Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

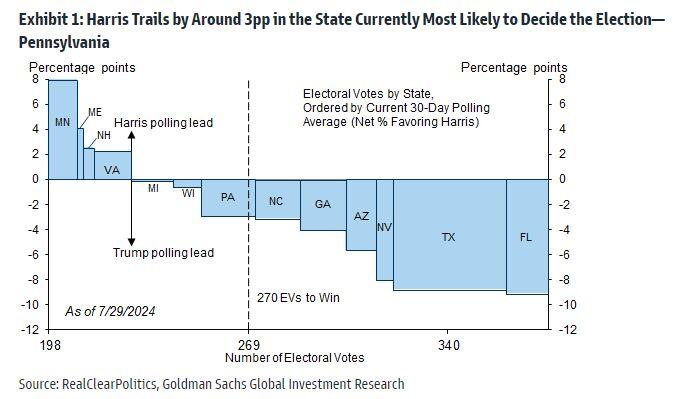

Goldman: Harris Trails by Around 3pp in the State Currently Most Likely to Decide the Election—Pennsylvania

Source: Mike Z., Goldman Sachs

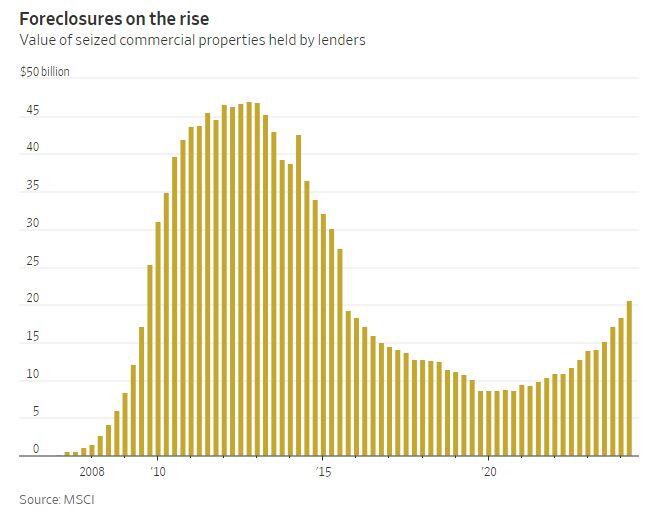

US Commercial Property Foreclosures jump to more than $20 billion during the 2nd quarter, the most in nearly a decade 🚨

Source: Barchart

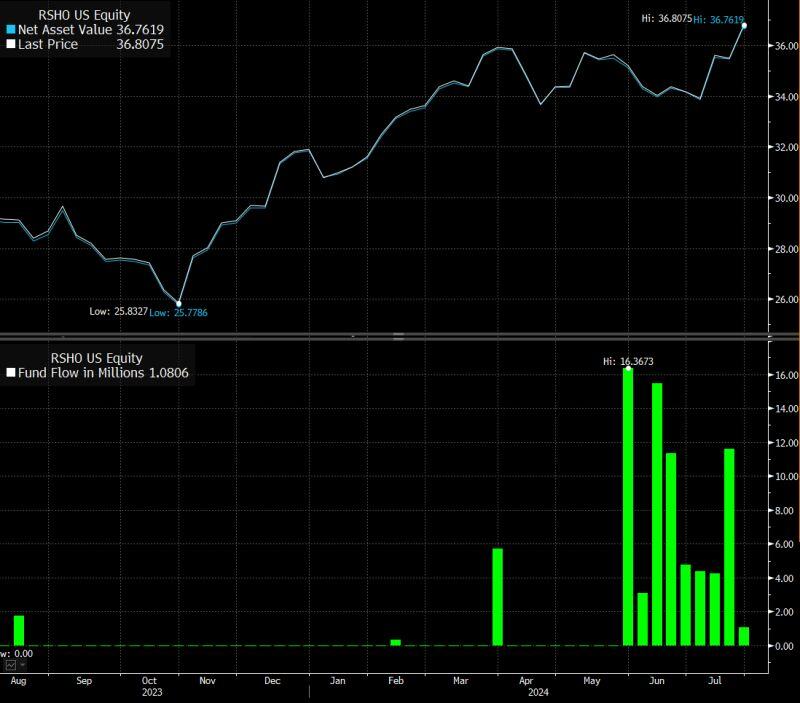

As highlighted by Eric Balchunas

The Reshoring ETF $RSHO is quietly nursing a 9-week flow streak (after being ignored since birth) which boosted its assets under management 7x this year. The American Industrial Renaissance ($AIRR) 3ETF also saw AuM jump by $800m YTD. BlackRock noticed this and launched iShares US Manufacturing ETF $MADE. All these ETFS are exposed to Trump Trade 2.0 but this theme spans beyond politics. Source: Bloomberg, Eric Balchunas

US Presidential elections >>> Are we back to square one?

Source: PredictIt, Bloomberg, www.zerohedge.com

Microsoft and Alphabet are now exactly on par since the launch of ChatGPT at the end of November 2022.

Source: HolgerZ, Bloomberg

The US government just moved $2 billion of seized bitcoin $BTC, two days after Trump's speech 👀

Source: Joe Consorti

Investing with intelligence

Our latest research, commentary and market outlooks