Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

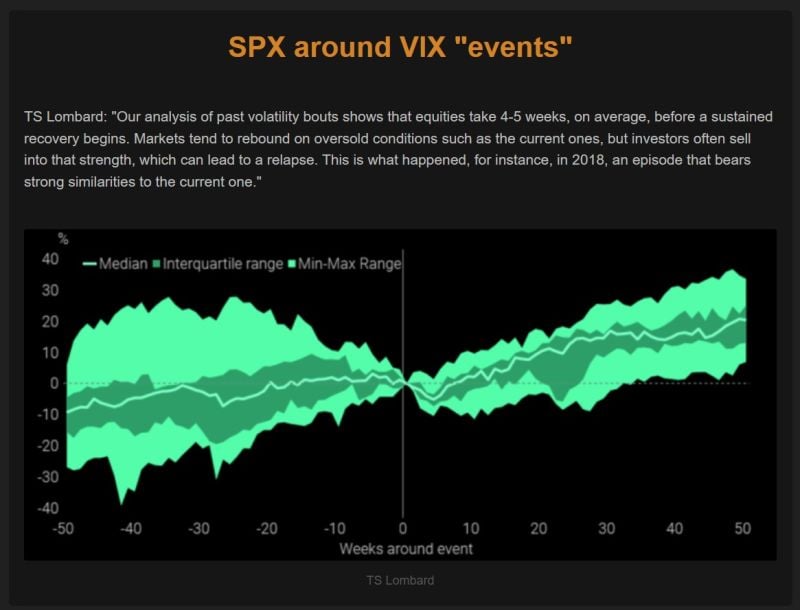

TS Lombard: "Our analysis of past volatility bouts shows that equities take 4-5 weeks, on average, before a sustained recovery begins.

Markets tend to rebound on oversold conditions such as the current ones, but investors often sell into that strength, which can lead to a relapse. This is what happened, for instance, in 2018, an episode that bears strong similarities to the current one." Source: TS Lombard, The Market Ear

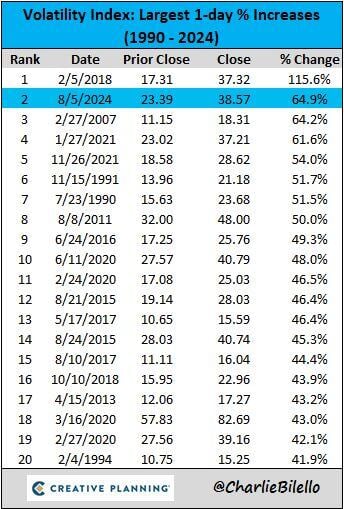

The $VIX spiked 65% higher today, the 2nd largest 1-day % increase in history

(note: $VIX data goes back to 1990). Source: Charlie Bilello

BREAKING: The S&P 500 closes 3.0% lower erasing $1.4 TRILLION of market cap today, posting its worst day since September 2022.

The S&P 500 is now just 1.4% away from correction territory. The Nasdaq 100 is in correction territory and will enter a bear market if it falls 7.5% from current levels. In less than one month, the S&P 500 has erased $5 TRILLION in market cap. Source: The Kobeissi Letter

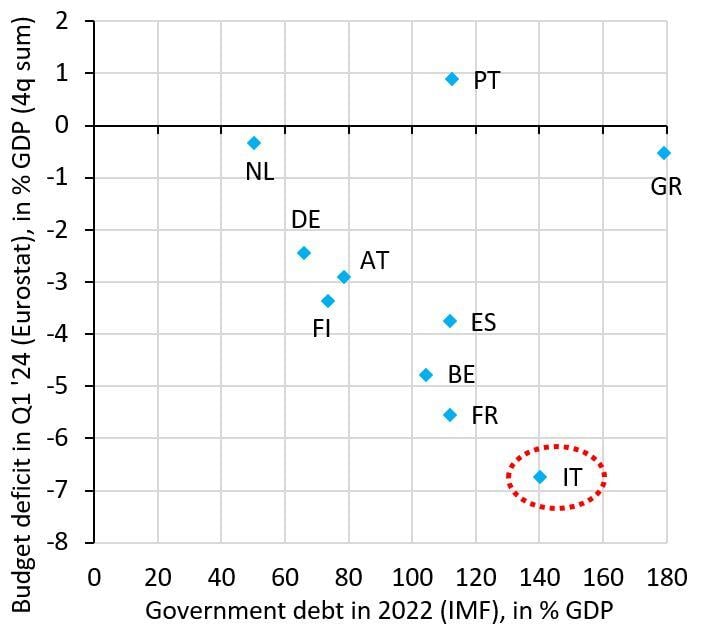

Why the ECB should keep interest rates at the lowest level possible explained in one chart

The Euro zone is an equilibrium where high debt countries like Italy, France and Spain run big deficits. The ECB enables this by capping yields when these spike like they did in 2022. This policy is an implicit subsidy of high debt countries by low debt ones... Source: Robin Brooks

US 2s/10s yield spread is now flat for the 1st time since 2022 on aggressive repricing of Fed rate cuts

US 2y yields have plunged by 70bps to 3.69% since last Wed while US 10y yields only dropped by 40bps in the same time. Source: Bloomberg, holgerZ

Investing with intelligence

Our latest research, commentary and market outlooks