Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Contrarian Investment

Source: The Investing for Beginners Podcast @IFB_podcast

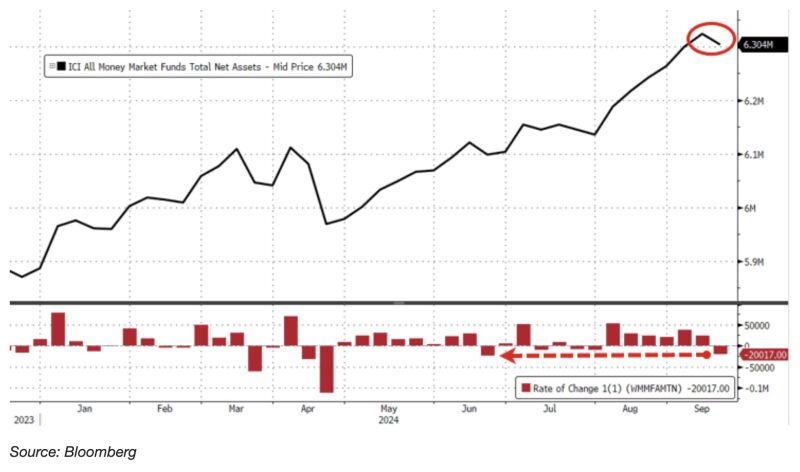

Money Market Funds saw a weekly outflow of $20 billion, the largest weekly outflow since June

Source: Barchart, Bloomberg

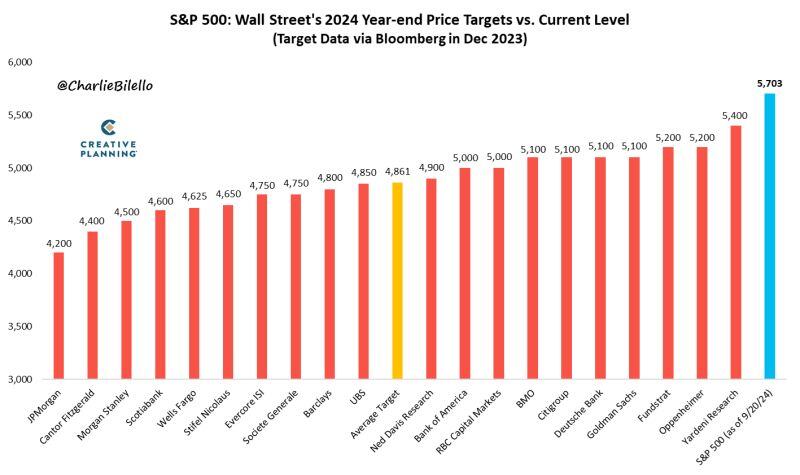

At 5,703, the S&P 500 is now over 300 points above above the highest 2024 year-end price target from Wall Street strategists and 17% above the average target (4,861).

And there's still 3 months to go in the year. $SPX Source: Charlie Bilello

How are the 'Magnificent 7' Tech stocks doing so far this year?

🟢 Nvidia Is Up +134.2% $NVDA 🟢 Meta Is Up +58.6% $META 🟢 Amazon Is Up +26.1% $AMZN 🟢 Apple Is Up +18.5% $AAPL 🟢 Alphabet Is Up +16.8% $GOOGL 🟢 Microsoft Is Up +15.7% $MSFT 🔴 Tesla Is Down -4.1% $TSLA Note that S&P 500 and Nasdaq are both up +19.6% YTD

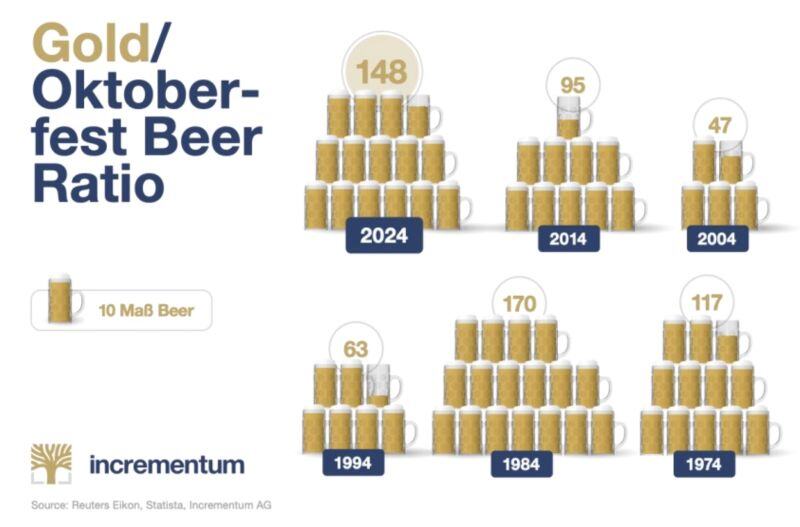

Ahead of Oktoberfest... Life is all about liquidity!

Source: Ronald-Peter Stoeferle, CMT, CFTe, MSTA, Incrementum AG

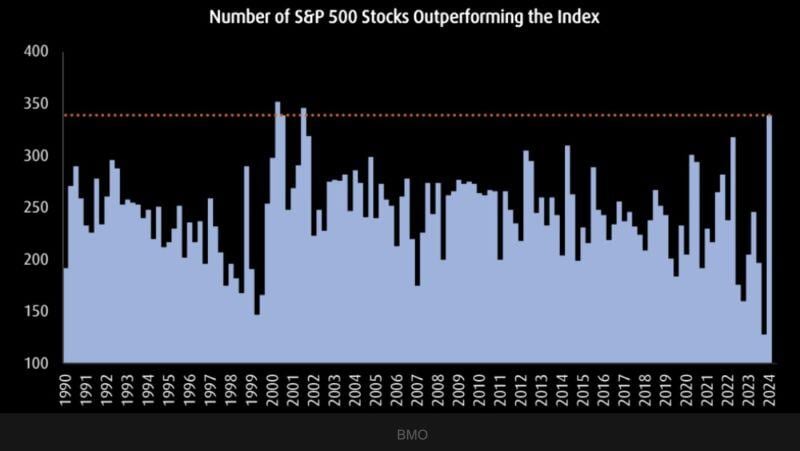

The number of sp500 stocks outperforming the index is the highest since 2002.

Source: Barchart, BMO

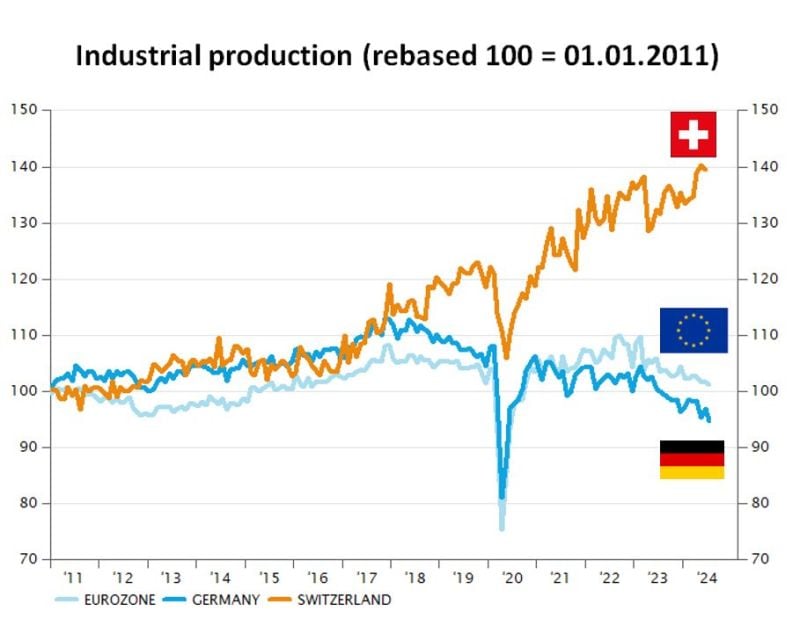

😱 The "shocking chart" of the day !!! 😱

Since 2011, the swissie is up more than 25% against euro. Despite this, industrial production growth in switzerland has INCREASED by 40% while it has DECREASED by 5% in germany and is roughly flat in the eurozone. Note the huge trend divergence since covid... HOP SCHWEIZ ! Source: Syz research

Investing with intelligence

Our latest research, commentary and market outlooks