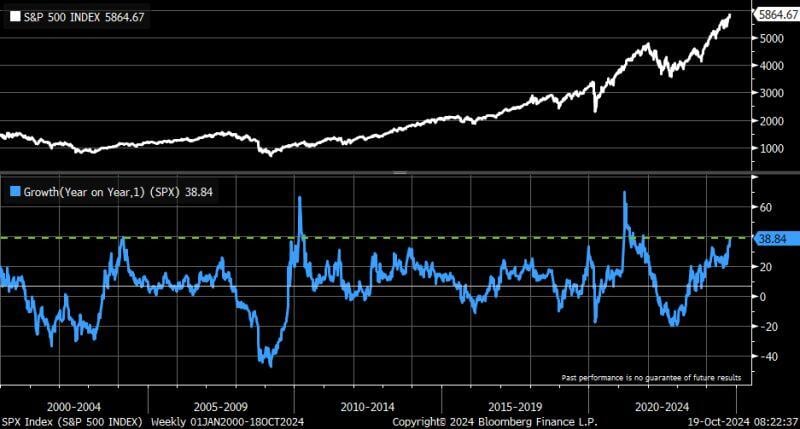

This is quite impressive ... the S&P 500 is up by 38.8% year/year.

Going back to 2000, there are only 25 weeks that had stronger gains, 24 of which were either in 2010 or 2021. Source: Bloomberg, Kevin Gordon on X

Uranium stocks ETF $URA is up +11% last week and +16% for the month, outpacing all other sectors.

Shares in nuclear energy companies surged to record highs last week after Amazon and Google struck landmark power supply deals, boosting efforts to deploy the first small modular reactors (SMRs) in the US. The share prices of US-listed SMR developers Oklo Inc and NuScale power rose by 99% and 36% respectively in the past week, after rivals X-energy and Kairos Power, two private SMR developers, announced the financing agreements. Shares in Cameco, Oklo, NuScale, Constellation and BWX Technologies all traded at record highs over the week. Source: FT

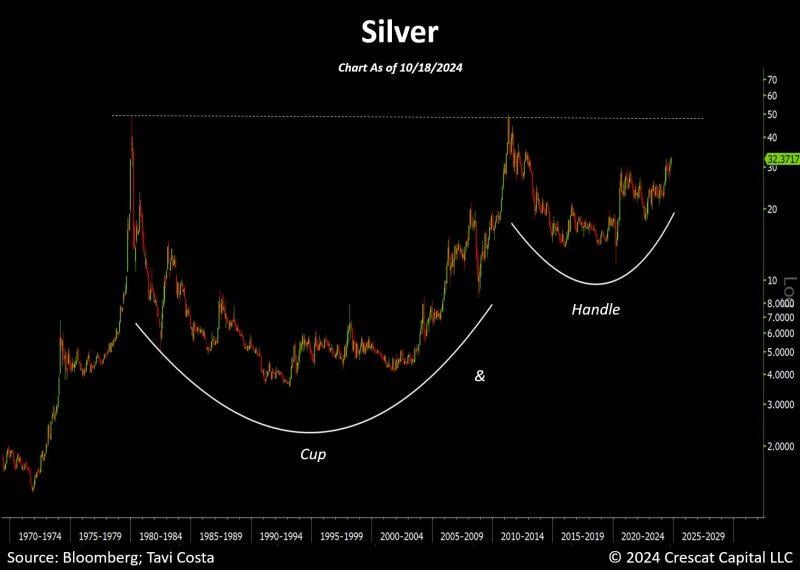

While silver is at a 12-year high, it remains one of the most undervalued metals in history compared to gold—the gold-to-silver ratio is still at 83!

Could this mean that the rally has further to go? Source: Tavi Costa, Crescat Capital, Bloomberg

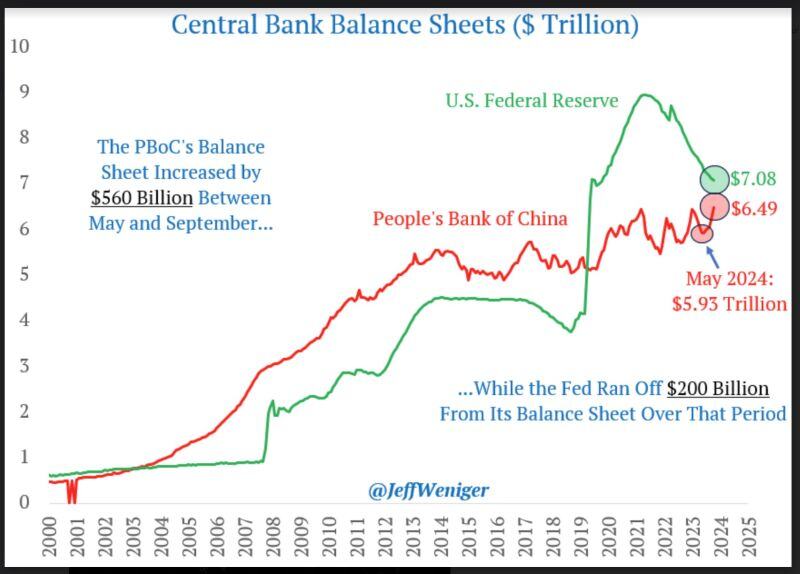

👉 A very important chart about global liquidity...

While the fed is still in qt mode (it has decreased the size of its balance sheet by $200B between May and September), the PBOC is in qe mode having increased its balance sheet by $560B between May and September... Ne-net liquidity is increasing. With global central banks cutting rates at the most aggressive pace since the pandemic and with the PBOC expanding the size of its balance sheet almost 3x more than the Fed is reducing it, it will be interesting to see the consequences on inflation + on gold, silver, etc. Source chart: Jeff Weniger

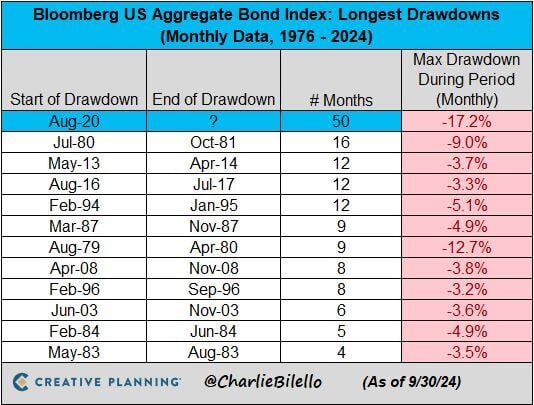

The US Bond Market has now been in a drawdown for over 50 months, by far the longest in history.

Source: Charlie Bilello

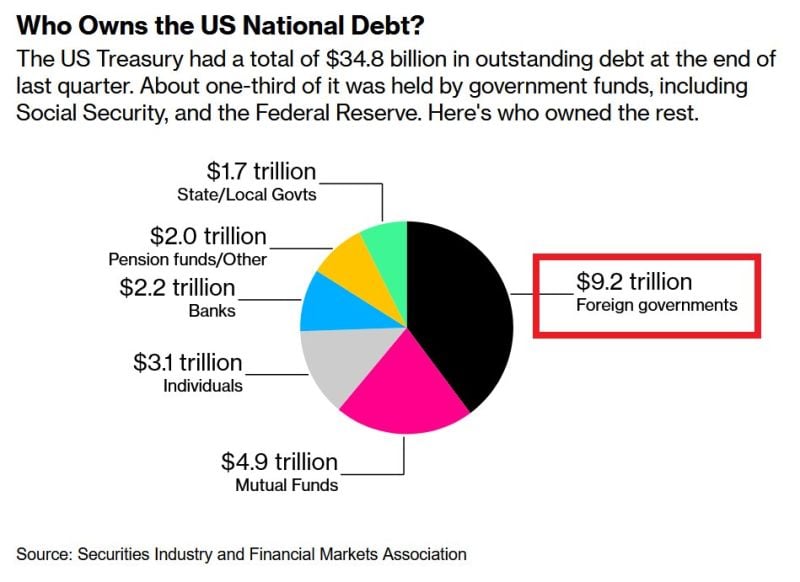

⁉️WHO OWNS THE US PUBLIC DEBT⁉️

~33% of the $35.7 trillion federal debt is held by government funds, including Social Security and the Fed. Over 25% is owned by foreign governments with the most held by Japan and subsequently China. ~15% is held by mutual investment funds. Source: Global Markets Investor

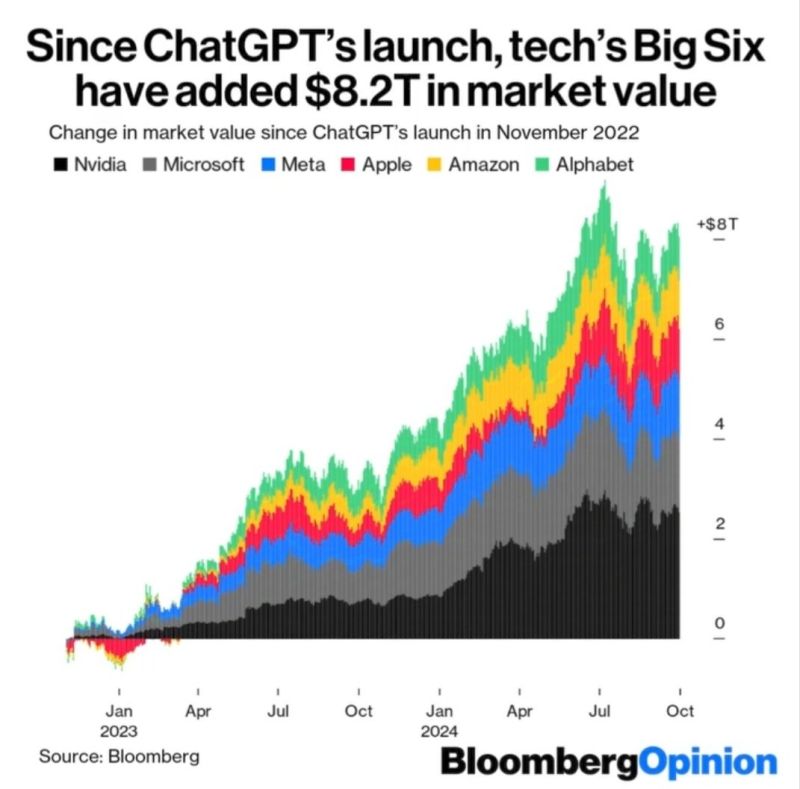

Since the launch of ChatGPT, the 6 biggest tech companies have added $8.2T in market value.

Nvidia added the most, with more than $2.5B! $NVDA $MSFT $META $AAPL $AMZN $GOOGL Source: Bloomberg Opinion, The Future Investors

BREAKING 🚨: The "Yen carry trade unwinding risk" is unwinding

Japanese Yen has fallen through the 150 level against the U.S. Dollar for the first time in 2.5 months Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks