Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"Doubt is the origin of wisdom" - Rene Descartes

Source: Wise Wonderer

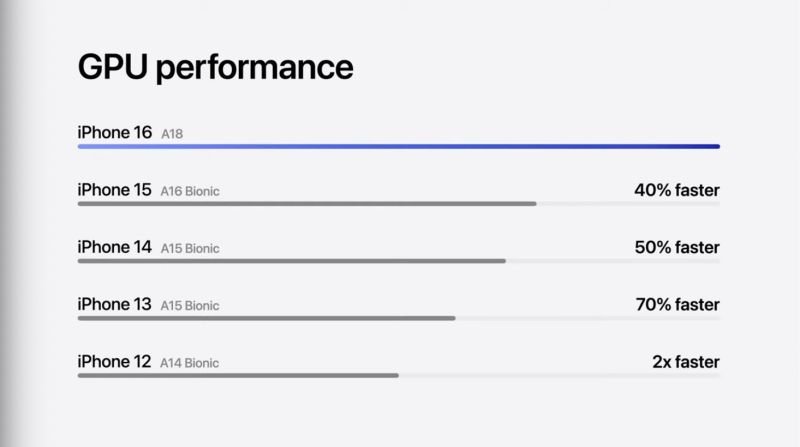

Apple's $AAPL new A18 chip for the iPhone 16 has 40% faster GPU performance than the iPhone 15

Source: Evan

It seems that the EU finally realizes that their de-industrialization process has been going too far and put them at a huge competitive disadvantage vs. the US.

The European Union requires radical reforms through a new industrial strategy to ensure its competitiveness, to boost social equality and to meet climate targets, according to a keenly awaited report from economist and politician Mario Draghi. The proposals laid out in the report would require between 750 billion and 800 billion euros in additional investment each year, the European Commission estimates. Other areas of concern include supply chain security and defense spending, the report states. BOTTOM-LINE: This could mean more debt, more money printing, more inflation, higher nominal growth. Source: CNBC

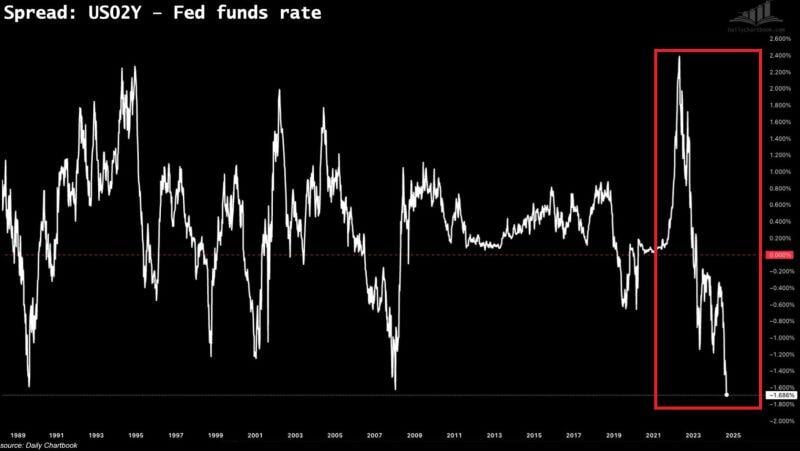

‼️THIS HAS NOT HAPPENED IN AT LEAST 35 YEARS‼️

The spread between the 2-year US government bonds and Fed's rates FELL to -1.686%, the most in over 3 decades. In other words, bond market expects the Fed to cut BIG in the next months. Question: Is the bond market too dovish? Or is the Fed too much behind the curve? Source: Global Markets Investor, Bloomberg

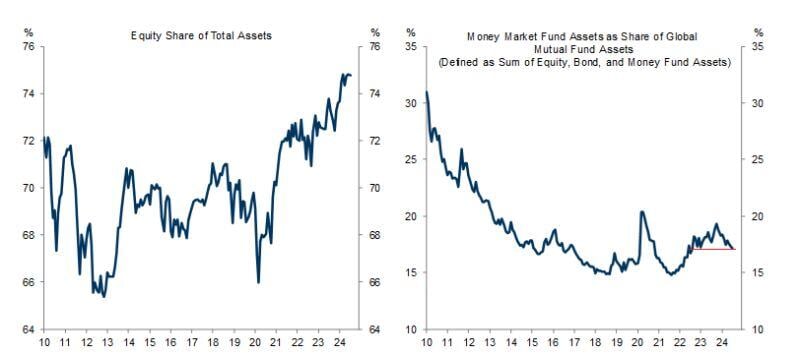

Ahead, of interest rates cut, how does the average asset allocation look like?

Are we going to see cash moving out of money markets into risk assets? Well, according to this chart by Mike Zaccardi, CFA, CMT, MBA, as a percent of total assets, money market fund holdings are now at 2-year LOWS !!!

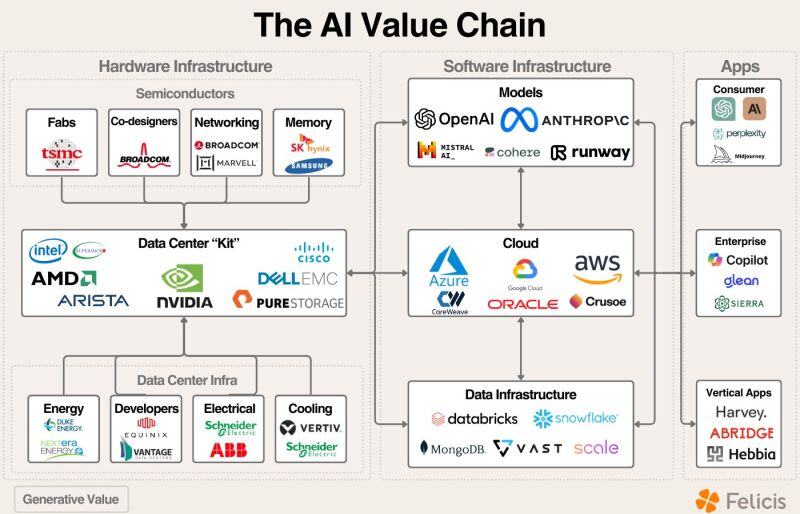

Mapping out the current state of AI markets by :

"Most value has accrued to the semiconductor ecosystem ($130B+ in revenue this year from AI) and the data center buildout (number of US data centers is expected to double in the next four years). Energy is a legitimate bottleneck to the data center buildout, and hyperscalers/developers are aggressively acquiring real estate with power availability. The cloud companies are at a ~$20B run rate, with Microsoft generating ~$5B of that. We’re seeing increasing interest in AI applications but little large scale value creation yet. The AI app layer will ultimately determine the value of the industry as the current infrastructure buildout will become a bubble without value creation on the back end". Source: @EricFlaningam, Felicis

Investing with intelligence

Our latest research, commentary and market outlooks