Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

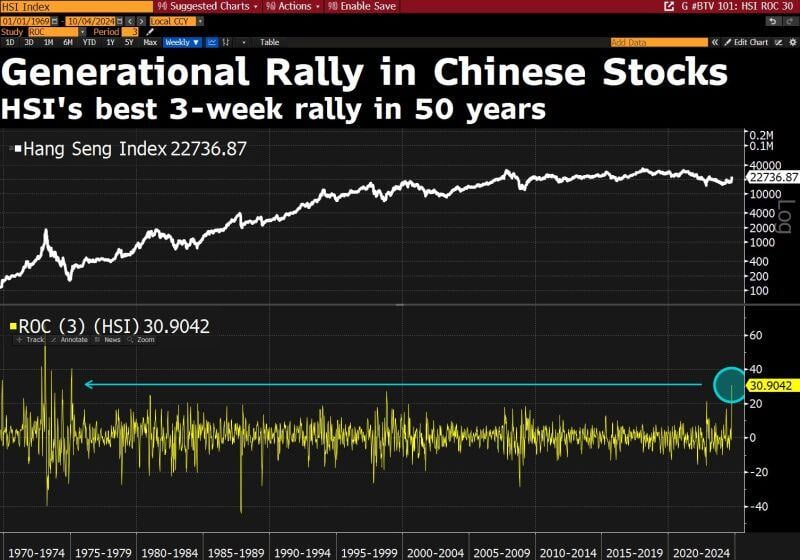

Hang Seng Index capped its best 3-week stretch since 1975

Source: Bloomberg, David Ingles on X

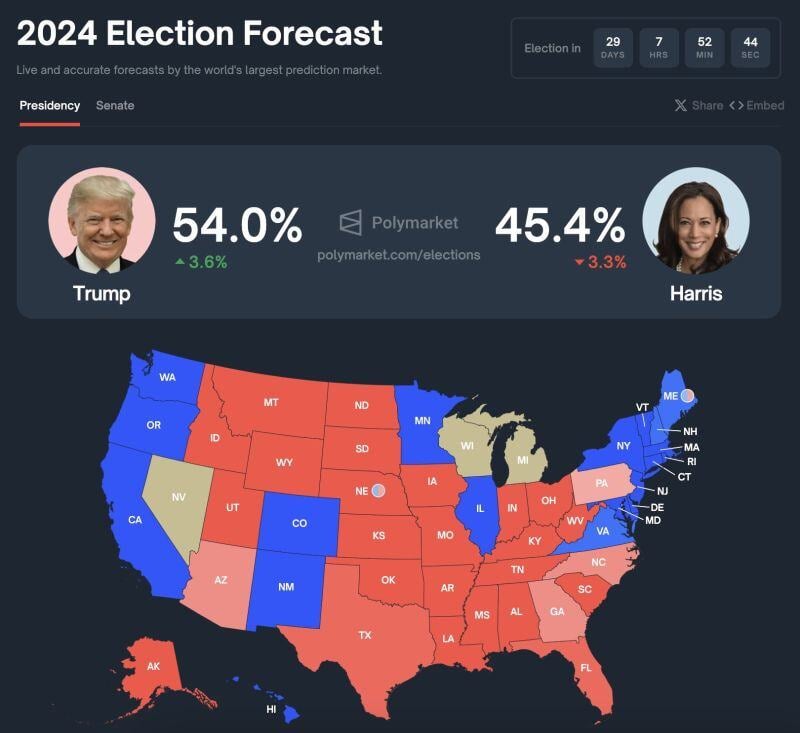

BREAKING: Polymarket’s prediction markets now show Donald Trump nearly 9 percentage points ahead of Kamala Harris.

This is nearly his largest lead since Kamala Harris entered the election. Source: The Kobeissi Letter on X

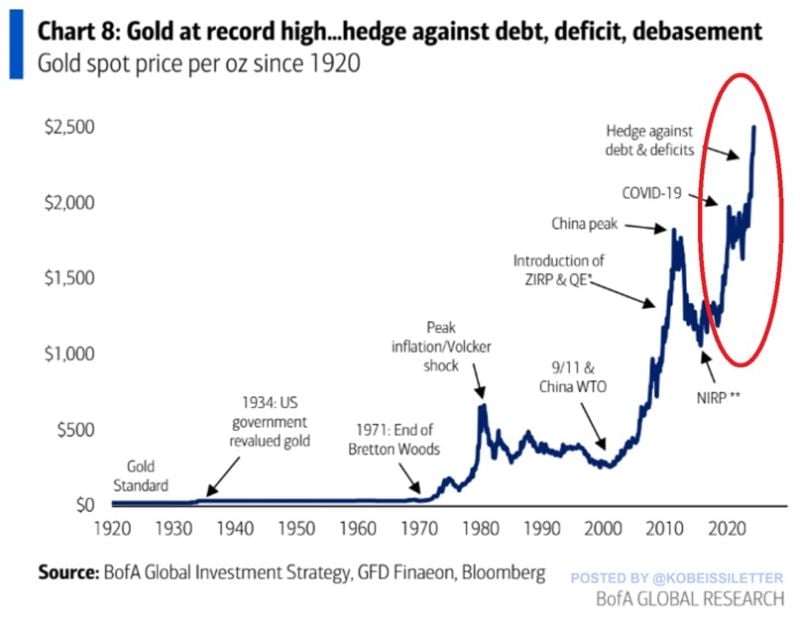

Gold as the ultimate store of value?

Over the last decade, gold prices have more than DOUBLED, marking one of the best rallies in modern history. Over the last 5 years alone, gold is up 76% and on track to be the best-performing asset class of the year, excluding bitcoin. So why gold keeps rising? Ever-rising debt and money debasement seem to be the main culprits. Since the pandemic, US national #debt has soared by $12 trillion while the US dollar lost ~25% of its value. Source: The Kobeissi Letter, BofA

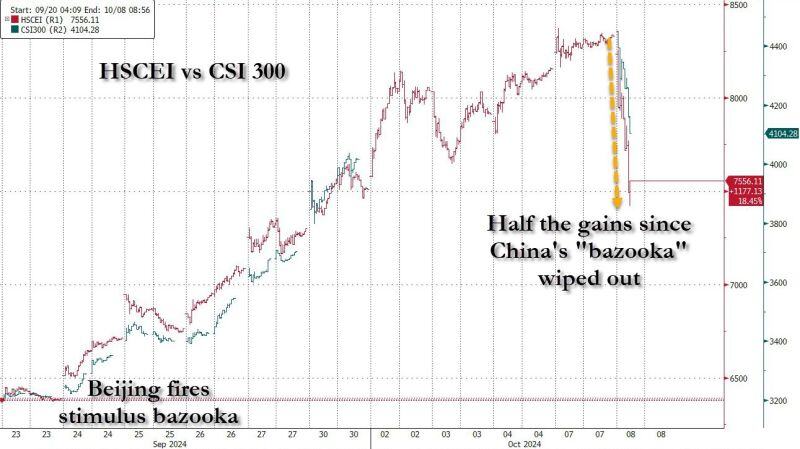

Half the gains since China's bazooka wiped out in an hour as authorities disappoint markets; Hong Kong stocks plunge more than 6%.

The rally in Chinese markets lost steam on Tuesday after a briefing from the country’s National Development and Reform Commission provided few details on further stimulus. While mainland China’s CSI 300 skyrocketed over 10% at the open Tuesday in its return from the Golden Week holiday, the index pared gains to a 5% rise later in the session. Hong Kong’s Hang Seng index briefly plummeted over 10%, before recovering slightly to a smaller loss of 6.4%. Zheng Shanjie, chairman of China’s National Development and Reform Commission, on Tuesday pledged a raft of actions to bolster the country’s economy during a highly-anticipated press conference. But he stopped short of announcing any new major stimulus plans, underwhelming investors and weakening the rally in the mainland Chinese markets. China will speed up special purpose bond issuance to local governments to support regional economic growth, the senior NDRC official said. Zheng said ultra-long special sovereign bonds, totaling 1 trillion yuan, have been fully deployed to fund local projects, and he vowed that China will continue to issue ultra-long special treasury bonds next year. The central government will release a 100 billion yuan investment plan for next year by the end of this month, ahead of schedule, a senior official added. Zheng also promised that more measures are coming that aims to support the property market and boost domestic spending. Source: CNBC, zerohedge

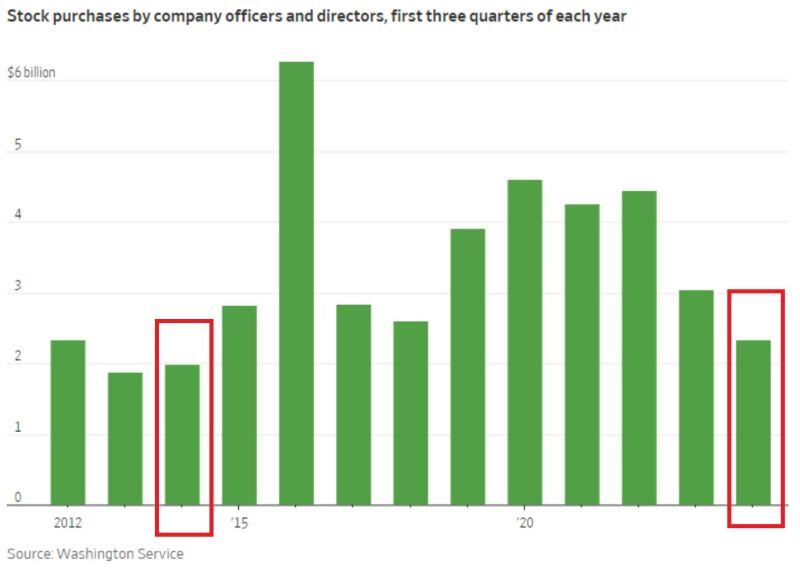

🚨 US INSIDERS ARE STOPPING BUYING THEIR COMPANIES' STOCKS🚨

US firms' executives purchased $2.3 billion worth of stock year-to-date, THE LEAST since 2010. To put this into perspective, during the COVID CRASH in 2020 they bought $1.3 billion in one month Source: Global Market Investors

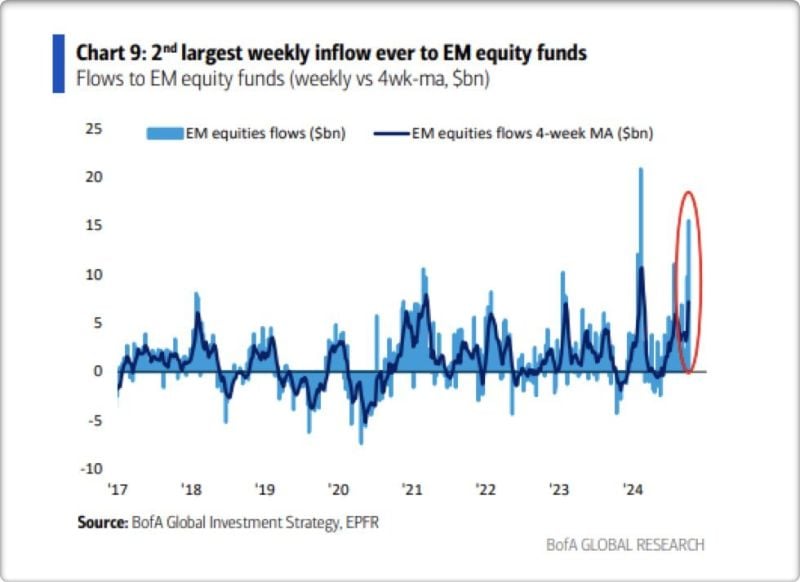

The come-back of emerging markets equities?

We just witnessed the 2nd largest weekly inflow to EM equity funds ever according to BofA / EPFR fund flows data. Among the tailwinds for EM equities: weaker dollar, Fed cutting rates, room for EM central banks to ease monetary policy conditions, China stimulus and cheap valuations. Source: BofA, @ackmeni on X

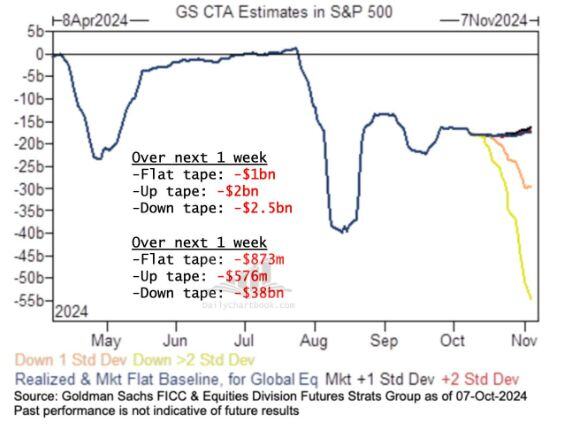

CTAs are projected to sell the S&P 500 in EVERY SINGLE scenario over the next week and month, as much as $38 billion worth, according to Goldman Sachs

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks